-

It sounds like a crazy mix, but Fifth Third says its new app would help young consumers round up debit card purchases and apply the money to their burdensome student debts. The motivation to attract millennials is clear, but will it work?

September 4 -

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

An artificial intelligence model predicted creditworthiness more accurately than traditional models in an experiment conducted by the auto lender. The technology someday could be used to find hidden gems among loan applicants — emphasis on the someday.

August 31 -

JPMorgan Chase's Amber Baldet shares how she got interested in technology; Credit Suisse’s Laura Hemrika talks microfinance; and a few of our Best Banks to Work For have female CEOs.

August 31

-

The largest generation of Americans is set to inherit over $59 trillion in assets, but the federal financial regulators are behind in hiring millennials and focusing on issues of concern to them.

August 31 Pickard, Djinis and Pisarri LLP

Pickard, Djinis and Pisarri LLP -

Consumer Financial Protection Bureau Director Richard Cordray said his possible political ambitions did not affect the small-dollar rule, while declining to spell out if he was running for office.

August 30 -

The Pay It Plan It feature allows customers to create payment plans for individual purchases, similar to personal loans. The plans include a fixed fee and no interest.

August 30 -

As Republicans policymakers pursue efforts to revamp the Consumer Financial Protection Bureau and replace its leadership, state agencies are already preparing to fill any vacuum that might ensue if the CFPB steps back.

August 30 -

Following short-term disruptions from Harvey, Texas bankers expect a long-term lift to the local economy; Buffett’s company officially becomes the bank’s largest shareholder.

August 30 -

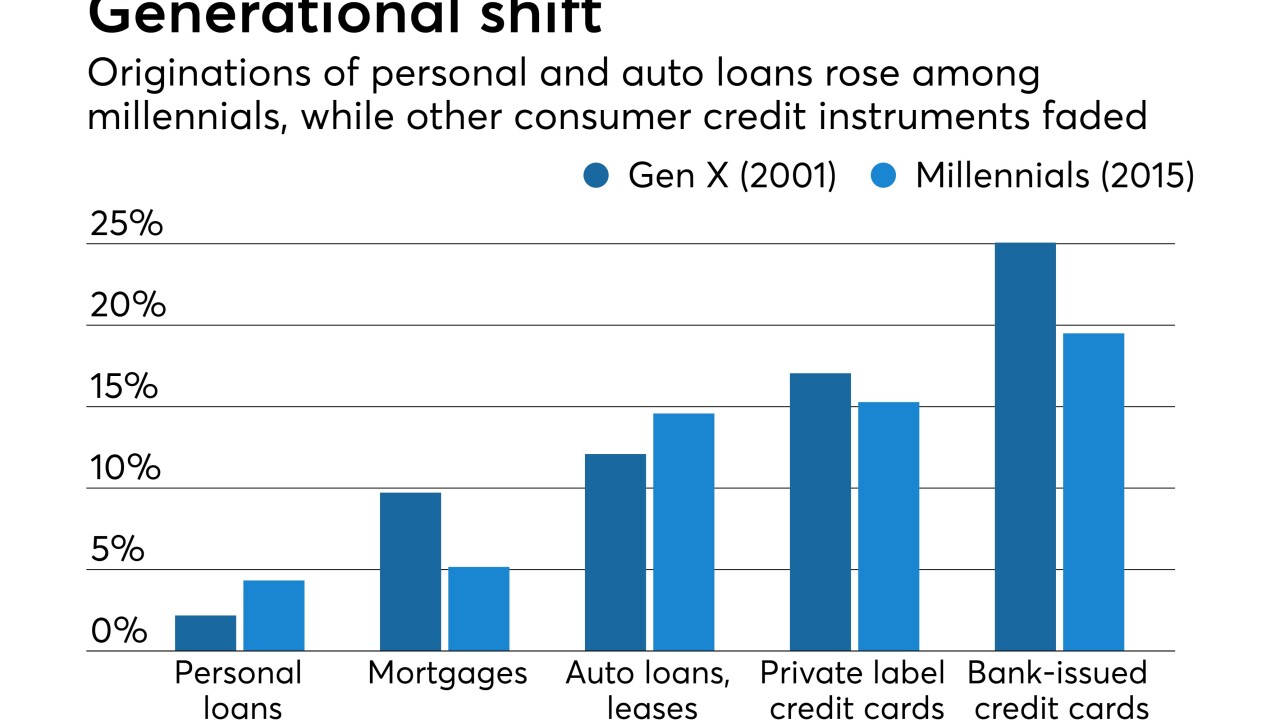

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

August 30