Community banking

Community banking

-

Old National will have the fifth-biggest deposit market share in the city when it completes the $434 million acquisition.

June 21 -

First Western in Colorado and Coastal Financial in Washington are the latest banks to disclose plans to go public.

June 20 -

Several leaders have retired after spending years preparing their banks for the regulatory milestone.

June 20 -

Fountain City Fintech, a program planned by NBKC Bank, would be one of the first fintech incubators formed by a community bank.

June 20 -

The company will pay $48 million for four branches and $230 million in loans.

June 20 -

The Dallas company expects to report a higher loan-loss provision after the loans, which include two shared national credits, deteriorated in the second quarter.

June 19 -

Ruoff Financial will make its first push into banking with the purchase of SBB Bancshares.

June 19 -

The National Credit Union Administration is set to vote on revisions to its field-of-membership rule, even as it's entangled in a legal dispute with the American Bankers Association over the rule.

June 19 -

The Connecticut company will have nearly $48 billion in assets after it buys First Connecticut Bancorp.

June 19 -

Cost-cutting will be important, but for its acquisition of CoBiz to be a winner, BOK Financial will have to prove it can boost fee income as it has with smaller acquisitions.

June 18 -

The deal for the Denver commercial lender joins a growing list of large acquisitions being announced in competitive urban markets.

June 18 -

The central bank's rule-writing workload is expected to remain busy for the foreseeable future, thanks in large part to enactment of the recent regulatory relief bill.

June 17 -

C.G. Kum, who has been the Los Angeles company's CEO the past five years, plans to retire in May.

June 15 -

Blue Lion Capital, which has been a vocal critic of the Seattle company's strategy, also wants management to consider selling its MSR portfolio.

June 15 -

Starling's Anne Boden and Mastercard's Ann Cairns have a similar warning for the banking and tech sectors. Facebook scolds activist investor Natasha Lamb for being "not nice." And some big Most Powerful Women moves, as Catherine Keating takes a new CEO job and Kathie Andrade exits TIAA.

June 15 -

Cadence first discussed a deal with the Atlanta target four years ago. But negotiations picked up steam once it was clear State Bank had another suitor.

June 15 -

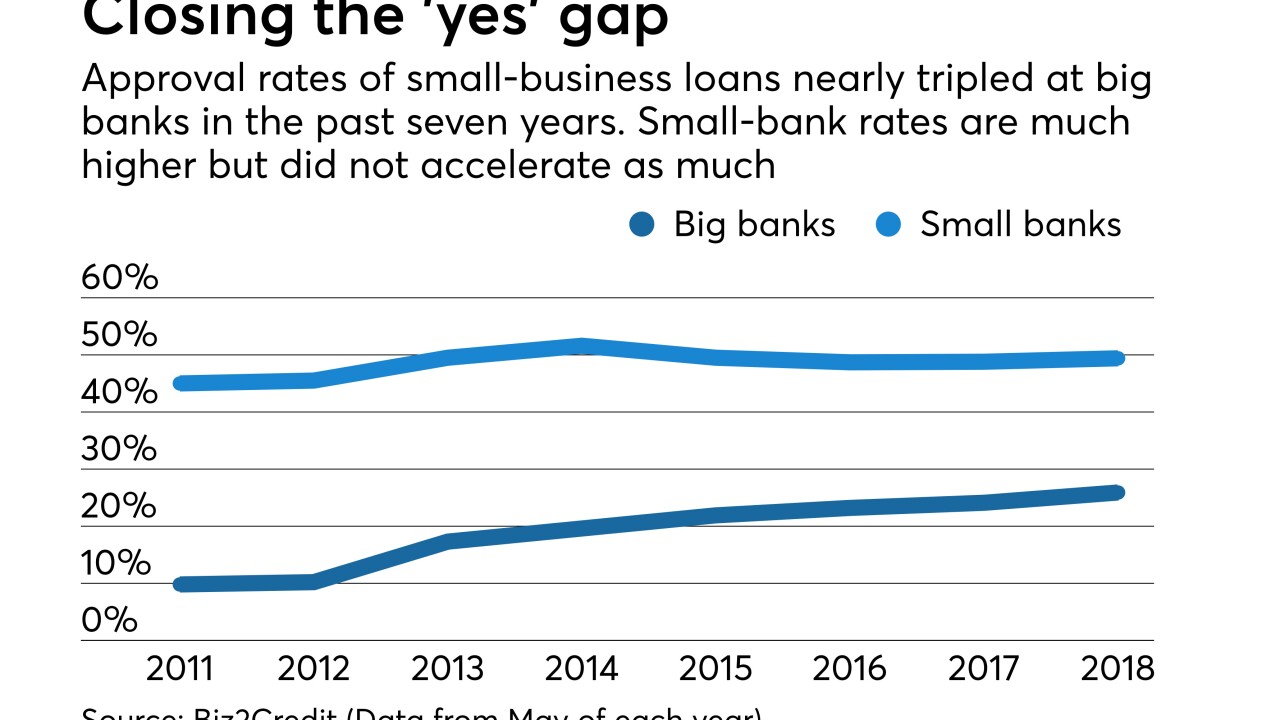

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

Of all the types of malicious software targeting businesses, ransomware continues to be one of the most pervasive, according to recent studies. Here's an overview of the things banks, especially small ones, are doing to stop it.

June 15 -

The company, which was flagged for two products, has been working with its regulators to determine the right amount to set aside.

June 15 -

The acquisition will help Carolina Trust expand its operations around Charlotte.

June 15