-

Moelis submits a revised Fannie/Freddie blueprint; FASB considering a plan to have banks break out charge-offs and recoveries on year-by-year basis; Wells Fargo layoffs begin with 1,000 jobs in mortgage and tech; and more from this week's most-read stories.

November 16 -

Adults ages 18 to 29 may have a hard time getting a mortgage, but they are not shying away from other forms of consumer debt, according to a report by the New York Fed.

November 16 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 American Banker

American Banker -

Self Lender is launching a secured credit card next year in the hopes of attracting big-bank partners that can use it to comply with the Community Reinvestment Act.

November 15 -

Upturn, which is owned by a BBVA unit, is offering a free online tool consumers can use to detect and dispute inaccuracies in their credit report.

November 15 -

The FDIC is seeking comment on how to encourage small-dollar lending at banks, signaling a course change from guidance it issued five years ago restricting such loans.

November 14 -

A new study from CUNA Mutual Group finds a disconnect between consumer sentiments and their financial behaviors.

November 14 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

November 13 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

November 12 -

The five institutions join AFG's balloon lending program, bringing 2.7 million consumers and $1.5 billion in assets into the fold.

November 9 -

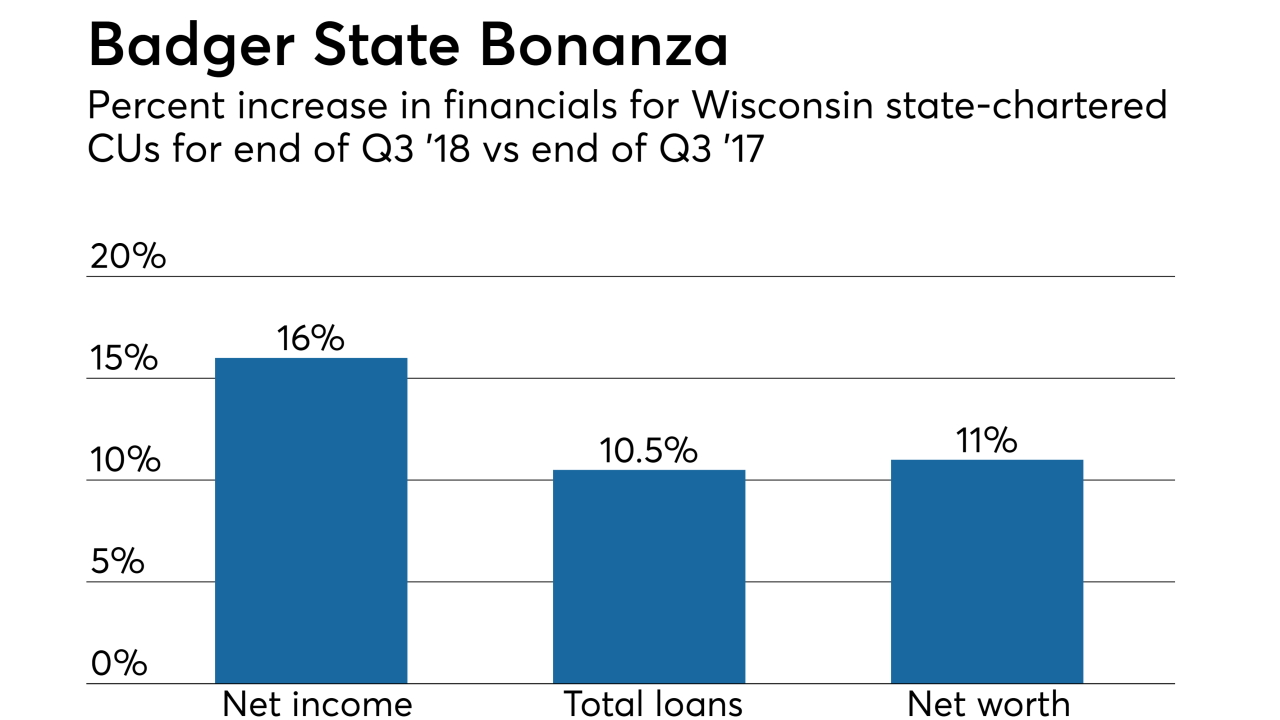

The state's Q3 numbers show a continuation of positive trends for Wisconsin's state-chartered credit unions.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8

-

Reversing a previous order, the Texas judge granted part of the bureau's request to stay the effective date and allow time for the agency to work on changes to the rule.

November 7 -

The passage of Proposition 111, which also prohibits lenders from adding origination and monthly maintenance fees, makes Colorado the fifth state to impose caps on payday loans through a voter referendum.

November 7 -

Credit Karma has agreed to buy a credit reporting company that TransUnion initially sought to develop as the fintech's British equivalent.

November 6 -

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

November 6 -

JPMorgan Chase and Wells Fargo detailed aggressive marketing plans, defended their credit judgments and downplayed the threat of a retailer revolt over high fees on rewards cards.

November 6 -

The Poughkeepsie, N.Y.-based credit union agreed to pay $95,000 to settle claims that it incorrectly repossessed vehicles of service members.

November 6