-

Bank robberies are becoming a thing of the past in cashless Denmark as the Nordic country recorded its first year of zero holdups in 2022.

January 3 -

Treasury Secretary Janet Yellen hailed the work done by women in her department as she unveiled the first U.S. banknotes bearing the signature of a female secretary.

December 8 -

An end-of-year push to attach a marijuana banking bill to a must-pass defense measure is facing stiff resistance from Senate Republicans and complicating the delicate lame-duck endgame for Democratic leaders soon to lose control of the House.

December 7 -

Banks are starting to have a tougher time obtaining funds in the financial system as the Federal Reserve shrinks its balance sheet and hikes interest rates, leaving analysts searching for any signs that the strains are approaching the magnitude of past credit crunches.

December 6 -

Marijuana shops across the U.S. are rushing to find alternative ways for customers to pay after networks that supported a popular workaround to the banking system began to shut down last week.

December 5 -

Treasury Secretary Janet Yellen, whose signature will soon appear on U.S. currency, joked with the talk show host Stephen Colbert that she worked hard to avoid the ridicule faced by some of her recent predecessors over their sloppy handwriting.

December 1 -

Thieves have increasingly used solid explosive to blow open cash machines rather than gas.

November 8 -

Citigroup plans to offer automatic-sweep products seven days a week as banks respond to clients' demands for higher interest rates on deposits and faster access to their cash.

October 5 -

After being hard-hit financially by the pandemic and the surging inflation that followed, the generation entering adulthood is meshing their love of late-‘90s nostalgia — think cargo pants, bucket hats and disposable cameras — with a dose of old-fashioned frugality.

June 29 -

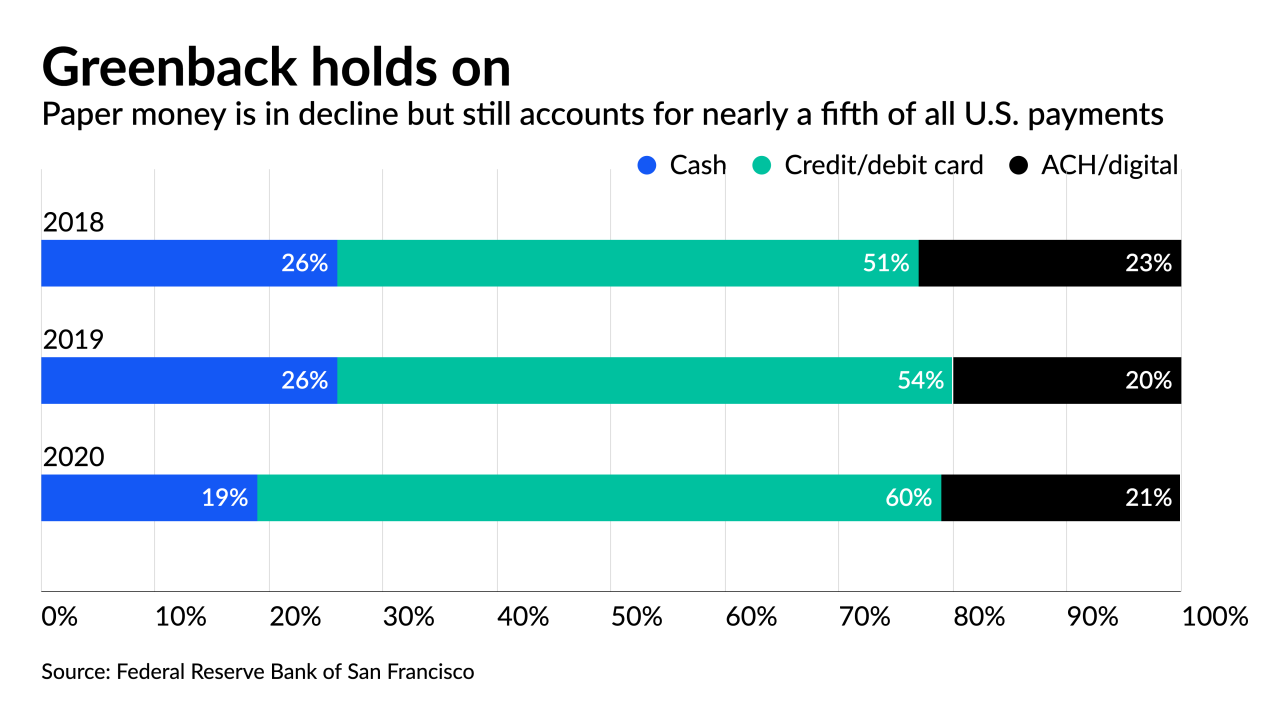

Cash is being used in fewer transactions than ever before, and the pandemic has only accelerated the trend. Yet the U.S. is far behind some European and Asian countries in embracing digital payments and significant hurdles remain to its becoming completely cashless.

January 27 -

During a House hearing, Democrats advocated for measures that ensure businesses keep accepting paper money, while Republicans argued in favor of chartering more fintechs and promoted stablecoins to extend access to the underbanked.

October 15 -

The shift away from human contact increased the popularity of kiosks, ATMs and other technologies that allow for more flexibility in payment methods.

September 1 -

While money market funds are flocking to the Federal Reserve’s overnight reverse repurchase agreement facility for the yield, large U.S. banks are using the program to shed unwanted deposits.

July 16 -

Resorts World is building its entire customer experience around a digital app, hoping to eliminate the need for — and costs of — handling paper money.

June 21 -

The move furthers the retail giant's strategy to become a one-stop shop for payments and financial services.

June 8 -

Japan is one of the most cash-centric of all developed nations, with about 80% of consumer transactions conducted with paper or coins, but the pandemic triggered some shifts that Adyen wants to capitalize upon.

May 19 -

The Federal Reserve Bank of Atlanta is enlisting banks, payment companies, retailers and universities to address problems that digital commerce creates for cash-reliant consumers.

May 14 -

Michael Moeser, senior analyst at PaymentsSource, talks to Simon Powley, head of advisory services at Diebold Nixdorf, about the importance of cash as the economy recovers from the coronavirus pandemic.

May 11 -

While German consumers prefer using cash in stores and are accustomed to paying for products after delivery, the global nature of e-commerce is sparking a change in payment habits.

May 3 -

Despite Japan being a heavily cash-based economy, e-commerce has created significant opportunities for banks and mobile wallet providers.

March 31