-

The company, which shuttered six locations in September, plans to close 14 more branches by the end of this year.

October 22 -

The company will close branches and cut jobs, with plans to reinvest some of the savings into digital enhancements.

October 22 -

The Cleveland company will exit indirect auto lending and close branches so it can devote more resources to mortgages, student loans and other relationship-driven, digital-friendly businesses.

October 21 -

The company will close eight locations, noting that customers have been quick to adopt digital channels during the coronavirus pandemic.

October 19 -

The North Carolina company had promised regulators not to close large numbers of branches until December. Meanwhile, vendor contracts, leases and other hurdles have made it hard to accelerate efforts to offset a sudden decline in revenue.

October 15 -

The Illinois company will shutter 17 locations, or about 15% of its branches, early next year.

October 15 -

The Minneapolis company says the majority of branches earmarked for closing have already been shuttered for months due to the pandemic. Some of the savings will be plowed back into digital expansion.

October 14 -

The coronavirus outbreak has taught community bankers to think on their feet and experiment. Speakers at an industry conference this week advised their peers to stay innovative to ensure they endure in a changing world.

October 2 -

The company joins a growing list of community banks paring back their networks.

October 1 -

The moves are intended to offset a protracted period of historically low interest rates and expectations of higher credit costs in 2021.

September 24 -

A nationwide branch network remains a calling card for the entire industry, while also exemplifying the movement's cooperative spirit.

September 24 CO-OP Financial Services

CO-OP Financial Services -

The company will shutter a fifth of its locations, while reinvesting some of the savings in its digital banking platform.

September 18 -

Several companies said this week they’re slashing expenses as the economy limps along. Others would prefer to keep investing in new technologies and hold off on moves like branch closings to better gauge which changes in consumer behavior will stick.

September 15 -

The $282 million-asset institution's new name is intended to build on its work with underserved communities around St. Louis.

September 15 -

“What COVID has done for us is it has showed us where to prioritize investments,” William Demchak said at an industry conference in discussing the Pittsburgh company's plans to speed up the shift to digital banking.

September 15 -

The company joins a growing list of banks shuttering locations as customers flock to digital channels.

September 14 -

Chris Gorman, the Cleveland company's chairman and CEO, said at an industry conference that an ongoing shift to digital channels provides an “opportunity to continue to ramp up" efforts to shutter physical locations.

September 14 -

The Liberty Lake, Wash.-based credit union has agreed to buy four branches from the Roseburg, Ore.-based bank.

September 11 -

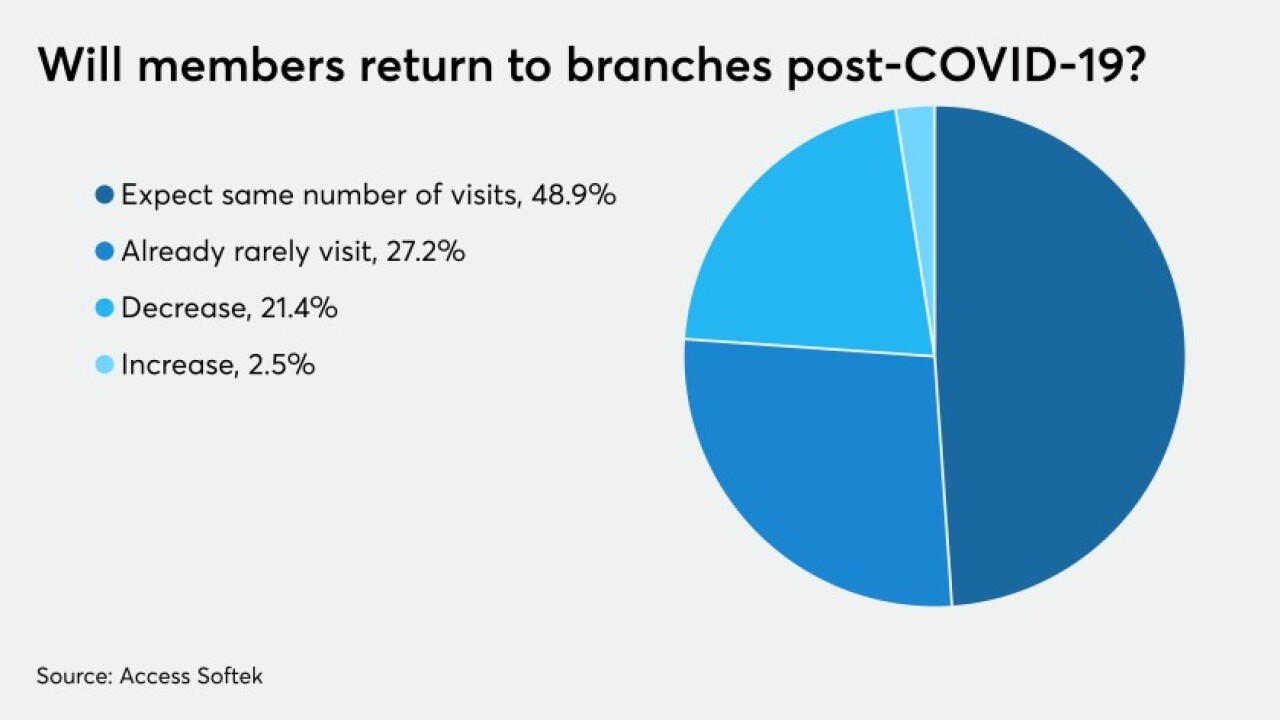

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

The company also plans to shed some corporate office space by the end of this year.

September 3