-

The nation's fifth-largest bank on Monday rolled out a three-month consumer loan that is far less expensive than the typical payday loan. The move comes as regulators are encouraging banks to reach out to the subprime market, which they largely abandoned.

September 10 -

PNC's Todd Barnhart, incoming Consumer Bankers Association chair, says the group is concentrating on the impending process of modernizing the Community Reinvestment Act among other issues that do not require action on Capitol Hill.

September 10 -

On Jun. 30, 2018. Dollars in thousands.

September 10 -

-

Net income up is up for the industry on average, but the number of federally insured credit unions has dropped to 5,480.

September 6 -

Club owners used to be able to get bank loans, but that changed as the de-risking wave reshaped banks' relationships with pot firms, exotic dancers and many others. Whether the taboo can or should last becomes a big question as adult entertainment keeps growing.

September 6 -

If Gov. Jerry Brown signs the legislation headed to his desk, it would be the first law of its kind in the U.S. It is designed to allow small-business owners to make comparisons between offers in the often bewildering world of online business lending.

September 5 -

In a report, the watchdog said the economic environment and competition instead have driven trends in small-business lending.

September 5 -

On Jun. 30, 2018. Dollars in thousands.

September 4 -

Finance students at Marquette University will make loans to small businesses in Milwaukee from a revolving fund seeded by Town Bank and held on the books of a local CDFI.

August 31 -

Organizers of Dogwood State Bank are looking to raise $75 million in hopes of opening by mid-2019.

August 31 -

The USAmeriBank deal was supposed to give Valley National Bancorp a bigger presence in Florida, but it did more than that — it provided a model for banking businesswomen that Valley can copy in its New York and New Jersey markets.

August 30 -

The Detroit bank wants to focus on its core business instead, but other institutions have seen rapid growth in loans for recreational vehicles and other large pieces of transportation equipment.

August 29 -

The LendingClub founder responded to being booted from his company by starting a new one with involvement from former investors — and a loan buyer he had supposedly wronged.

August 29 -

Bank of Montreal set a profit record for its U.S. business, thanks in part to Donald Trump's tax cuts and lower provisions for bad loans.

August 28 -

The service can be useful for customers short on cash, but financial institutions need to clarify overdraft rules and develop alternative forms of credit.

August 27 The Pew Charitable Trusts

The Pew Charitable Trusts -

Organizers of new banks want to cater to underbanked minorities, entrepreneurs, military veterans and other specialized groups.

August 27 -

The move is important for new banks in states like California, where a small-business lending program requires a three-star rating from the agency.

August 24 -

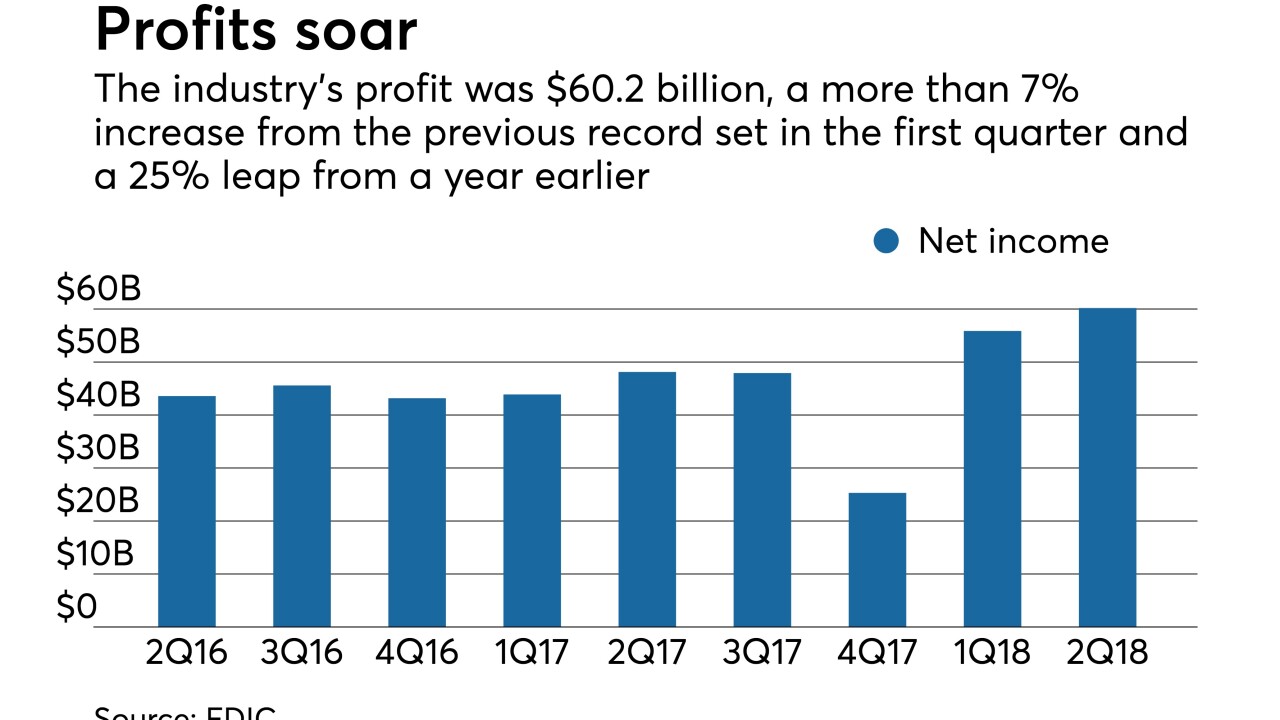

A huge chunk of the profit increase in the second quarter was due to a lower tax rate, but rising net interest margins and loan growth signal that institutions continue to derive revenue from their loan book.

August 23 -

The service can be useful for customers short on cash, but financial institutions need to clarify overdraft rules and develop alternative forms of credit.

August 23 The Pew Charitable Trusts

The Pew Charitable Trusts