-

CEO Charlie Scharf said in a letter to Congress that a review is underway to determine how many customers were affected by confusion over monthly fees and that the bank will begin issuing refunds next year.

December 5 -

Rep. Katie Porter, D-Calif., wants details about refunding "hundreds of millions of dollars" in fees improperly charged on checking accounts. Wells has acknowledged the potential problem but hasn't estimated how much it owes.

November 22 -

It’s only a matter of time before Silicon Valley “overturns more complex banking functions”; banks would have to help FinCEN identify suspicious firearms sales.

November 18 -

By working with the tech giant on its consumer checking account, Stanford FCU hopes to grow but some wonder about the broader implications for fields of membership.

November 18 -

Questions about the search giant's planned use of transactional data resonate not only with wary consumers, but also with banks that are worried about big tech’s financial services ambitions, as well as lawmakers and regulators concerned about the tech industry’s growing reach.

November 13 -

Google has partnered with Citigroup and a California credit union to offer consumer checking accounts, a person familiar with the matter said.

November 13 -

Tech giant takes will work with Citi; the bank reportedly asked IT providers to return some of the money it paid them in 2018.

November 13 -

Tinker Federal Credit Union has allowed the retailer to install its lockers at several locations. It's one of a variety of new tactics institutions are using to get potential new members in the door.

November 4 -

After a news report said the bank kept alive accounts customers thought they had closed, Sen. Elizabeth Warren told acting CEO Allen Parker in a letter that Wells is "still fundamentally broken."

August 21 -

The health care payments market is big – accounting for over one in six dollars of the U.S. GDP – yet it remains perpetually outdated with its heavy reliance on using paper statements for sending out bills.

August 1 -

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

Several wealth management firms, including Marcus by Goldman Sachs and Wealthfront, have launched banking products to complement their investment services.

July 23 -

The bank will reduce its footprint to its German roots; U.S. banks are offering cash bonuses to keep customers from fleeing to higher-yielding accounts.

July 8 -

New York Attorney General Letitia James said there is “no basis to believe” that the overdraft rule has harmed small banks and credits unions.

July 2 -

The move figures to generate more low-cost funding for the firm’s consumer lending businesses without sacrificing substantial revenue.

June 17 -

Over time, real-time payments could become the predominant payment type while virtually eliminating cash and checks.

June 6 Citizens Bank

Citizens Bank -

While in its infancy in influencing B2B payments, AI ultimately will change the way businesses of all sizes run their financial operations, writes Rene Lacerte, CEO of Bill.com.

May 16 Bill.com

Bill.com -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 14 -

The agency launched a review to gauge whether the regulation requiring consumers to opt in to overdraft protection “should be amended or rescinded” to minimize the effects on smaller financial institutions.

May 13 -

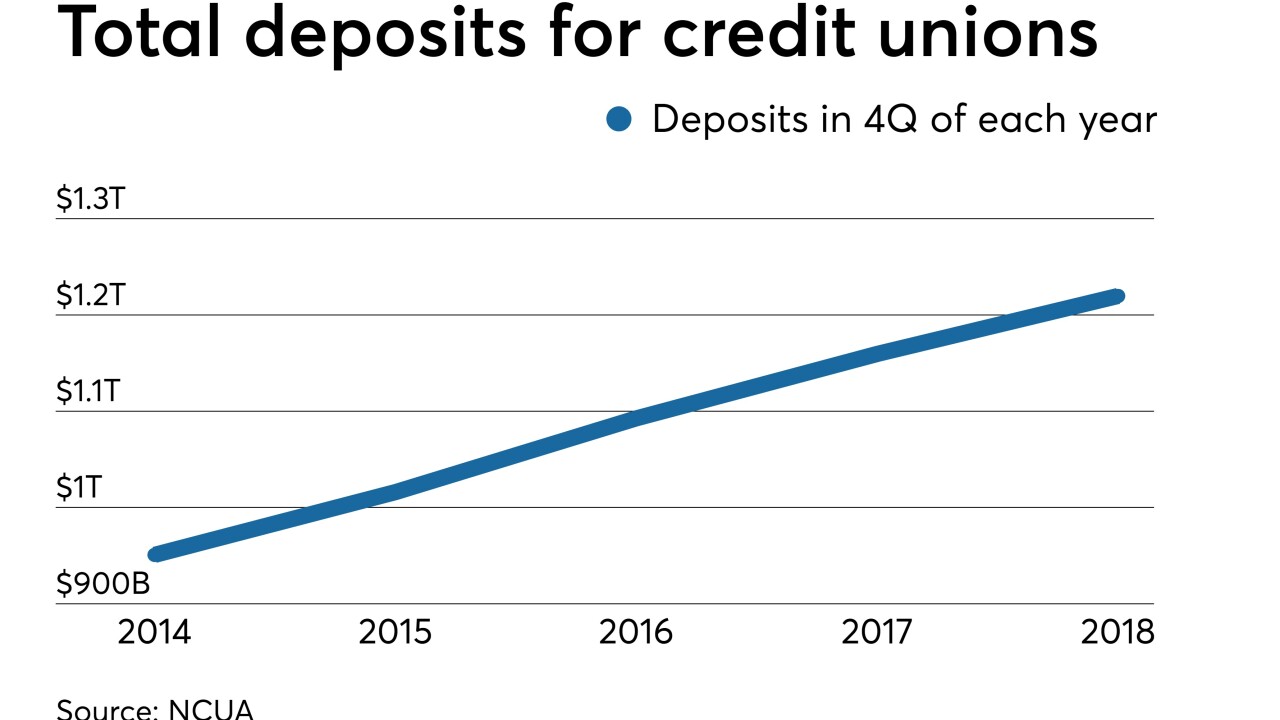

As credit unions attempt to bring in deposits to fund more loans, one institution's success story could offer a path for others.

May 1