-

From the opportunities — and threats — in artificial intelligence to envisioning a world in which "Wi-Fi is like air," here is what everyone was buzzing about at American Banker's Digital Banking conference.

June 11 -

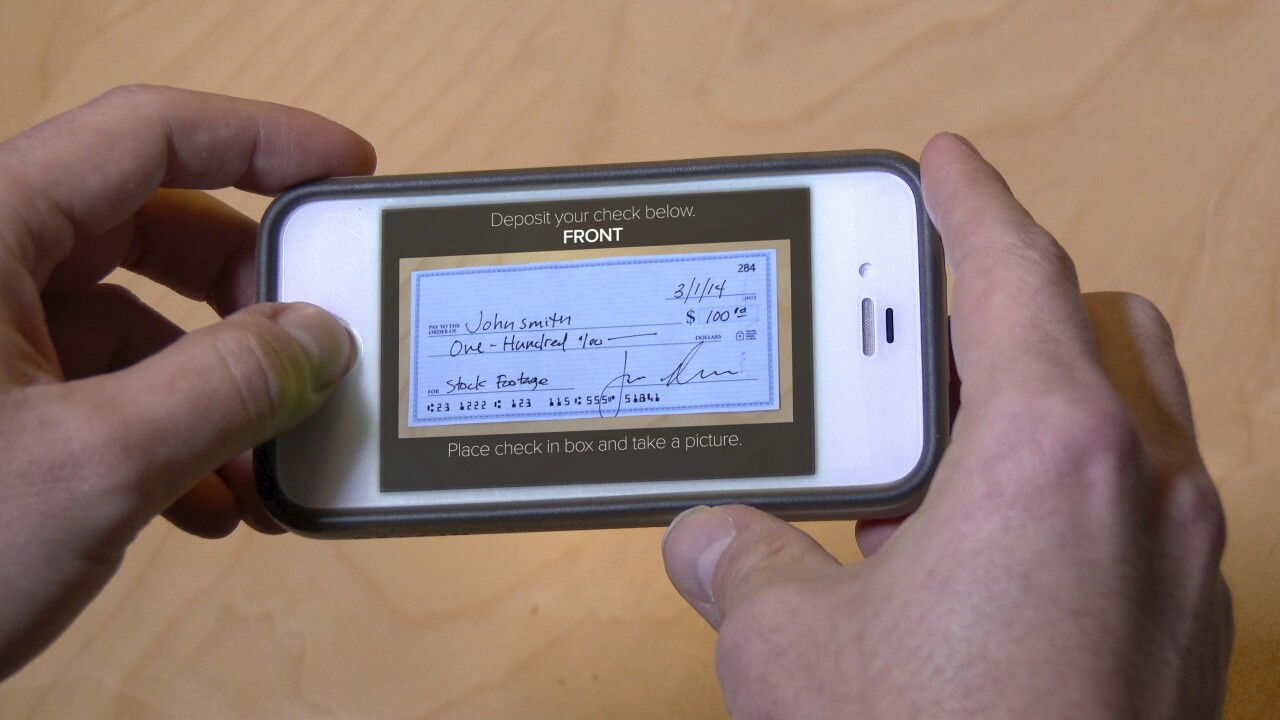

USAA's lawsuit accusing Wells of infringing on its remote-deposit patents is new territory: bank-on-bank fights over intellectual property.

June 11 -

Chief among the tips shared at Digital Banking 2018 were: be willing to experiment, seek out partners, rethink cost-cutting and small banks should stop making excuses.

June 11 -

When asked if other banks were being sued, USAA said the lawsuit names only Wells Fargo because the bank is one of the biggest adopters of remote mobile deposit capture and has failed to license the technology.

June 8 -

Facebook, Apple, Amazon, Netflix and Google garner so much attention that they have their own collective shorthand, FAANG. But it was a mostly different set of companies, including Starbucks and Acorns, that were top of mind this week for their financial services moves.

June 8 -

Banks will need to evolve further and faster to reach consumers in an interconnected, always online world, according to industry leaders.

June 7 -

The firm graded bank and credit card apps on customer satisfaction, appearance, navigability, and availability and clarity of information.

June 7 -

The bank’s joint initiative with CFSI awards capital to firms trying to address issues that the startup teams personally experienced.

June 7 -

A popular AI open-source platform with bank investors is being combined with IBM hardware and Nvidia processors in the hopes of creating high-speed, “driverless” AI.

June 7 -

At American Banker’s Digital Banking conference in Austin, industry leaders wrestled with philosophical questions about artificial intelligence and the rapidly evolving expectations of customers.

June 6 -

Most big banks are launching robo-advisers to compete for a new breed of wealth management customer. The risk is that automated services will disappoint traditional customers.

June 5 -

Julieann Thurlow, CEO of Reading Cooperative Bank, argues that tech-savvy lenders like SoFi can draw in low-risk borrowers with a fast, simple online process.

June 5 -

Black Knight has acquired HeavyWater, a developer of artificial intelligence and machine learning technology for the mortgage industry, and plans to incorporate the startup's borrower data verification and other automation capabilities into its existing product suite.

June 4 -

In opening offices in several German cities, Silicon Valley Bank is seeking out familiar kinds of high-tech customers in a new market. This is a venture any midsize bank could learn from.

June 4 -

Mary Kate Loftus spearheaded a $131 million digital initiative to improve the customer experience, deepen relationships and attract more of HSBC’s target consumer segments. She was one of our Digital Banker of the Year finalists for 2018.

June 3 -

Hurricane Maria left behind a shattered Puerto Rico. Camille Burckhart and her technology team at Banco Popular found that they were uniquely positioned to help people rebuild. She has been selected one of our Digital Banker of the Year finalists for 2018.

June 3 -

With a lighter compliance burden, small banks could shift tech spending to customer-facing innovation.

June 1 -

-

The $142-billion asset bank expects to deepen relationships with existing customers and add new ones, by collaborating with Intellect Global Transaction Banking to develop new services.

May 31 -

Hyperledger, an open-source organization focused on blockchain technology, has added 16 members.

May 31