-

As banks press for deregulation, the debate over whether high bank capital standards are inhibiting loan growth has taken center stage.

August 8 -

Young businesses often prefer banks, especially community banks, over online lenders. However, traditional lenders need to make quicker decisions, simplify the application process and make other improvements, these customers say.

August 8 -

The online consumer lender reported a net loss of $25.4 million, bringing its red ink in the five most recent quarterly reports to more than $200 million.

August 7 -

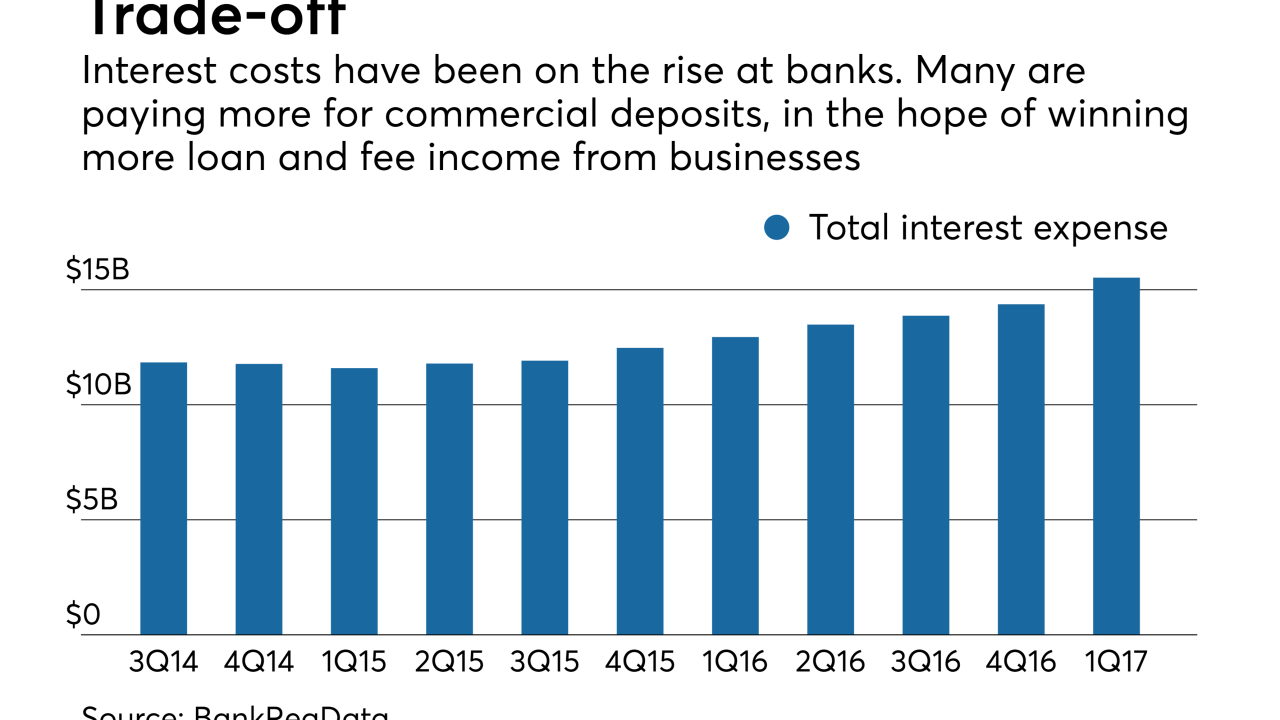

Many banks are adopting an “it takes money to make money” approach, paying more interest on deposits in exchange for loan growth, fee income and customer retention.

August 7 -

The online lender said it is on track to hit its goal of becoming profitable by yearend. It also extended a partnership agreement with JPMorgan Chase.

August 7 -

It is the latest of several popular apps to close down in recent weeks.

August 4 -

The online lending platform Kabbage announced Thursday it has raised $250 million from the Japanese telecom giant SoftBank, marking its largest equity fundraising round to date.

August 3 -

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

With the environment in Washington favoring deregulation, banks are pushing regulators to let them back into the payday lending game. They should know better.

August 2 Center for Responsible Lending

Center for Responsible Lending -

JPMorgan Chase is among four banks sued by a trustee for investors in the debt of Millennium Health LLC, alleging the lenders failed to inform them of a federal probe into the billing practices of the borrower.

August 2