Community banking

Community banking

-

Commercial real estate lenders have to consider not only how they’ll weather the COVID-19 downturn, but whether worker and consumer habits have changed for good.

March 30 -

The acquirer had pursued a de novo strategy in its home state but was unable to raise enough capital.

March 30 -

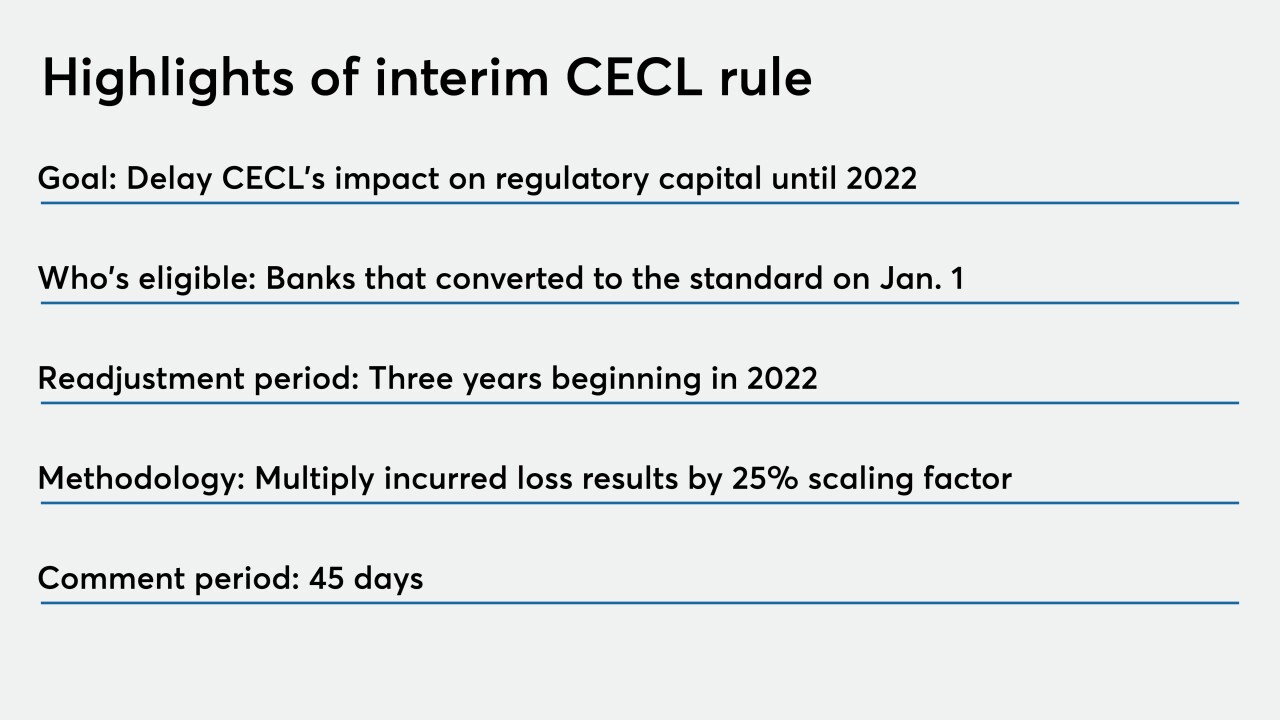

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

Citigroup CEO says it’s a “fine line” between supporting customers and burdening them with debt; Goldman gives away 600,000 N95 masks it had from prior scares.

March 27 -

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

Tom Meyer, CEO of 1st Capital since 2015, decided to step down because shelter-in-place orders are keeping him from family hundreds of miles from the bank.

March 26 -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

March 26 -

The regulator's extension for first-quarter documents applies to BHCs with less than $5 billion in assets.

March 26 -

A former market president for State Bank Financial would serve as CEO of the proposed Classic City Bank.

March 26 -

The company is one of the first to share information on impacted clients, forbearance requests and emergency loan applications.

March 25 -

Many banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”

March 25 -

Banks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

March 25 -

As companies move work off-site because of the pandemic, a host of issues have arisen around remote access, network monitoring and cybersecurity.

March 24 -

The central bank will prioritize monitoring and outreach while reducing examination activity due to the coronavirus pandemic until at least the end of April.

March 24 -

The COVID-19 crisis is forcing many banks to hold their spring shareholder meetings online only.

March 24 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

March 23 -

Some industry observers are calling on the Treasury Department to bring back the Small Business Lending Fund to help small companies stay afloat during the coronavirus pandemic and get back on their feet once the crisis passes.

March 23 -

On Dec. 31, 2019. Dollars in thousands.

March 23 -

On Dec. 31, 2019. Dollars in thousands.

March 23