-

From the presidential election to Supreme Court cases, growth strategies and more, these are the issues that could define the next 12 months.

January 9 -

So far this year, Lloyds and Clydesdale and Yorkshire Banks have had payment failures in the U.K. And in the U.S., a software glitch at parking technology vendor Parkeon halted digital payments at meters in New York and other cities.

January 9 -

Cybersecurity, AML compliance and consumer protections top the credit union regulator's list.

January 8 -

Facebook’s Libra cryptocurrency project has drawn vast political pushback, but also more tangible government action as nations globally consider central bank supported digital currencies. It’s also sparking a potential bottom-up approach in New York.

January 8 -

Comerica will continue to handle the U.S. Treasury’s Direct Express prepaid card program, beating out other banks for the third time since the program launched in 2008, despite a high-profile glitch in 2018 that drew lawmakers’ scrutiny.

January 7 -

More groups said they submitted bids for digital banking licenses in Singapore as companies, ranging from a property giant to Chinese fintech firms, joined forces to go for the sought-after permits.

January 6 -

The SAFE Banking Act is on hold after Sen. Mike Crapo announced his opposition to it. One observer suggested that could have a "chilling effect" on CUs looking to enter the pot banking space.

January 6 -

Europe's PSD2 data-sharing mandate is inspiring banks such as BBVA to form unconventional alliances.

January 6 -

Several former high-level Wells Fargo executives are under criminal investigation in connection with the bank's fake-accounts scandal and could be indicted as soon as this month.

January 3 -

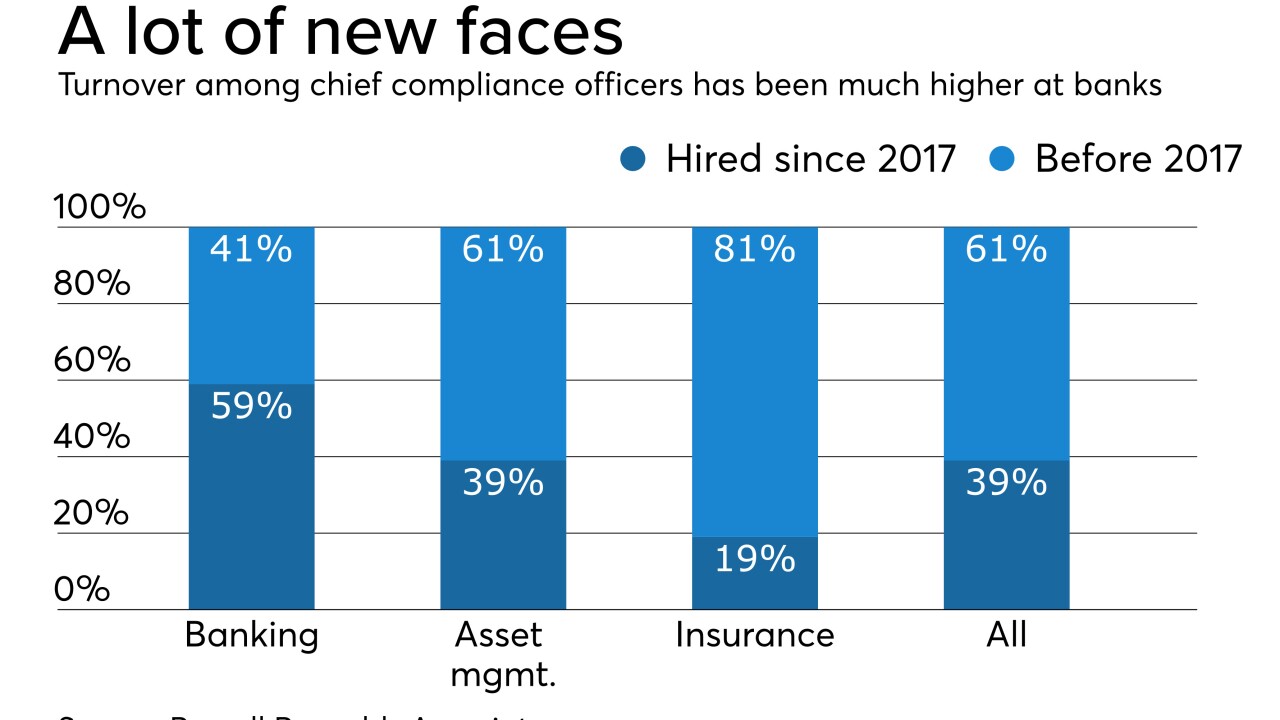

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3