Community banking

Community banking

-

West Florida Banking is made up of bankers who ran Jefferson Bank of Florida, which is now part of CenterState Banks.

May 30 -

Smaller banks are often not taking the extra step beyond traditional functions such as online bill pay, writes Alberto Hernandez, COO for the U.S. region at Valid.

May 30 -

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter.

May 29 -

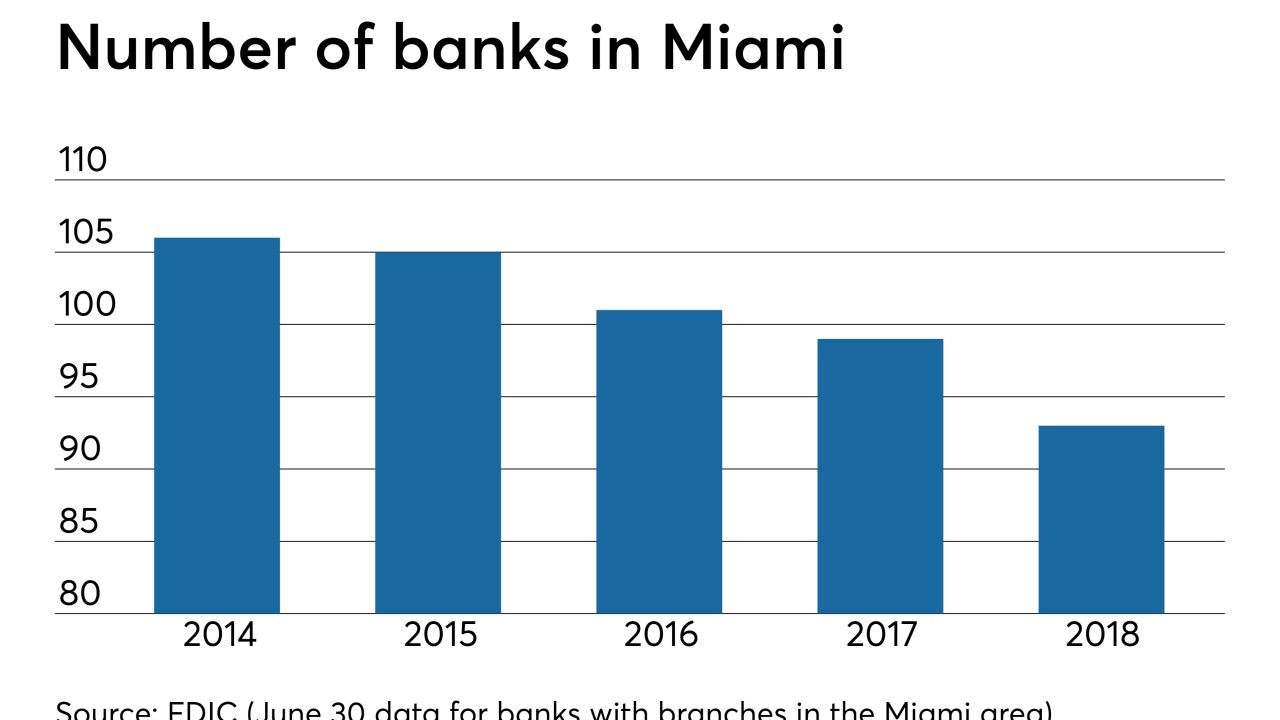

A strong economy and the chance to court Hispanic customers and businesses have banks interested in the region once more.

May 29 -

A Burke & Herbert veteran will serve as CEO until January, when the bank will introduce an outsider as its leader.

May 29 -

While some of the biggest institutions are already rapidly developing new technologies, it’s important that community banks also tap the power of artificial intelligence and machine learning.

May 28 -

More businesses are considering moving away from cash and checks, according to a recent survey by Citizens. That should be a wake-up call to smaller institutions, said Michael Cummins, who oversees treasury solutions at the regional bank.

May 27 -

The president's big loan from, and sizable deposits with, Professional Bank in Boca Raton have raised some eyebrows. But the bank's chairman says it recruits relationship bankers from larger rivals to get just these kinds of customers.

May 24 -

Regulators have taken a number of steps to implement last year’s reforms to Dodd-Frank, but there are several important items left on the to-do list.

May 24 -

Charges against Stephen Calk indicate he lied to regulators about what he knew when he approved loans to Paul Manafort, as well as his interest in landing a job in the Trump administration.

