-

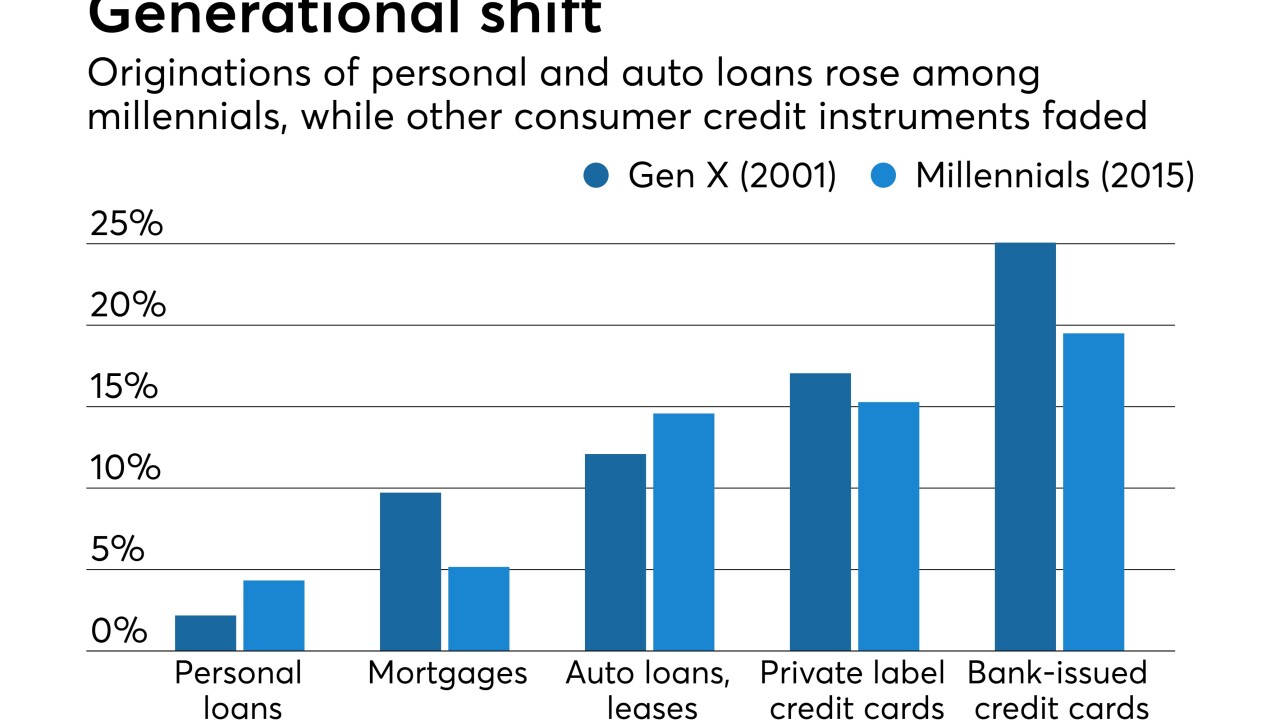

Sure, personal loans have a long way to go to catch up in market share with other forms of consumer credit, but millennials are relying more heavily on them than their Gen X predecessors while paring back on credit cards and mortgages. Online lenders are a big reason, and banks are exploring ways to adjust to changing habits.

August 30 -

The Canadian bank blamed flat profits at its U.S. business, which includes Chicago-based lender BMO Harris Bank, partly on Washington gridlock that has stalled pro-business reforms.

August 29 -

The startup, which offered credit lines of up to $1,000, hoped to tap into the millennial generation's frustration with overdraft fees.

August 29 -

The Consumer Financial Protection Bureau’s likely decision to pare back its final rule on small-dollar lending may help guard it against a congressional rollback and pave the way for bankers to return to the space.

August 29 -

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, wrote a letter to CFPB Director Richard Cordray calling on him to clarify whether he is running for political office.

August 29 -

In the coming year, bankers in Puerto Rico will need to keep an eye on how steep cuts in government spending will affect the island’s consumers, says José Rafael Fernández, CEO of OFG Bancorp.

August 29 -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Powell downplayed fears about subprime auto lending, saying he aims to improve Santander Consumer's compliance culture, beef up customer services and expand its relationship with Chrysler Capital.

August 28 -

It is reasonable to rethink the role of state usury laws in national credit markets, but there should not be any erosion of consumer protections.

August 28 Georgetown University

Georgetown University -

Scott Powell will lead the auto lender while continuing to serve as CEO of Santander Holdings, the U.S. division of the Spanish banking giant Banco Santander.

August 28