-

Businesses and consumers using Ingo Money will be able to pay credit card bills through U.S. MoneyGram locations.

October 17 -

ATM operators have been down this road before, dealing with Mastercard's rules on EMV transactions occurring with the international Maestro debit cards as far back as 2013. But awareness and experience doesn't automatically translate to preparation.

October 10 -

As more merchants worry about EMV card slowdowns ahead of the holiday shopping seasonwhen bottlenecks at checkout points could lead to many lost salesmore companies are coming up with their own ways to slash EMV payment times.

October 6 -

For many restaurants that originally put EMV on the back burner because of technical complexities and a lower general risk of counterfeit card fraud, waiting to support chip cards has proven to be the right decision.

October 6 -

The biggest surprise for many who awaited the Consumer Financial Protection Bureaus final rule for prepaid cards was discovering that its reach extends to some of the payments industrys highest-profile tech firms, such as PayPal Inc.s Venmo, Square Inc.s Square Cash and Dwolla.

October 5 -

The Consumer Financial Protection Bureau's final rule on prepaid cards will improve fraud protection and provide greater transparency of costs for such products, but is already drawing fire from both consumer advocates and bankers over how it treats overdraft fees.

October 5 -

Visa Inc., MasterCard Inc. and American Express Co. lost an early round of a lawsuit alleging they colluded to pin liability for fraudulent transactions on merchants who didnt meet a chip-reading technology deadline.

October 4 -

Independent ATM operator Cardtronics plc is expanding to Australia and New Zealand with the purchase of Canadas DirectCash Payments Inc., which operates ATMs in several regions.

October 3 -

EMV chip cards have delivered on their promise to halt counterfeit fraud at the physical point of sale. But for a technology developed long before the invention of e-commerce, mobile wallets and the word "omnichannel," delivering on its promise still feels like falling short.

October 2 -

Restaurants are burdened by a basic payroll issue that might be easily solved by technology, and investors are taking notice.

October 2 -

A year after the U.S. EMV liability shift kicked the country's migration into high gear, there are still major hurdles to widespread adoption. The shift took effect Oct. 1, 2015, placing liability on the party unable to handle EMV security, but even this incentive wasn't enough to get everyone on board at the same time.

September 30 -

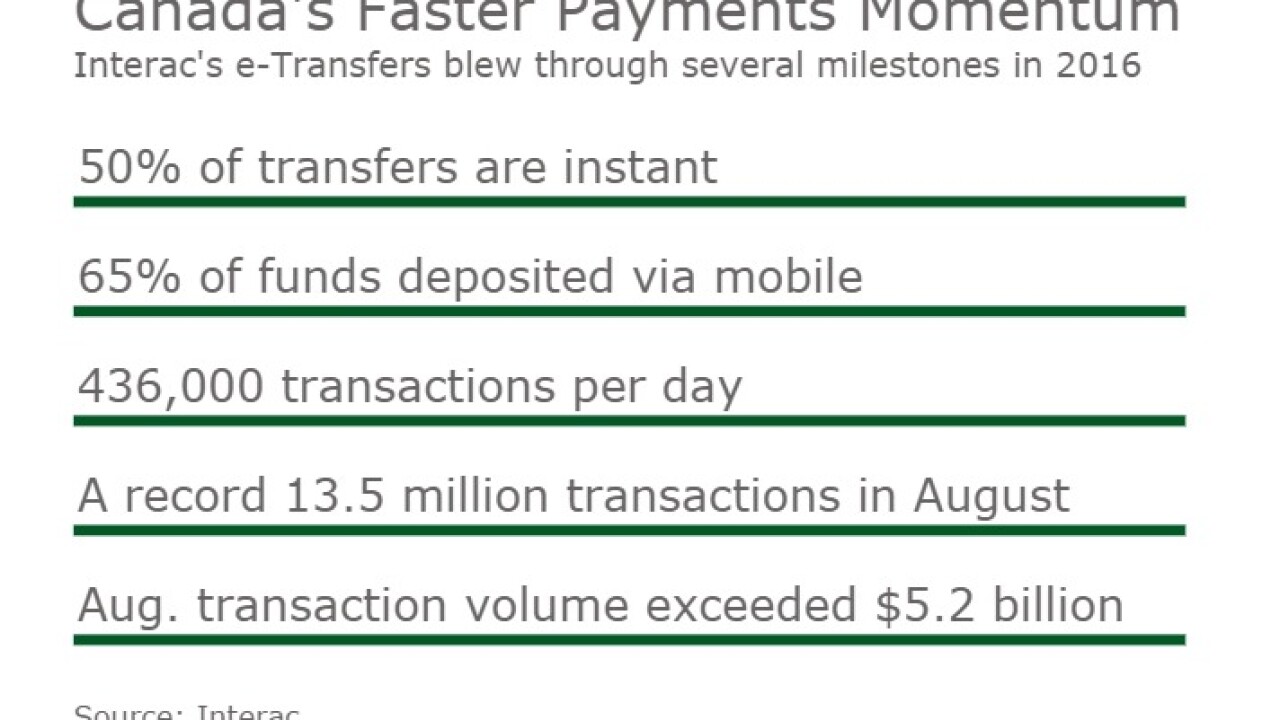

Much like contactless mobile payments, 'faster payments' are making a methodical push throughout Canada, an advance that's moving quicker than many other countries, especially the U.S.

September 29 -

Visa Inc. is trying a new gambit offset consumers' irritation with hassles surrounding the messy EMV chip-card migrationit's introducing a winsome young woman to console the masses.

September 27 -

Amex has been given the court's blessing to deter merchants from steering consumers away from its pricier cards, raising questions for those pushing newer loyalty strategies.

September 27 -

For merchants still on the fence about whether to buy Square Inc.s $49 contactless card reader, theres a new enticement to consider: Square has sped up the time it takes to accept EMV cards by 1.5 seconds.

September 26 -

The U.S. shift to EMV-chip card security hasn't been smooth. Many companies saw the card networks' Oct. 1, 2015 fraud liability shift date as a starting point rather than a deadline, and even the companies that thought they would be unaffected by the EMV transition found themselves dealing with major headaches.

September 23 -

Replacing gas pump hardware is a big, disruptive move for any fuel seller, but with the sector's EMV liability shift only a year away, more companies are facing the inevitable.

September 20 -

At the start of its fourth decade, the Automated Clearing House a payment method most commonly known for facilitating payroll direct deposits has found itself firmly in the crosshairs of the card networks and alternative payment providers.

September 19 -

New payment card technologies are forcing Mastercard to break into a new set of BINs (bank identification numbers).

September 19