Community banking

Community banking

-

Enterprise Financial Services in Clayton, Mo., said Wednesday that it has promoted James Lally to president.

August 10 - Delaware

The Bancorp in Wilmington, Del., is being investigated by the Securities and Exchange Commission for restating more than three years of financial statements.

August 10 -

Synovus Financial in Columbus, Ga., has agreed to pay nearly $9 million to settle lawsuits that claim the company knew of illegal transactions by one of its clients.

August 10 -

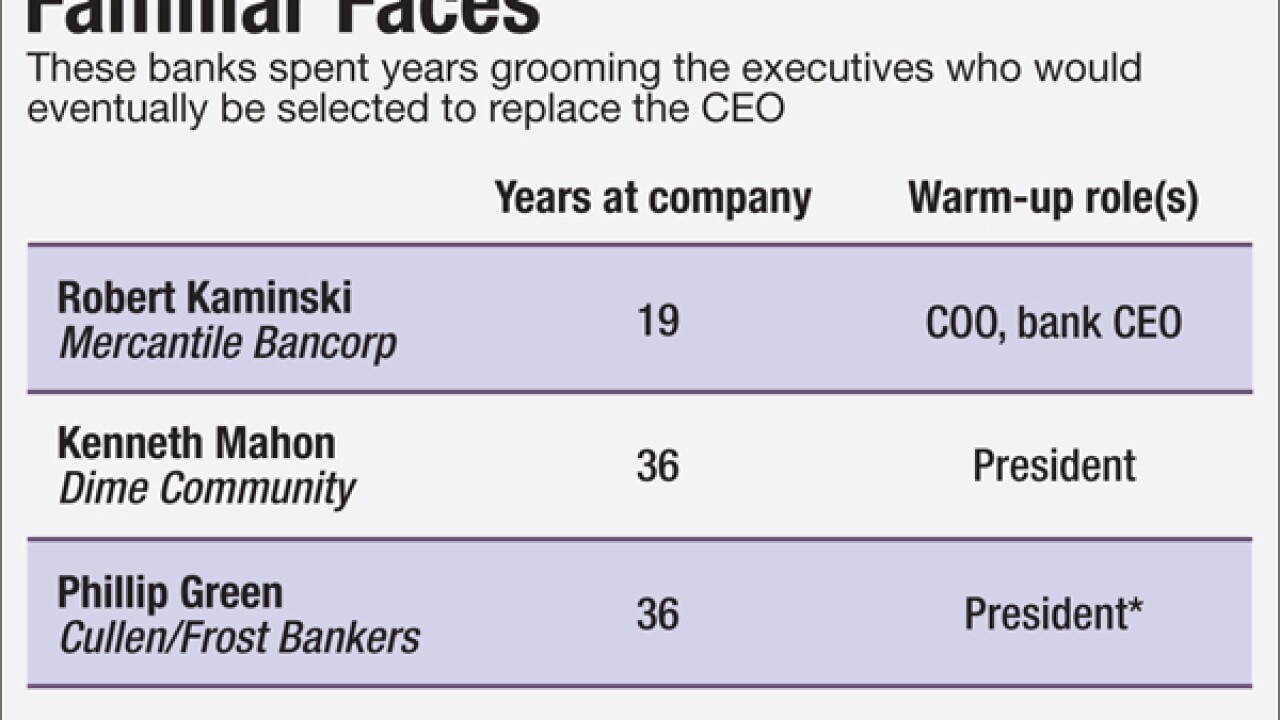

Mercantile Bank and Dime Community recently outlined plans for their CEOs' retirements, while Cullen/Frost made the transition earlier this year. Each transition is anchored in a belief that success hinges on turning day-to-day operations over to a trusted lieutenant.

August 10 - Indiana

Old National Bancorp in Evansville, Ind., has agreed to buy its headquarters building and two other branches from a landlord.

August 10 -

The emergence of lenders that have no real connection to a geographic area prompts questions over how the Community Reinvestment Act's "good neighbor" policy can continue.

August 10 - New Jersey

Valley National Bancorp in Wayne, N.J., has taken several steps to help it navigate through a difficult interest rate environment.

August 10 -

Small-business owners heard "no" more often in July when seeking loans from big banks after six months of improving prospects.

August 9 -

New Jersey Community Bank in Freehold has exited a pair of regulatory orders. The $102 million-asset bank also said in a press release Tuesday that two siblings have resigned from its board.

August 9 -

PricewaterhouseCoopers LLP failed to spot for seven years a multibillion-dollar fraud that led to the demise of Taylor Bean & Whitaker Mortgage Corp., a lawyer for the lender's bankruptcy trustee told a Miami jury on Tuesday.

August 9 -

Several court decisions in Delaware could make it harder for shareholders to sue banks following a merger announcement.

August 9 -

The $4.3 billion-asset holding company said in a press release Monday that the fixed- to floating-rate subordinated notes are due in 2026.

August 8 - California

Pacific City Financial in Los Angeles has raised $15.3 million in a secondary stock offering.

August 8 -

Under pressure from regulators to beef up risk management in commercial real estate lending, banks are using new software tools to improve analysis.

August 8 - Louisiana

MidSouth Bancorp in Lafayette, La., has named Troy Cloutier, the son of Chief Executive Rusty Cloutier, to run its bank.

August 8 -

Community banks are often burdened with manual data entry for processing commercial loans. Union State Bank has turned to digitization software to make it easier. It may sound modest in the age of APIs, but it made a quantifiable difference.

August 8 -

NexTier Bank in Butler, Pa., has tapped its chief operating officer as its next leader.

August 8 -

The Bancorp in Wilmington, Del., has raised $74 million by selling common stock and a new series of preferred stock.

August 8 -

The biggest change in banking in the last 60 years is the shift in balance sheets from business lending to real estate finance and therefore more risk tied to volatile real estate prices.

August 8 -

TIAA in New York has agreed to buy EverBank in Jacksonville, Fla.

August 8