-

Facebook calls an emergency meeting about its planned payments network; Well Fargo report says 200,000 jobs will be lost to robots and technology.

October 2 -

With the pace of credit unions gaining CDFI certification already slowing, a change to how the Treasury Department reviews applications could have an impact on institutions receiving grants.

October 1 -

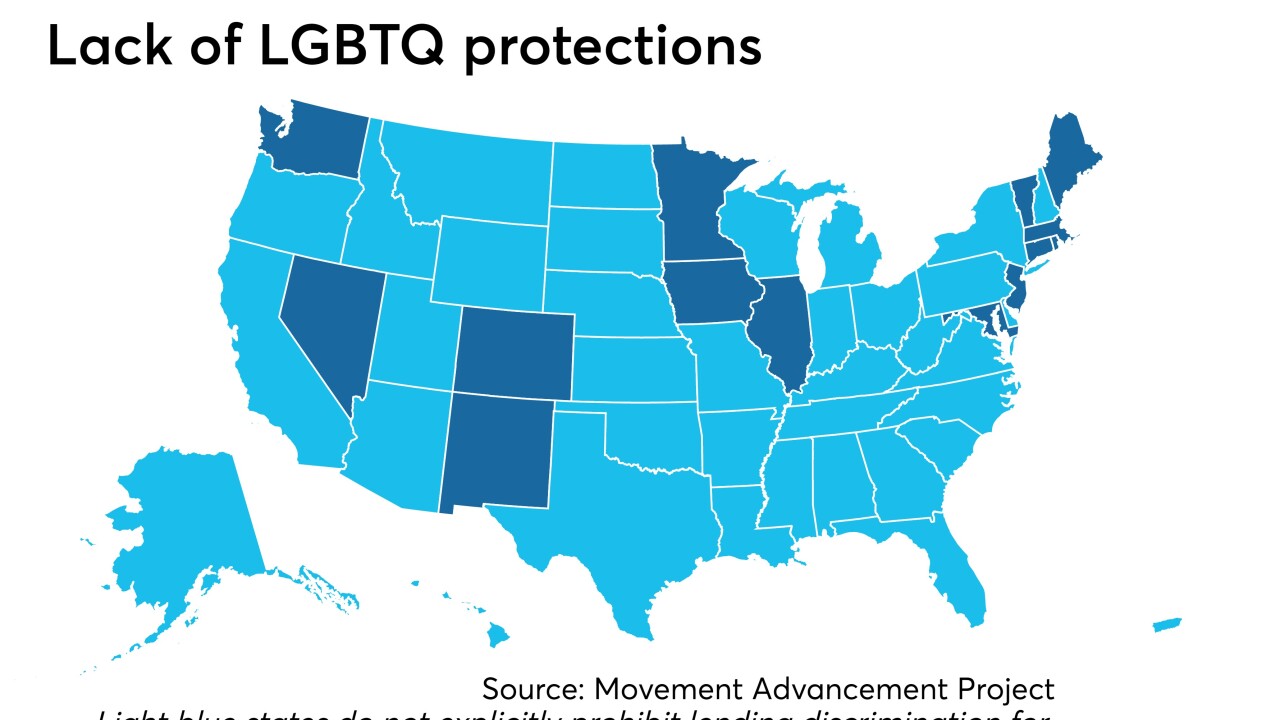

With credit discrimination still legal in many states, the Michigan-based institution aims to help this marginalized group.

September 30 -

Their challenge is creating a viable, profitable product that doesn't get flagged for being predatory.

September 26 -

A hearing on legislative proposals exposed a sharp partisan divide over a regulatory plan to restrict the frequency of collection calls.

September 26 -

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25 -

The industry is waiting to see if banks will get the same no-cost land leases on military bases that credit unions currently enjoy.

September 23 -

Among the highest-ranking women at Discover, Offereins is leading the push to improve gender equity at firms throughout the Chicago region.

September 22 -

Even as her company invests heavily in cutting-edge technologies designed to improve service and efficiency, Keane is making sure that Synchrony is also investing in educating and training employees whose jobs are at risk of disappearing.

September 22 -

Royal Bank of Scotland promoted Alison Rose to chief executive officer, making her the first woman to run one of Britain's big four lenders.

September 20 -

CUNA Mutual Group found that loan balances increased by 6.6% for the year ending in the second quarter.

September 20 -

Readers react to plans by Democratic presidential candidates to reform college tuition, credit unions buying more banks, whether the next president could fire the CFPB head and more.

September 19 -

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

Board Member Todd Harper was the lone dissenting vote on the rule, saying it was a "bridge too far." Lawmakers and consumer groups have also spoken out against it.

September 19 -

With 20- and 30-somethings just beginning to build financial wealth, banks must orient their business to meet the needs of these consumers.

September 19 Financial Health Network

Financial Health Network -

Linda Lacewell, New York’s superintendent of financial services, said the CFPB's debt collection proposal does not go far enough to protect consumers.

September 18 -

Nitin Mhatre of Webster Financial explains why the Consumer Bankers Association — whose members want a bigger piece of the student lending market — backs legislation that would make the federal government tell borrowers how much they will ultimately owe, as private lenders are already required to do.

September 18 -

Senate Democrats are warning the Consumer Financial Protection Bureau to be careful as it considers changes to its mortgage underwriting rules.

September 17 -

A proposal to define wages-on-demand would protect consumers and serve as an example for others.

September 17 University of Houston Law Center

University of Houston Law Center -

Mission Lane, which was spun off from LendUp in December, said Monday that Shane Holdaway took the helm in August after roughly a year serving as CEO of Barclays' U.S. consumer bank. The upstart lender also announced that it has raised $200 million in equity funding.

September 16