-

Four federal agencies offered guidance Wednesday on how to offer products that compete against payday loans without incurring Washington's wrath. The announcement could spark the rebirth of deposit advances, which were regulated out of existence during the Obama administration.

May 20 -

One of the biggest subprime auto lenders agreed to pay $550 million to settle predatory lending charges; the bank regulator has largely completed his goal of overhauling the Community Reinvestment Act.

May 20 -

The lender will pay $65 million in restitution and forgive nearly $500 million in auto debt to settle charges that it steered subprime borrowers into risky loans.

May 19 -

Congress should pass legislation authorizing use of nontraditional data sources to make credit more available to consumers who’ve taken a hit from the coronavirus pandemic.

May 19Remitter USA and meldCX -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

With rates so low — after steep emergency Federal Reserve cuts in response to the pandemic’s fallout — banks will struggle to generate bread-and-butter interest income and asset-sensitive lenders will face substantial net interest margin contraction this year and next, analysts say.

May 18 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

Democrats’ latest proposal to back debt collectors, enable loans for nonprofits and provide other relief could help steer negotiations with the Senate on more stimulus.

May 15 -

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

May 13 -

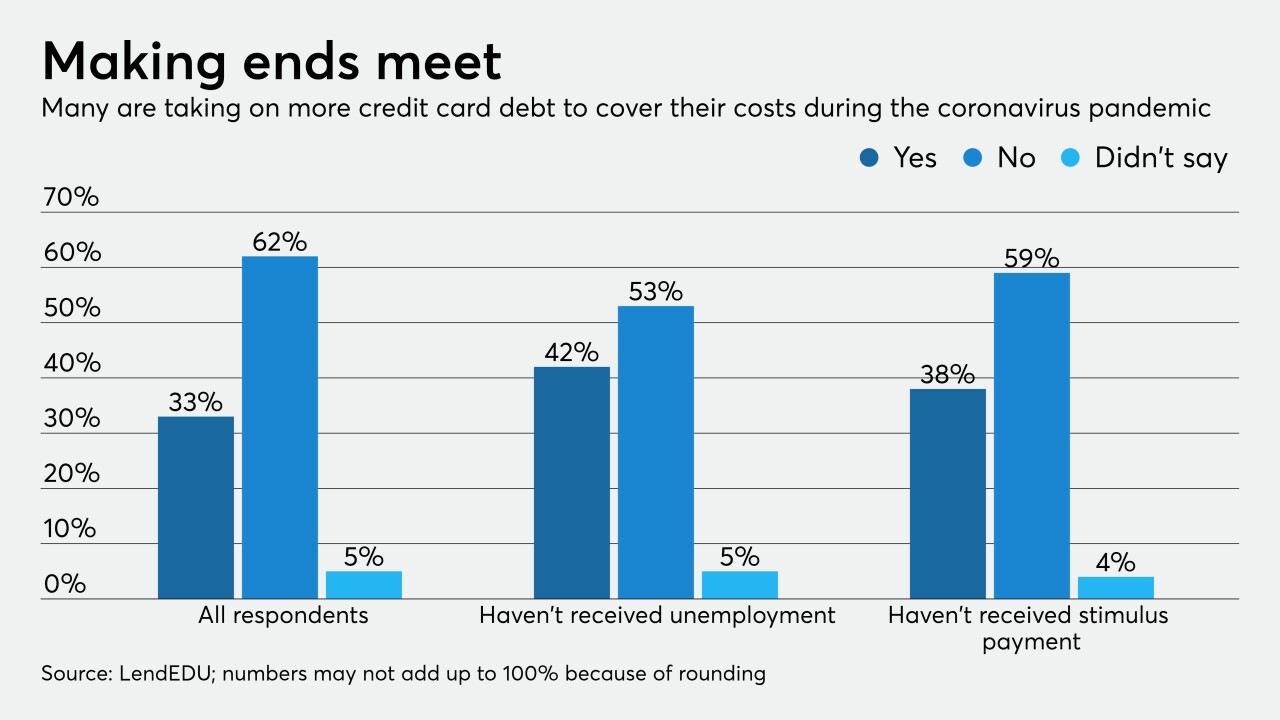

Despite some improvements, almost one-quarter of respondents to a LendEDU survey were still waiting on their relief checks and those consumers are more likely to take on additional credit card debt.

May 12