-

The credit bureau's $638 million deal to buy the ID verification firm is its second M&A agreement in a little over a month to broaden its line of products and services that help customers combat fraudsters and identity thieves.

October 27 -

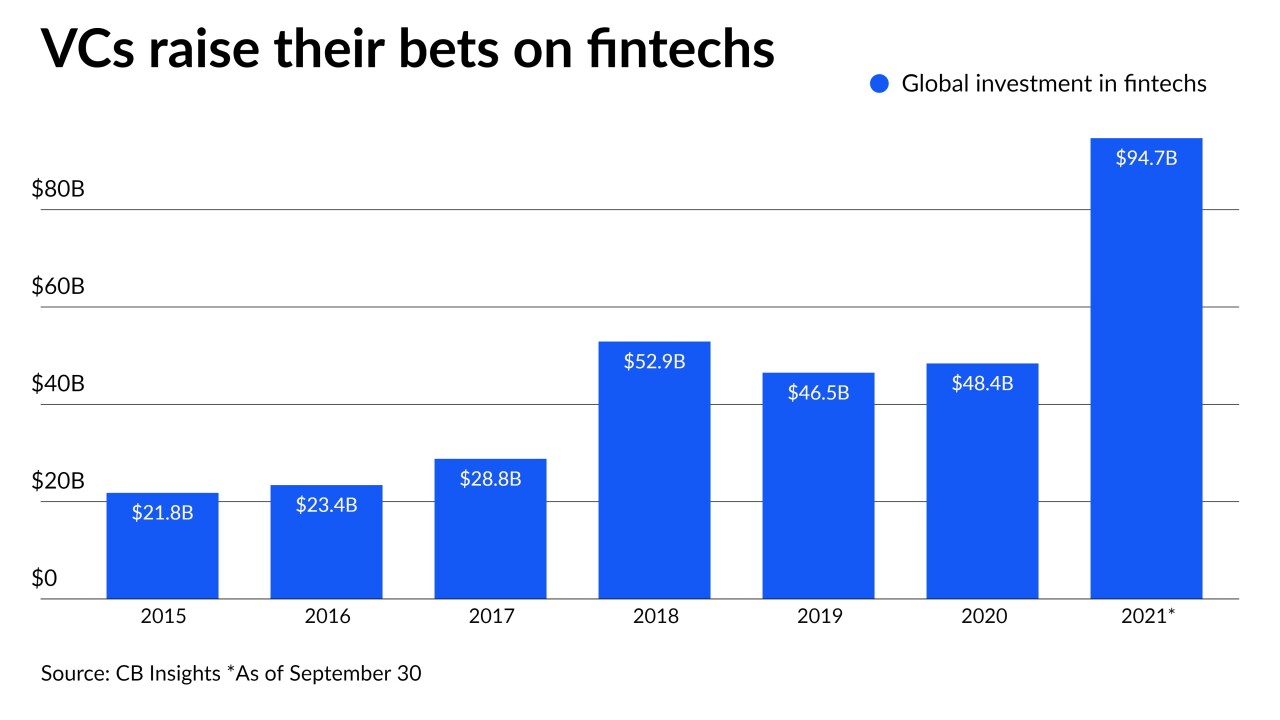

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

The bank is the first to offer a service from The Clearing House’s Real Time Payments network that lets businesses send bills to retail clients, who are given the option to pay them immediately.

October 25 -

Michelle Moore, head of consumer digital at Wells Fargo, is leading development of an entirely new banking app and a virtual assistant named Fargo that will roll out next year.

October 25 -

Account takeovers and ATM skimming are rampant in cities like Las Vegas and New York. Meanwhile, scammers are targeting travelers as they attempt to pay airlines, cruise ships, car rental companies and hotels.

October 22 -

The 44 large bank and insurance company partners of the Fintech Innovation Lab are inviting startups whose technology can help them manage cybersecurity threats as well as handle climate change metrics and other growing needs to join the lab's next cohort.

October 20 -

The technology from the San Francisco loan software company will pre-populate loan applications with payroll and tax data from multiple sources.

