-

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Tuesday's hearing on the CARES Act was dominated by bickering over Treasury's decision to shut down the Fed's emergency lending facilities, drowning out pleas from some lawmakers for more aid.

December 1 -

The latest bipartisan plan to accelerate the economic recovery would appropriate roughly $300 billion for the Paycheck Protection Program, but the legislative package still faces long odds in the divided Congress.

December 1 -

Treasury Secretary Steven Mnuchin called on the Federal Reserve Thursday to let several of its emergency lending facilities expire at yearend and return unused funds provided by Congress. But the central bank wants the programs to continue.

November 19 -

It is a frustrating reality during a time of national crisis that emergency payment options for vulnerable populations remain such a complex and inefficient landscape, says Flourish Ventures' Sarah Morgenstern.

November 4 Flourish Ventures

Flourish Ventures -

Underwhelming participation in the middle-market loan program has forced the central bank to reduce the minimum borrowing amount for the third time, to $100,000.

October 30 -

Businesses that received Paycheck Protection Program loans and Economic Injury Disaster advances discovered later they can't get full forgiveness. Lenders want the rules changed.

October 26 -

Defaults have been milder than expected thanks to government relief and stricter underwriting. But with the crisis dragging on and policymakers unable to agree on a stimulus plan, loans to highly indebted companies remain at risk.

October 15 -

Executives are urging Congress and the White House to prioritize another round of help for businesses amid concerns that the continuing restrictions on reopening could lead to more loan defaults.

October 13 -

The banking giant may be sitting pretty with plenty of money reserved for bad loans — or it could have to set aside billions more in coming quarters. It hinges on an ongoing U.S. recovery and the passage of a new stimulus package.

October 13 -

Lenders welcomed the move as a helpful first step but are still urging policymakers to develop a broader, simpler process for expediting the approvals of loans extended to troubled small businesses under the Paycheck Protection Program.

October 9 -

Customers suffered when they were placed in mortgage relief plans without their consent, the Massachusetts senator says. She urged the Federal Reserve to take the blunder into account as it weighs when to lift other sanctions against the bank.

October 1 -

Capping a series of appearances on Capitol Hill this week, the Federal Reserve chair and Treasury secretary emphasized that they don’t have the authority to reallocate CARES Act funds to assist small businesses on their own.

September 24 -

Commercial real estate companies are among those left out of the Federal Reserve’s middle-market relief program, but House members said they need government-backed financing to navigate the pandemic as much as anyone.

September 22 -

Measures designed to give banks and credit unions more flexibility to help customers weather the coronavirus pandemic are set to expire Dec. 31 unless Congress renews them.

September 18 -

The Federal Reserve and the Treasury Department released a set of FAQ's aimed to clearing up misconceptions about the Main Street Lending program and encouraging more bank participation.

September 18 -

With only a fraction of the funds allocated being used, Federal Reserve Chair Jerome Powell said the central bank is considering tweaks to the middle-market rescue program in an appeal to lenders wary of taking on added risk.

September 16 -

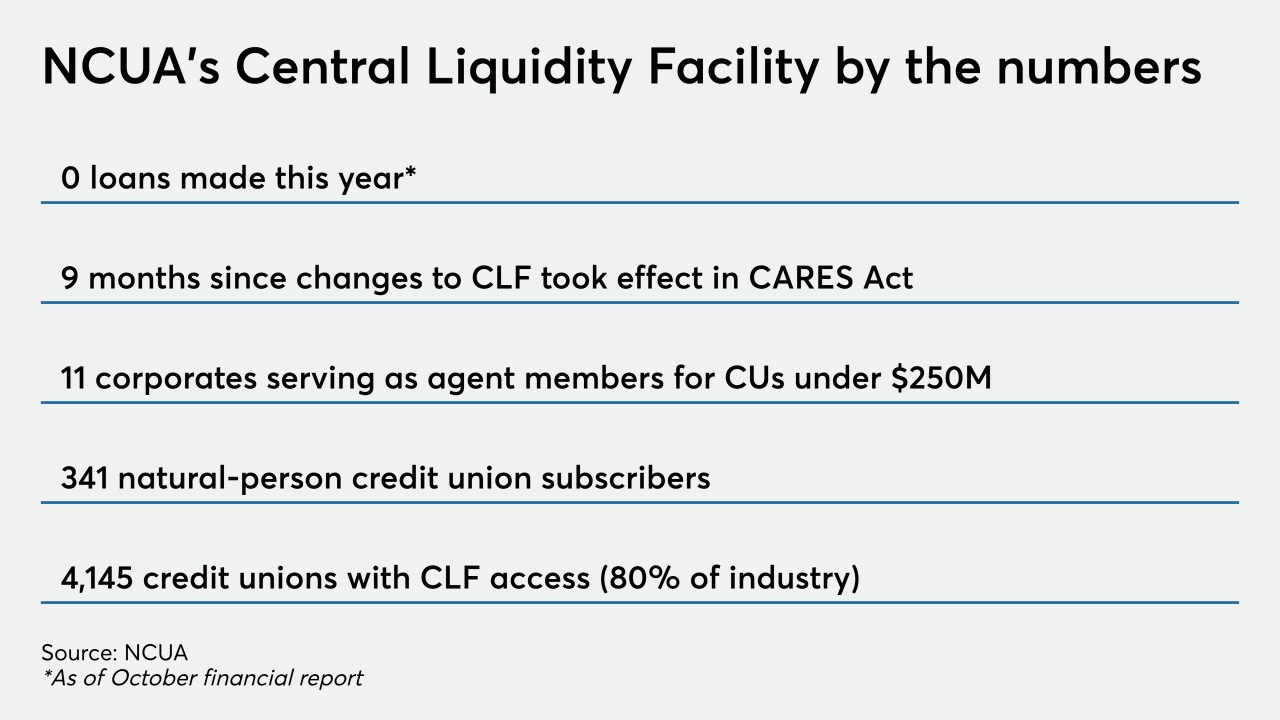

For all the damage from the pandemic and economic downturn, this crisis has not impacted liquidity. Lawmakers would be foolish to permanently alter the Central Liquidity Facility.

September 11

-

The Senate Banking Committee met Wednesday to review central bank lending facilities such as the Main Street Lending Program, which provides bank-issued loans to middle-market firms. But some lawmakers on the panel said the focus of pandemic relief has been misplaced.

September 9 -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27

![Fed Chairman Jerome Powell said the central bank had previously concluded that asset-based borrowers were able to secure financing elsewhere. Treasury Secretary Steven Mnuchin said “small hotels do not fit into [the Main Street Lending Program] because they already have other indebtedness.”](https://arizent.brightspotcdn.com/dims4/default/71a30be/2147483647/strip/true/crop/1600x900+0+0/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2Fb3%2F79%2F3b1db6264efa9eab86e05b296afc%2Fpowell-jerome-mnuchin-steven-bl-092220.png)