Commercial banking

-

A slight decline in core deposits in the second quarter stoked worries that tighter liquidity is around the corner. Bankers are exploring responses beyond the typical CD rate special if third-quarter results show the trend is continuing.

September 22 -

The Cincinnati bank says its investment unit is taking an equity stake in NRT Sightline to provide a wide range of banking and payments services to casino operators.

September 20 -

The Oregon bank has expanded the role of its chief credit officer to include oversight of risk management.

September 20 -

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18 -

Wells Fargo, PNC and others are finding that the web seminar is an effective way to promote themselves through advice and useful content aimed at consumers and business clients.

September 18 -

The Cincinnati company has agreed to acquire Epic Insurance Solutions in Louisville, Ky., as it continues to build out its fee-based lines of business.

September 15 -

The Dutch government sold a third stake in ABN Amro Group NV, taking advantage of a rally in the shares of the nationalized lender.

September 15 -

The New York bank has prided itself on its ability to grow organically, but CEO Joseph DePaolo hinted Wednesday that M&A could be in its future.

September 13 -

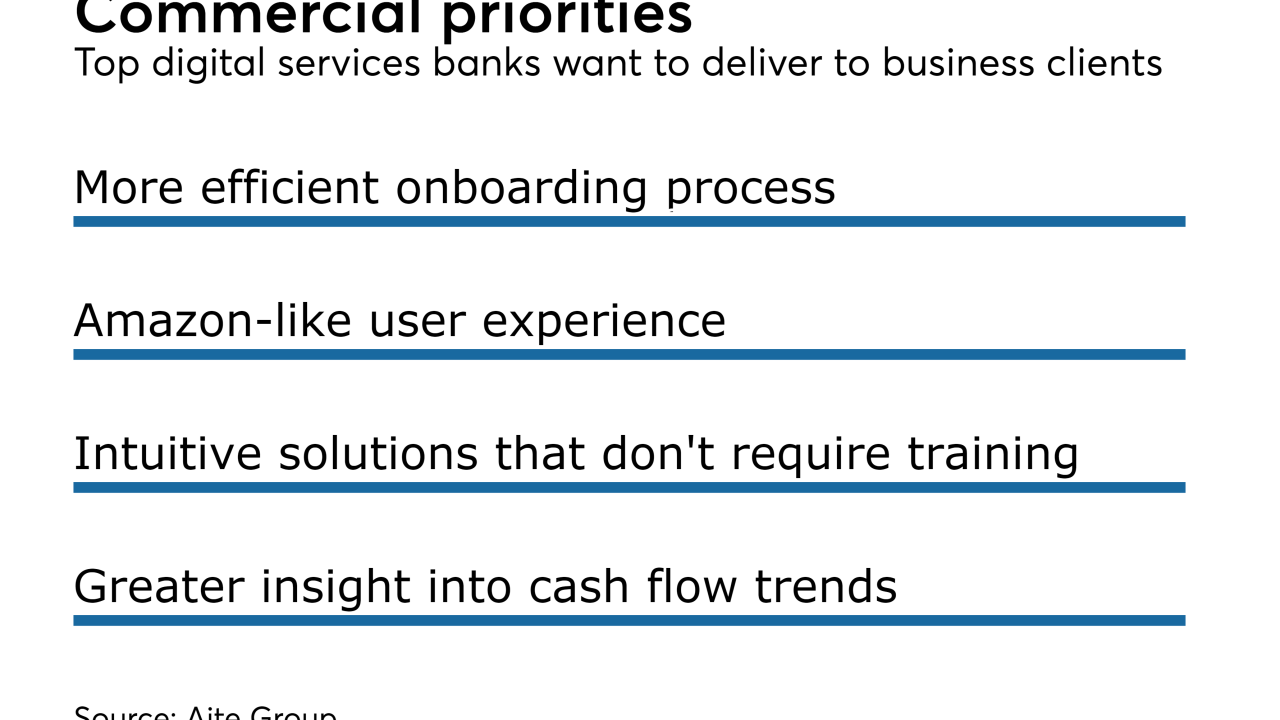

Systems that run cash management services were built decades ago and prioritized functionality over user experience. That is starting to change as banks invest more heavily in digital upgrades geared toward commercial customers.

September 13 -

A New Jersey politician has downplayed his Goldman Sachs career. The move shows that bankers have a ways to go rebuilding credibility with voters, though factors such as party affiliation, location and the type of banking career also matter.

September 12