-

Federal Reserve Chairman Jerome Powell said about 300 lenders have signed on to the program and that the central bank is committed to making adjustments that could attract more borrowers.

June 30 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

Some observers said the central bank should have suspended dividends entirely in response to an unprecedented economic emergency caused by the pandemic. Others said its more cautious moves were appropriate because big banks' capital is strong and the economy could bounce back.

June 26 -

National Credit Union Administration Chairman Rodney Hood told a NAFCU audience now is the time to take action on the member business lending cap so credit unions can continue to help with the coronavirus recovery.

June 25 -

Despite success lobbying for PPP inclusion and the elimination of Regulation D, the industry must continue to push for additional reforms.

June 25

-

Nick Darvill, who is currently president of the credit union service organization, will take over as CEO when Jim Gallagher retires from that position.

June 24 -

Upstart, which specializes in the use of alternative data and AI in credit decisions, will make car loans directly and sell its technology to banks and other lenders.

June 24 -

With credit quality suffering due to the coronavirus outbreak, the online business lender faces onerous loan repayments if it can't renegotiate a corporate debt facility.

June 24 -

Banks are beginning to emphasize soft skills to help employees make “human” connections with customers in an environment of reduced face-to-face contact.

June 23 -

The Paycheck Protection Program put a premium on speed in processing and funding loans.

June 23 -

A global health crisis. Economic free fall. A reckoning over racism and inequality. We will not be the same after this — and neither will banking.

June 23 -

Participation in the Main Street Lending Program for midsize companies is partly about public service, but the core business rationale is building "a banking relationship that continues on for some time," the Boston Fed chief says.

June 23 -

Former Comptroller of the Currency Gene Ludwig says making online lenders, credit unions and other nonbanks comply with the Community Reinvestment Act would be a powerful tool in addressing racial and economic injustices.

June 22 -

Funds from a certificate of deposit at Berkshire Bank will help fuel lending to minority-owned small businesses. Mellody Hobson explains why merely "working on diversity" is not good enough. And Wells Fargo ties compensation to progress on diversity targets.

June 22

-

Business owners are changing banks at three times normal levels, a trend researchers attribute to their difficulty in obtaining emergency loans. If the forgiveness stage of the Paycheck Protection Program proves arduous, that rate could climb much higher.

June 21 -

The agencies said late Friday that they will provide information on small businesses that received $150,000 or more from the Paycheck Protection Program.

June 19 -

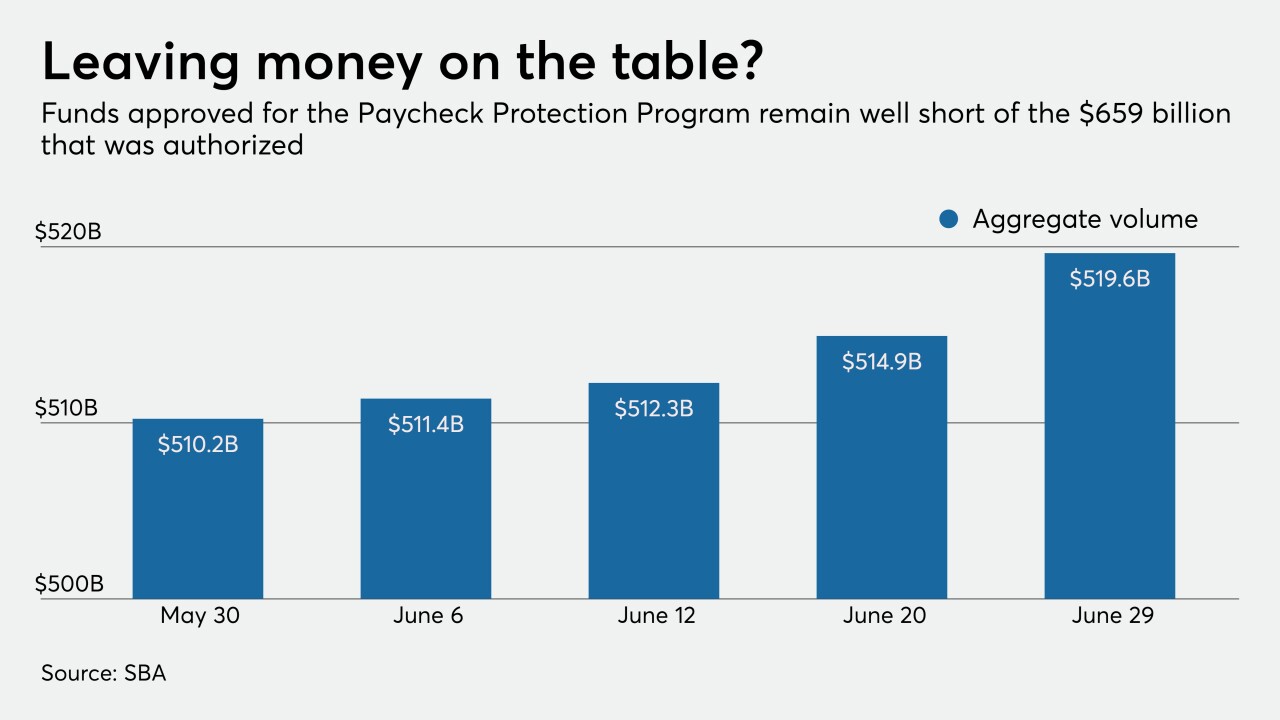

Activity in the Paycheck Protection Program has waned, but some argue that many small businesses, especially those owned by minorities, will miss out if the June 30 application deadline isn't extended.

June 19 -

Worried about a lack of demand and that some of their customers are ineligible, community banks are still on the fence about participating in the effort to back loans for businesses recovering from the pandemic crisis.

June 19 -

A blueprint that includes more CRA and tax credits for lower-income African Americans would help a demographic disproportionately harmed by the coronavirus pandemic.

June 19 Operation HOPE Inc.

Operation HOPE Inc. -

Other challenger banks focused on personal loans have struggled since the onset of the coronavirus pandemic.

June 17