-

Banks want and need to rival tech giants in their use of customer analytics. Some think artificial intelligence is the key to making it happen.

January 26 -

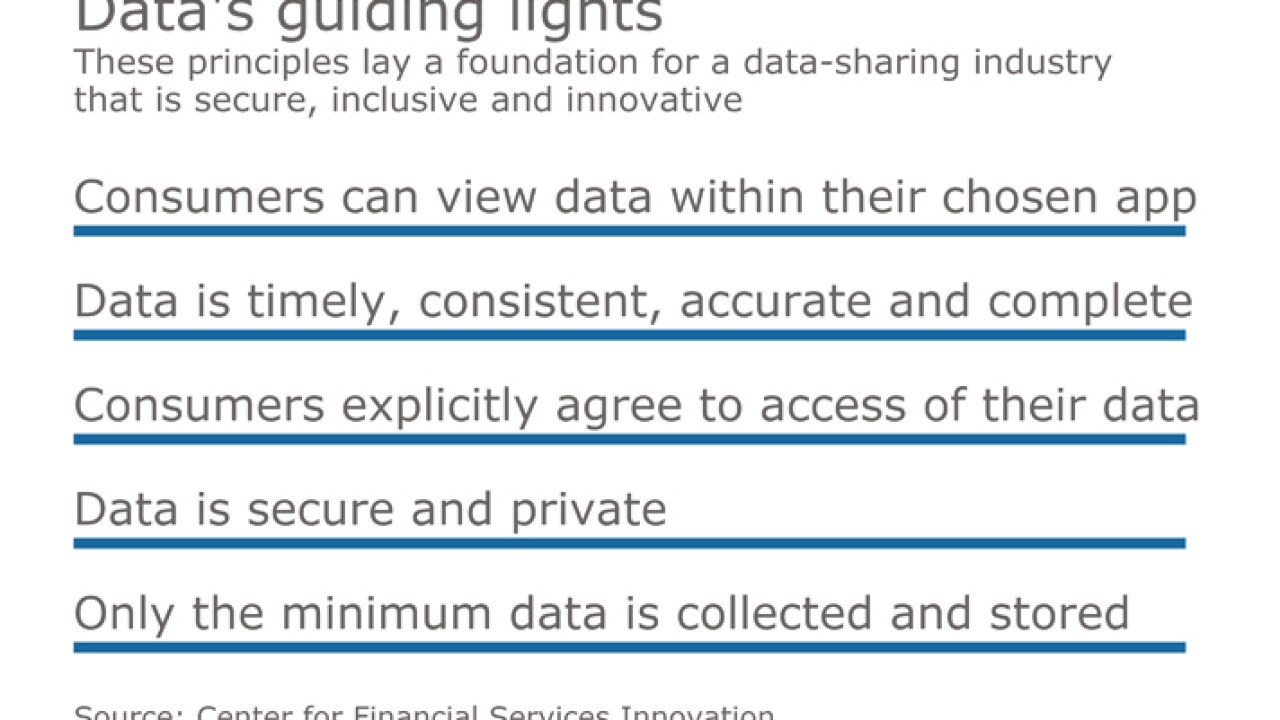

The deal points a way forward, not only to resolve the debate over screen scraping and ownership of customer data but to redefine banks' value proposition.

January 25 -

Customers of JPMorgan Chase will no longer have to surrender their bank credentials in order to use Intuit products like Mint, TurboTax or QuickBooks.

January 25 -

President Trump's campaign to keep jobs in the U.S. could leave bankers worried about their outsourcing IT functions. They are an unlikely target.

January 24 -

Add package pickup to the growing list of things banks are doing with branches as foot traffic declines.

January 23 -

Banks are becoming more comfortable with robotic process automation and could use it overhaul everything from the payroll functions to advising customers.

January 23 -

Lloyds Banking Group was hit by a cyber attack that disrupted online services for customers two weeks ago, a person with knowledge of the matter said.

January 23 -

The Cincinnati bank will be advised by QED Investors on its fintech strategy .

January 20 -

Bank consortium R3 CEV, one of the most well-funded blockchain working groups, has endured criticism for its meticulous process. But if blockchains are most valuable with a network effect, maybe forgoing some agility is worth the long while.

January 20 -

As artificial intelligence makes analytics better, the question of who gets to benefit from the intel will come up more. Fintech startup wallet.ai believes customers should be told of propensities that might be hurting them.

January 19