-

Sloane, who died on Saturday, refused to bulk up on commercial real estate loans, a move that helped him survive two severe economic downturns.

April 9 -

Clayton is the latest to raise concerns about bank loans to highly indebted companies; Wells Fargo’s performance took a hit with its reputation.

April 9 -

The San Francisco fintech, which uses artificial intelligence to make consumer credit decisions, has raised an additional $50 million. It also announced new partnerships with lenders and plans for a credit card.

April 8 -

The congressional hearing will be ripe with opportunities for lawmakers to raise flags on issues of diversity, deregulation and social policy.

April 8 -

The Tennessee company has set up a $3.5 million reserve associated with the unnamed borrower.

April 8 -

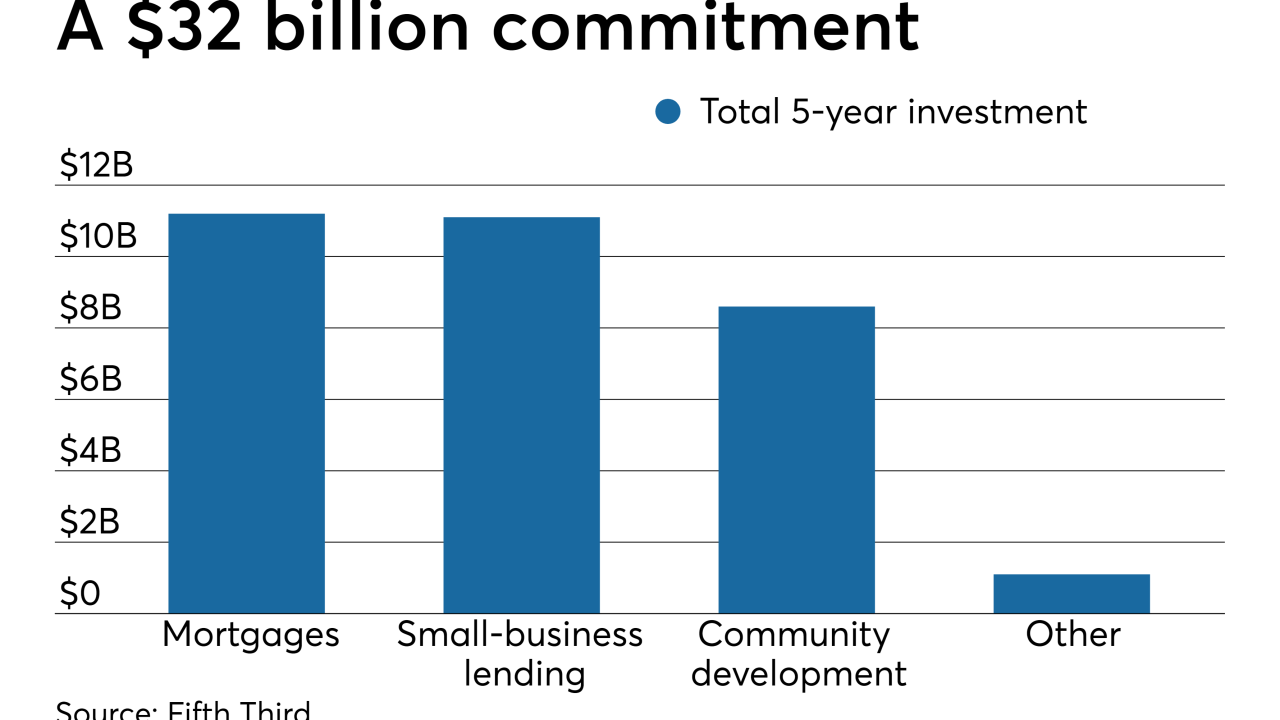

The bank is pledging to lend another $2 billion in a market where it has invested $3.6 billion in various community development initiatives since 2016. Most of the new funds will be used to make loans to small businesses that operate in low- and moderate-income neighborhoods.

April 5 -

To generate revenue, SoLo Funds depends on consumers willing to front funds through its platform.

April 4 -

In successive speeches, Joseph Otting and Jelena McWilliams expressed hope for a Community Reinvestment Act rule by early next year, and also said regulators should align their small-dollar lending policies.

April 3 -

Since last fall, when the value of digital money plummeted, lenders have been pushing people who have paper profits to leverage them into cash by borrowing against their cryptocurrencies. And the fact that there's no tax bill on the transactions is a big selling point.

April 2 -

On Dec. 31, 2018. Dollars in thousands, except for average loan amount.

April 1 -

The Los Angeles bank will take a $1.4 million hit to earnings after the multifamily properties sold for less than their book value.

April 1 -

Some fintechs have figured out how to provide international students and immigrants with credit cards and loans. Machine learning makes the underwriting possible.

March 31 -

The San Francisco-based online lender said that the departures of two prominent board members are not the result of any disagreement with the company.

March 29 -

StreetShares will add to its line of financing products with a credit card specifically for small-business owners with a military background.

March 28 -

Assemblywoman Monique Limon is in the “early stages” of exploring how to create a state-level Consumer Financial Protection Bureau as part of a broader push for more consumer protection for state residents.

March 27 -

Some lenders, especially in markets like California, are preparing in case of a technology-industry stumble that hurts business, real estate and other loan segments. Whether those fears are well founded is a matter of debate.

March 26 -

Regional and community banks are working to finance the economic development districts created by the new law. But they have lots of questions about how the program works — and thoughts on how to improve it.

March 26 -

On Dec. 31, 2018. Dollars in thousands.

March 25 -

AI-driven customer insights, mortgages and small-business loans are among the features in the app, which the bank is rolling out Friday.

March 24 -

The bureau had already proposed removing the underwriting portion of the rule, but a judge in Texas has indefinitely delayed the other key component as well.

March 22