May 23 -

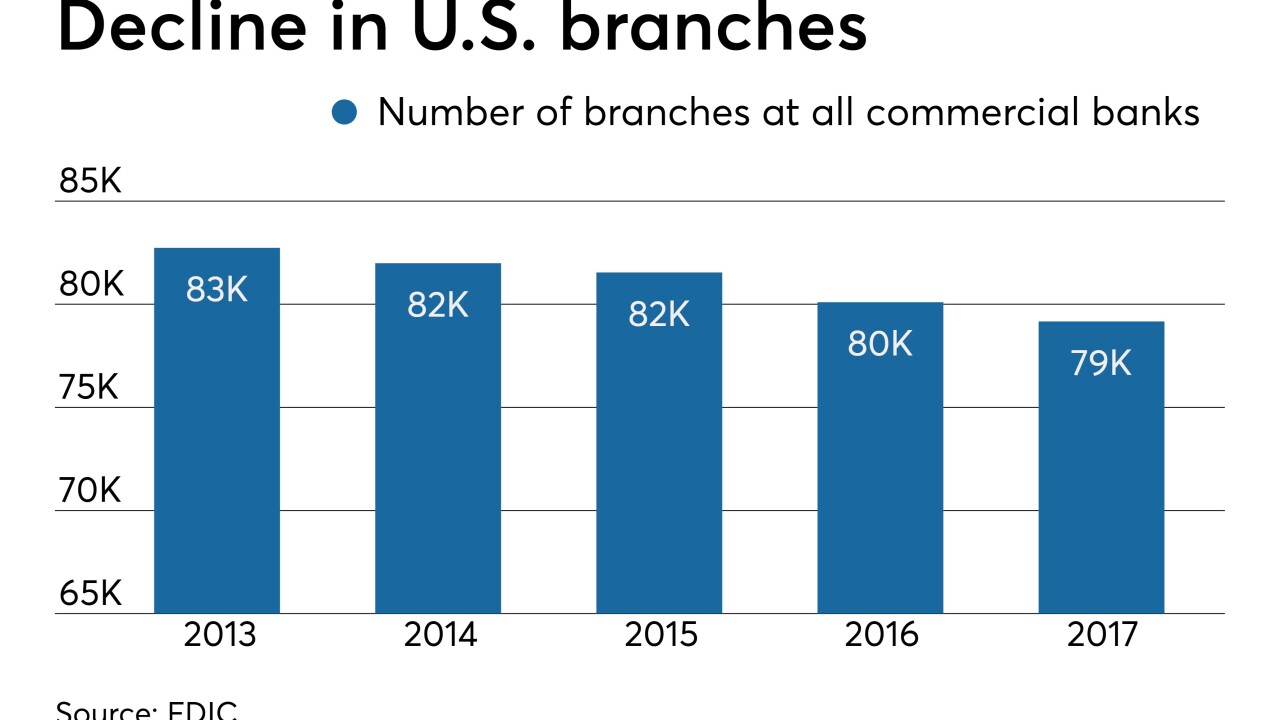

As foot traffic continues to decline, bankers are relying on gimmicks like dramatic lighting and placing buildings closer to highways in an effort to market their institutions.

May 23 -

Chris Lorence, a former marketing official at the Independent Community Bankers of America, is the Credit Union National Association's latest recruit from other financial services trade groups in recent years.

May 22 -

Anthony DeChellis’ strategy for staying relevant in a competitive metro market is a little odd — rebuild the private banking business his predecessor shrank — but observers say he might be the executive who can pull it off.

May 22 -

Avidia Bank joins the network even as other community banks call on the Fed to create its own real-time payment service to compete.

May 22 -

The parent of Ponce Bank has agreed to acquire Mortgage World Bankers.

May 22 -

While regulation and nonbank competition are spooking some banks and credit unions, others believe low funding costs and the right relationships can help them succeed.

May 22 -

While some of the biggest institutions are already rapidly developing new technologies, it’s important that community banks also tap the power of artificial intelligence and machine learning.

May 22 -

The pace is torrid now, but it could slow if bank stock prices keep rising and one prominent lawmaker’s proposal to restrict share repurchases gains traction.

May 21 -

While regulation and nonbank competition are spooking some banks, others believe low funding costs and the right relationships can help them succeed.

May 21 -

BB&T’s chief executive has not prioritized meeting with local leaders and consumer advocates to discuss its merger plans, missing a valuable opportunity to create a new kind of large bank.

May 21