Community banking

Community banking

-

The company would prefer buying banks with $5 billion to $10 billion in assets unless it finds an appealing alternative in a strategic market such as Raleigh or Nashville.

January 13 -

Groundbreaking ceremonies, donations to worthy causes and more great givebacks from credit unions to the communities they serve.

January 13 -

The deal expands Post Oak’s existing operations around Houston

January 13 -

William Davis Jr. was the company’s CEO from 1996 to 2009

January 13 -

The Seattle company warned that fourth-quarter profit could fall more than 80% from a year earlier.

January 13 -

Big banks report; Why Goldman is different

January 13 -

The company had been operating for years under a licensing agreement with the San Francisco banking giant.

January 12 -

The California bank, grappling with credit-quality issues, did not say when – or if – a successor will be named

January 12 -

First Internet Bancorp is the latest institution to enter the business or to significantly expand operations.

January 12 -

The company recently received Fed approval to increase its ownership in Carter to 9%.

January 12 -

Any economic environment, including this one, has risks but it is unclear whether banks are sufficiently worried about what lies ahead.

January 12 -

Salisbury Bancorp in Lakeville, N.Y., has agreed to buy a branch from ES Bancshares in Newburgh.

January 12 -

Huron Community Financial Services in East Tawas, Mich., is getting ready to offer insurance products.

January 12 -

First Business in Wis. to consolidate bank charters-

January 12 -

The U.K.-based firm has raised $373 million from investors since it was founded in 2010.

January 11 -

The company will pay $23.4 million for the $194 million-asset parent of Capaha Bank.

January 11 -

Larry Mazza, MVB’s chief executive, joined the board at BillGO.

January 11 -

First Community Bancshares in Bluefield, Va., spent $15.5 million to buy back the securities.

January 11 -

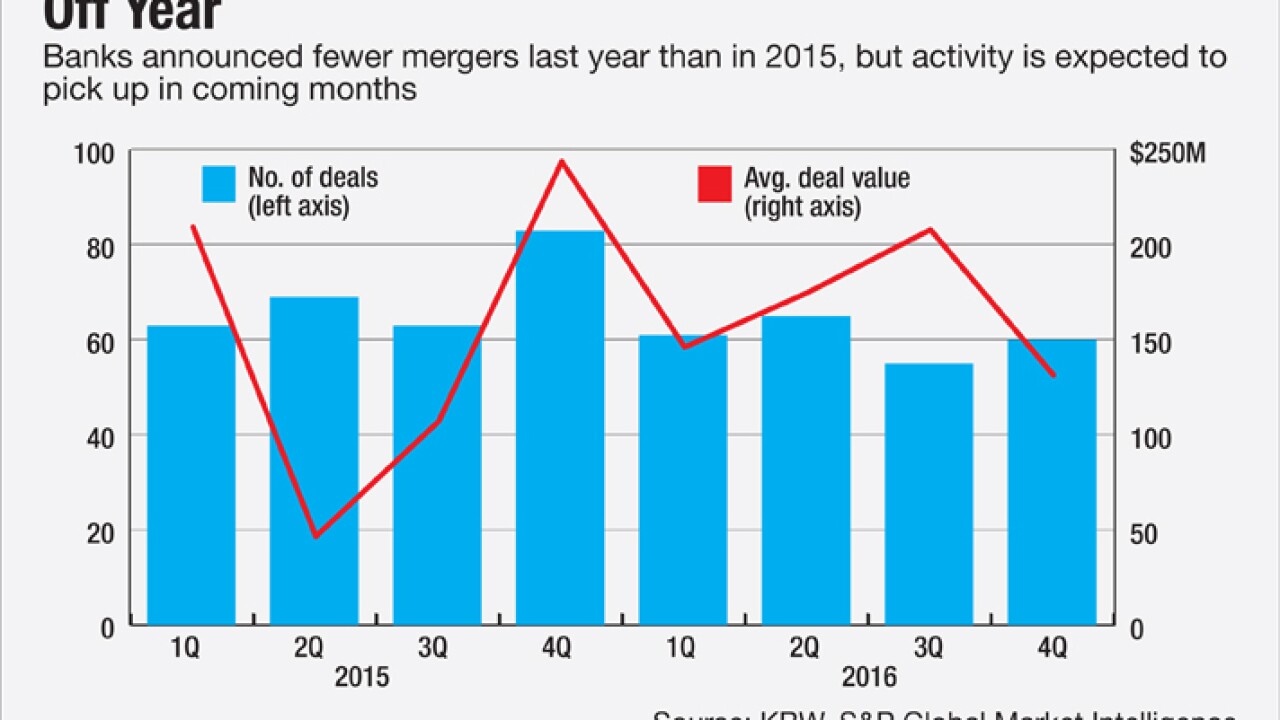

There is optimism that consolidation could bounce back from a lackluster 2016 as bank stocks rally. At the same time, expectations of regulatory easing and tax reform could entice more banks to stay independent, at least in the short term.

January 11 -

Credit unions are relying on tried-and-true methods of aiding the communities they serve, all while adding new and innovative strategies into the mix.

January 11