-

The move come a day after the Bank of England cut rates and introduced a series of emergency measures, including capital requirements and a lending program for smaller companies.

March 12 -

Firms such as Afterpay that offer financing to shoppers have been enjoying rapid growth. But their model is under scrutiny from regulators, being mimicked by credit card lenders and faces heightened risks in a downturn.

March 11 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

Kathy Kraninger was grilled about whether her agency and others were doing enough to cushion consumers from the economic blow of the coronavirus crisis.

March 10 -

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

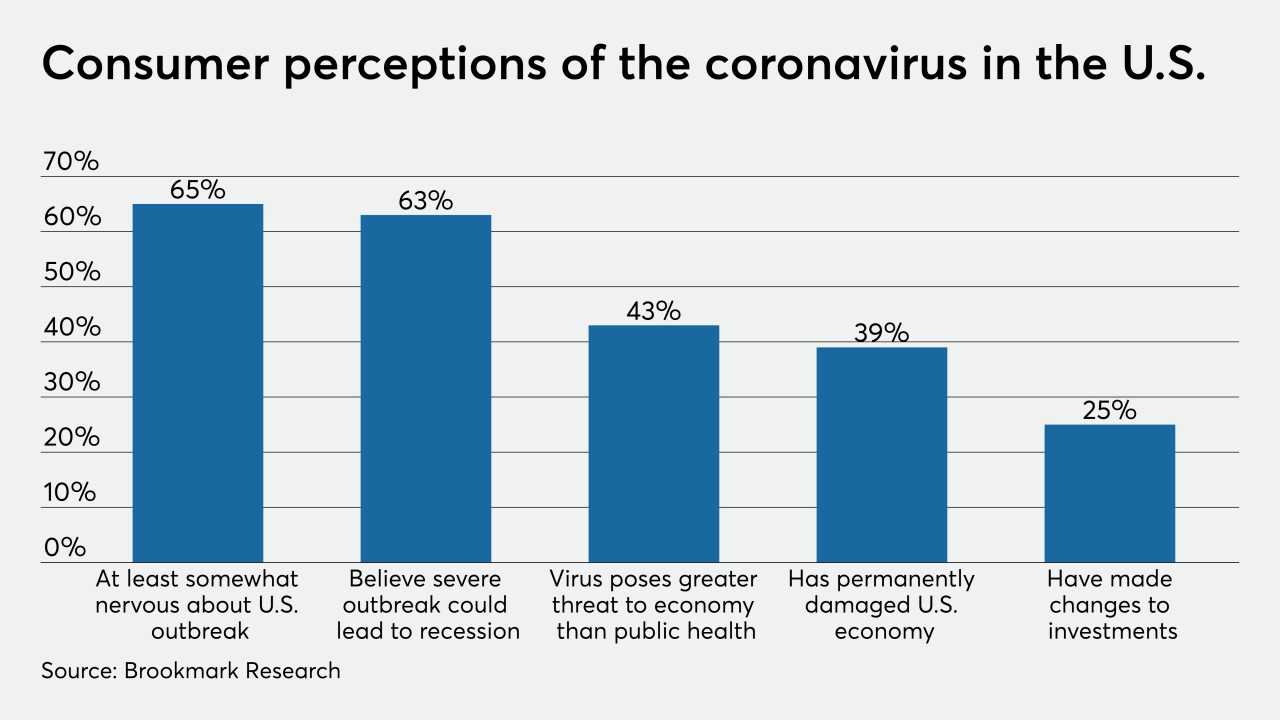

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

March 9 -

Brendan Coughlin, head of consumer banking, explains how Citizens established its relationships with Apple and Microsoft for point of sale financing and how they've evolved.

March 9 -

The Consumer Financial Protection Bureau will have a busy week starting with Director Kathy Kraninger testifying before lawmakers on Tuesday.

March 9 -

Maybe Congress shouldn’t be so quick to change laws without real-world input.

March 9 Community Financial Services Association of America

Community Financial Services Association of America -

With prices rising rapidly and loan terms increasing, some institutions may want to consider adding a leasing option to their auto loan portfolio.

March 6 Credit Union Leasing of America

Credit Union Leasing of America -

U.S. lawmakers are pushing regulators to provide room for banks to work out loans with businesses and consumers who may be affected by the coronavirus.

March 6 -

Most states have some kind of pricing limit on consumer loans. But proposals for a national usury law divide even Democrats, some of whom are concerned about restricting credit.

March 5 -

On Sep. 30, 2019. Dollars in thousands.

March 2 -

On Sep. 30, 2019. Dollars in thousands.

March 2 -

Credit unions that don't embrace digital retailing as part of their auto lending strategy will end up spinning their wheels.

February 27 Cox Automotive

Cox Automotive -

The agency is investigating Discover Financial Services over student loan-servicing practices and its compliance with a 2015 consent order involving the business.

February 27 -

Executives outlined changes in energy lending policies, said that the largest U.S. bank has only scratched the surface in middle-market credits and discussed their preparations in case of an economic slowdown.

February 25 -

With interest rates and unemployment at rock-bottom lows and home values rising, the part of JPMorgan's retail business that sells home loans to consumers made money last month, marking the first profitable January in five years, according to people familiar with the matter.

February 24 -

Intuit’s reportedly nearing a $7 billion deal to acquire Credit Karma, giving it an offering that could empower fintechs to more closely encroach on bank territory.

February 24 -

Debt collectors would have to tell consumers upfront that they cannot sue to recover "time-barred" debt under a proposal issued Friday by the Consumer Financial Protection Bureau.

February 21