-

A group of community banks and two major trade associations have formed a partnership with and invested in the fintech NYDIG to offer the service on the banks’ mobile apps by midyear. The banks say it will help them generate revenue and retain customers interested in cryptocurrency.

January 18 -

New York Community Bank and Synovus Bank are among the founding members of the group, which will use the US Dollar Forward stablecoin on the Provenance blockchain.

January 12 -

The Change Company, a lender to Black, Hispanic and low-income borrowers, was set to merge with the former quarterback’s blank-check company. Steven Sugarman, a onetime Banc of California chief, says his company is now in talks with other investors and inviting banks to use a new digital marketplace for its loans.

January 10 -

Both traditional financial institutions and neobanks — including NorthOne, Novo and BMO Harris Bank — are developing technology to meet the needs of younger small-business owners.

January 7 -

Banks and credit unions that cater to members of the armed forces are partnering with fintechs or patenting their own tools to help users convert currency, borrow money and handle financial matters in environments with unreliable internet service.

January 5 -

Personalized advice, embedded finance and virtual branches are among the initiatives financial services companies have on their drawing boards for the coming year.

January 4 -

Large banks explored the concept more than five years ago before quietly moving on. The advent of stablecoins and general acceptance of blockchains have helped make it more practical for some regionals.

December 29 -

Banks have extra reason to be concerned by the news that a commonly used piece of software could be exploited by hackers.

December 23 -

The mission of the North Carolina company, founded by banks to archive digital images of checks, has evolved over the last 20 years. It is migrating to a public cloud to help it expand beyond check services.

December 22 -

A dispersed workforce presents added cybersecurity challenges resulting from employees accessing their organization’s networks through a home connection. This new reality reinforces the need for financial institutions to transform their digital infrastructure to guard against breaches.

December 22 ServiceNow

ServiceNow -

Some established financial technology companies like Robinhood are said to be refusing to accept funds from accounts at young digital-only banks that they say are growing too fast to deter fraud. The companies being blocked respond that it’s an unfair, scattershot approach.

December 20 -

The consumer bureau asked for public feedback about payment platforms as part of a focus on the Silicon Valley giants’ financial services aspirations. But comment letters so far have been dominated by users complaining that they lost money on the big-bank-owned peer-to-peer network.

December 20 -

The Pennsylvania bank run by Sam Sidhu is updating its platform to support real-time payments for cryptocurrency companies and will offer embedded finance and banking-as-a-service to fintechs.

December 16 -

Asenso Finance and a community development financial institution, the National Asian American Coalition, have developed a loan aimed at borrowers with limited credit histories. The underwriting relies in part on alternative data and borrowers are required to take financial literacy courses.

December 15 -

An audit found most of the biggest banks and largest community banks fail to meet basic Americans with Disabilities Act rules for website and app readability. U.S. Bank does more than most to make digital channels accessible.

December 13 -

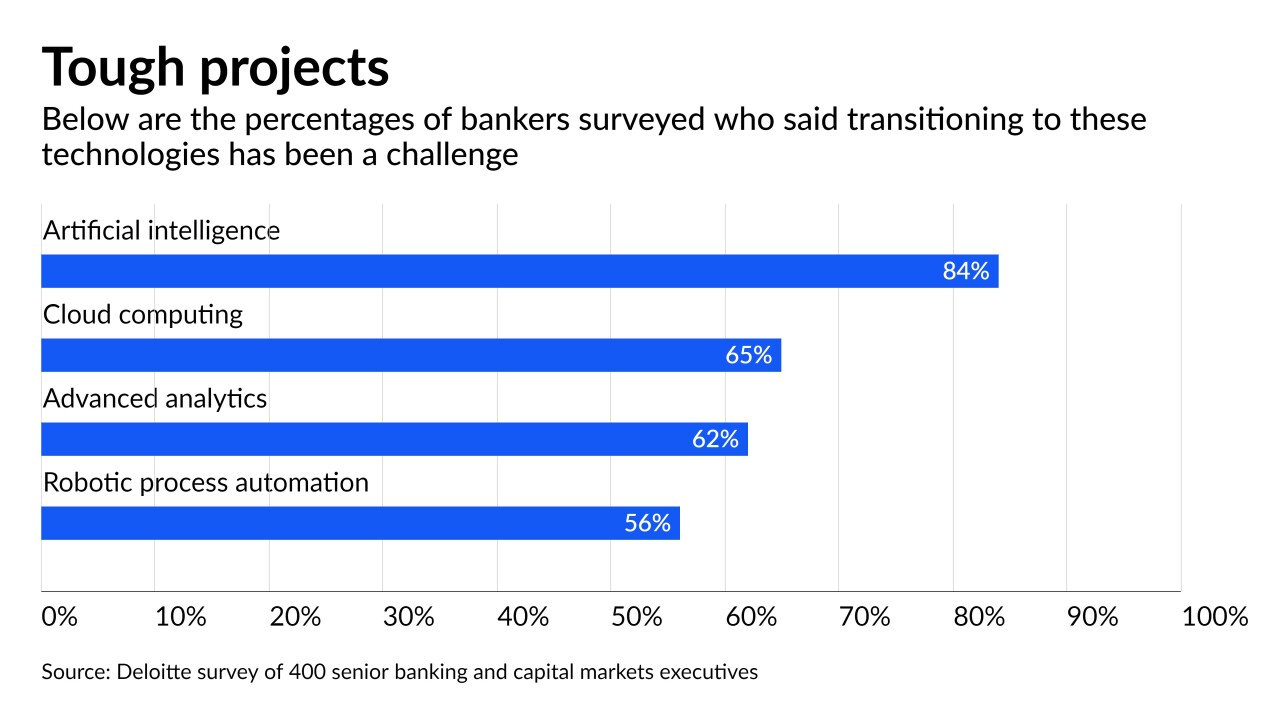

A new survey of industry executives finds substantial interest in cryptocurrencies and mergers but anxiety about competition from large technology companies.

December 13 -

Through its partnership with Visa, the California credit union lets members receive digital replacements for lost cards almost instantly and add digital cards to mobile wallets like Apple Pay.

December 10 -

Goldman Sachs, which already runs Apple Card and part of its consumer banking operation on AWS’s cloud, will now host market data there for hedge funds and other institutional clients.

December 9 -

-

Like many smaller financial institutions, Centra Credit Union in Indiana is trying to reduce its tech-maintenance burden by shifting some applications to the cloud, starting with data analytics.

December 3