October 20 -

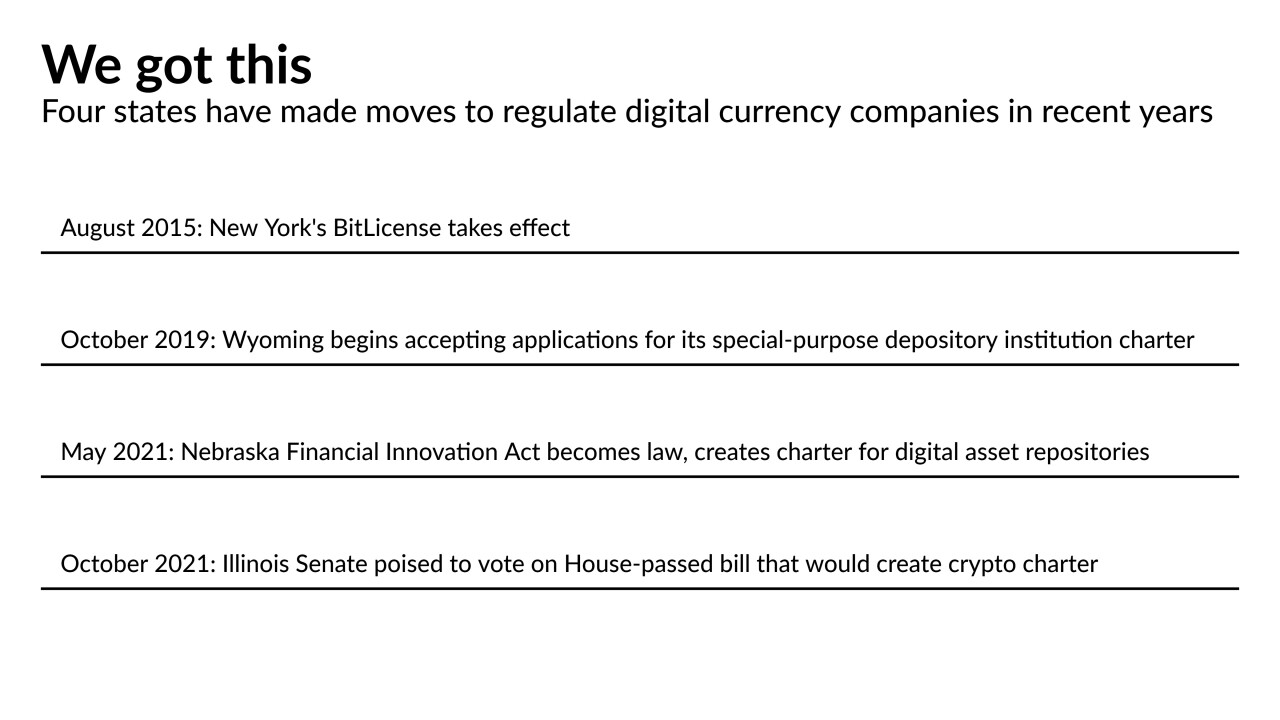

While federal agencies debate how to regulate cryptocurrency-related businesses, Wyoming and Nebraska have already created a special-purpose charter, and Illinois is close to finalizing its own.

October 18 -

The cryptocurrency exchange, which has been embroiled in a dispute with the Securities and Exchange Commission, says the federal government should create a stand-alone body to supervise the marketplace for digital assets.

October 14 -

Talwar, who is leaving his job as chairman of Goldman's consumer bank this month, explains his philosophy on innovating within a large organization, making a digital-only unit work within a 150-year-old institution, and how he deals with skeptics.

October 14 -

Cybersecurity teams are using scoring systems, standard formats and other tactics to prioritize the deluge of alerts they're receiving about commonly used programs.

October 13 -

JAM Fintop's Banktech fund, which is backed by community banks, has invested in Monit, a small-business predictive analytics company. Two of the banks have expressed interest in using its product.

October 12 -

Silvio Tavares, the former chief executive of the Digital Commerce Alliance, will lead the credit-bureau analytics firm.

October 12 -

During the pandemic, the use of digital assistants by low- to moderate-income consumers has soared. One reason: Those seeking loan modifications or fee waivers see the technology as less intimidating than humans.

October 8 -

-

The bank is giving virtual reality headsets to branch employees, which they'll use to practice conversations in private before they happen in real life.

October 7 -

-

The bank's group head of small and medium enterprise banking says she wants to enact policies that reduce the burdens of COVID-19 on women and their careers.

October 6 -

Housing will still be a priority of the Consumer Financial Protection Bureau, but newly confirmed Director Rohit Chopra is also expected to investigate discrimination in the Paycheck Protection Program and bias in AI-powered lending algorithms.

October 4 -

Chief Information Officer Scott Case and his staff are building patent-pending technology to transfer data from legacy BB&T and SunTrust systems to new digital channels while preserving the best of each company's platforms elsewhere.

September 27