-

Acting Comptroller of the Currency Michael Hsu previewed but provided little detail about the “high-level … supervisory expectations” for large institutions. His statement was one of several by regulators to coincide with an international climate change summit.

November 3 -

The Financial Stability Oversight Council's guidelines for regulators avoided measures that banks feared such as fossil fuel loan limits and rigid new stress tests. But the panel is recommending rules that would require financial institutions to disclose their exposure to global warming.

October 24 -

The Financial Stability Oversight Council issued a much-anticipated report with tentative recommendations on how regulatory agencies should begin preparing to contain the risk.

October 22 -

From factoring global warming into the underwriting of government-backed loans to conducting "sensitivity analysis" of banks' ability to withstand severe weather, several government agencies are accelerating efforts to address the impact of climate change on the financial system.

October 20 -

Goldman Sachs CEO David Solomon said the Wall Street firm wouldn’t abruptly stop working with fossil fuel companies, stressing the need for a balanced transition to green energy that avoids higher energy prices.

October 19 -

JPMorgan Chase signed a pledge to align its lending and investment portfolios with net-zero emissions by 2050, joining more than 40 rival financial firms in the Net-Zero Banking Alliance.

October 8 -

The European Central Bank will look at the trading operations of major lenders as part of climate stress tests next year, after judging that an assessment of loan books alone won’t give enough insight into the fallout they face from global warming.

September 16 -

The European Central Bank is stepping up pressure on lenders to prepare for stress tests next year that will show just how vulnerable the industry is to climate change, according to people familiar with the process.

September 1 -

Climate activists broke windows at JPMorgan Chase offices in central London Wednesday as part of two weeks of protests against organizations that support fossil fuels.

September 1 -

Financial Services Superintendent Linda Lacewell said she will step down Aug. 24, the same day Gov. Andrew Cuomo plans to leave following a sexual harassment investigation. The state’s attorney general found that Lacewell helped with the governor’s public relations response to the allegations.

August 13 -

Climate activists are starting to map out a coordinated campaign to oppose the potential renomination of Federal Reserve Chair Jerome Powell, because they view his record on fighting climate change through the banking system as scant and not aggressive enough.

August 13 -

The fintech startup Aspiration is in talks to go public through a merger with a blank-check firm in a transaction that’s slated to value the combined entity at more than $2 billion, according to people with knowledge of the matter.

August 12 -

Ando, a challenger bank focused on sustainability, is helping Virginia Community Capital Bank expand its 5-year-old clean energy lending program by finding a bigger pool of depositors who are eager to fund solar loans.

August 6 -

Sen. Patrick Toomey, the ranking Republican on the Banking Committee, has argued that research by the Federal Reserve into these topics could result in “mission creep.” Fed officials have said their job includes fostering inclusive economic growth and ensuring the banking system is girded against financial risks posed by climate change.

August 4 -

Until recently, only the largest financial services firms were tallying the risks from climate change and opportunities in the green economy. But a new report from Regions Financial suggests the practice is gaining wider traction.

August 3 -

BlackRock and other major financial institutions are working on plans to accelerate the closure of coal-fired power plants in Asia in a bid to phase out the use of the worst man-made contributors to climate change.

August 3 -

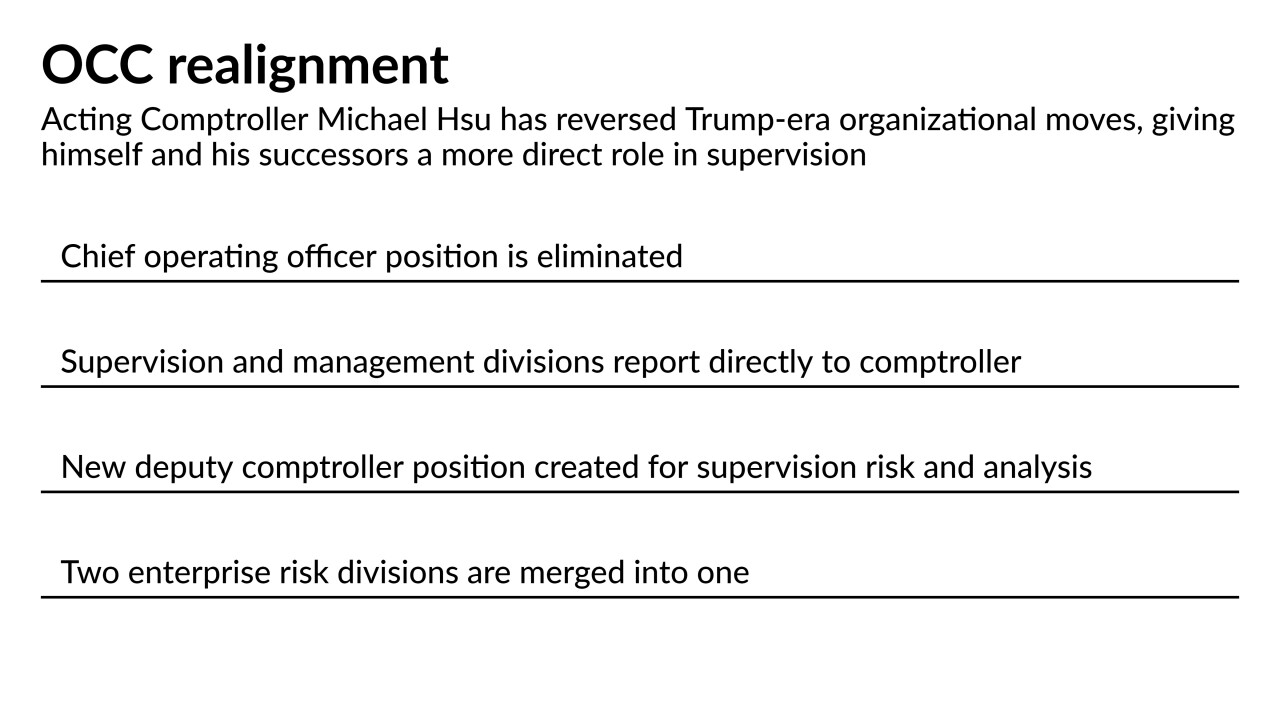

Michael Hsu is reorganizing the Office of the Comptroller of the Currency so that he directly oversees staffers who develop examination strategy. Some analysts suggest the move could result in more aggressive oversight by an agency long accused of being too cozy with national banks.

July 21 -

The European Union’s planned Green Asset Ratio, intended to reveal how much a bank lends to climate-friendly companies and projects, will offer a distorted picture of reality, according to a Bloomberg survey of some 20 major European banks.

July 20 -

As attitudes about corporate responsibility evolve, regulators will expect banks to take a more proactive approach to environmental, social and governance issues. That means going beyond assessing climate-related risks to incorporate a focus on ethics, culture, inclusion and customer protection.

July 9 Treliant

Treliant -

Jennifer Eastes is tasked with spearheading and accelerating environmental, social and governance efforts at the Cleveland-based company.

July 8