Community banking

Community banking

-

On Sep. 30, 2020. Dollars in thousands.

January 4 -

Speculation is swirling that the Boston company will go on a buying spree after raising $1.8 billion, though some investors are advising caution. This tension makes CEO Bob Rivers one of our community bankers to watch in 2021.

December 31 -

Triad Business Bank opened in North Carolina shortly before the launch of the Paycheck Protection Program, which brought in many clients. CEO Ramsey Hamadi, one of our community bankers to watch in 2021, will have to work hard to retain them after their loans are forgiven.

December 30 -

Chris Maher recently unloaded loans hurt by the coronavirus shock, convinced he was freeing the New Jersey company of baggage that could impede a large M&A deal. This assertive move makes him one of our community bankers to watch in 2021.

December 29 -

The company promoted two executives as part of an effort to revamp its leadership team and establish a bigger presence in the Carolinas.

December 28 -

Gilles Gade, one our community bankers to watch in 2021, led an effort that made Cross River Bank one of the biggest Paycheck Protection Program participants. He is ready for his team to pick up where it left off when the new stimulus package kicks in.

December 28 -

Coastal Community in Washington is an investor in and the first client of Synctera, a software company that aims to help community banks manage their fintech relationships, including regulatory obligations.

December 28 -

The company will pay $20 million in cash for a bank with two branches and $58 million of loans.

December 22 -

There’s an alarming gap between how small and large banks view the importance of digital engagement, according to a recent survey by Celent and Arizent.

December 21 -

The agency’s second in-depth study of the community banking sector pointed to continued challenges for local institutions from the pandemic and other headwinds, but many smaller banks are reaping the benefits of M&A and holding their own against larger competitors in key lending categories.

December 16 -

The company agreed will pay nearly $10 million for Sunset parent Waukesha Bankshares.

December 16 -

The Independent Community Bankers of America had planned to hold its annual conference in Hawaii before the coronavirus pandemic hit.

December 15 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

December 14 -

The $62.7 million merger of Linkbancorp and Gratz Bank would create a company with over $800 million of assets and nine branches stretching from Harrisburg to the Philadelphia suburbs.

December 14 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

The events of this year transformed banking, for better or worse. Smart bankers will build on the ways they learned to do their jobs better.

December 11 -

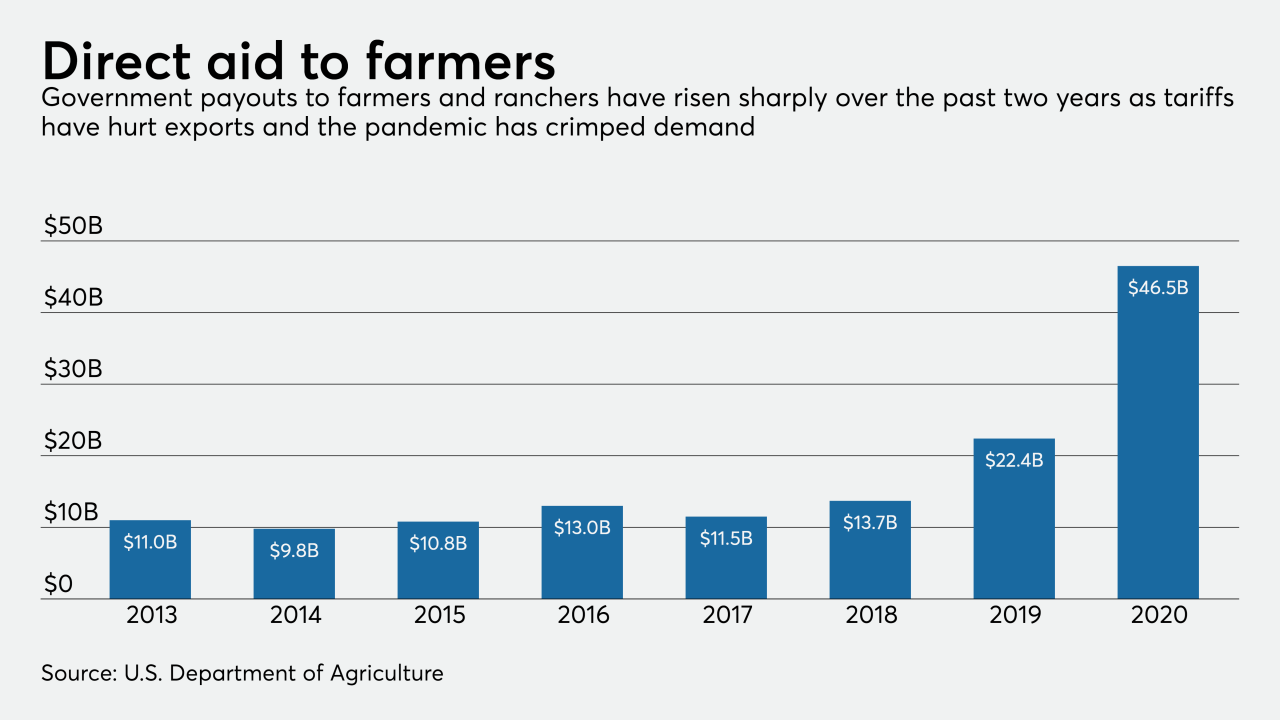

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

Bill Knott succeeded Terrie Spiro as leader of the Maryland bank, which raised capital in 2017 by going through a complicated bankruptcy process.

December 9 -

First Kansas, part of the multibank holding company Ottawa Bancshares, expects to complete the acquisition early next year.

December 9 -

On Sep. 30, 2020. Dollars in thousands.

December 7