-

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The price for the 20% stake in Santander Consumer USA Holdings that Santander does not already own is significantly higher than what the buyer first offered in July.

August 24 -

Customers have been particularly frustrated with midsize issuers for failing to adjust their rewards programs to reflect changing behavior and generally being less responsive than large issuers, according to a new report from J.D. Power.

August 19 -

The bank's earlier decision to stop accepting applications for the consumer loan product had sparked a backlash among customers and lawmakers.

August 18 -

Holders of the card, issued by Synchrony Financial, receive 3% cash back on medical visits, veterinarian bills, gym fees and certain other health-related expenses.

August 16 -

On Mar. 31, 2021. Dollars in thousands.

August 9 -

On Mar. 31, 2021. Dollars in thousands.

August 9 -

The agreement between the state’s financial regulator and Meratas will subject the company to heightened regulation after years of criticism that income-share agreements have escaped scrutiny.

August 5 -

Consumers who had paid down balances during the pandemic started spending more, while issuers made additional credit available, according to researchers at the Federal Reserve Bank of New York. The findings suggest the start of a return to more normal borrowing patterns in the card industry.

August 3 -

The bureau said two rules related to communications with debtors will go into effect as originally planned on Nov. 30. The agency had previously proposed an extension to consider consumer advocates' concerns about the regulations.

July 30 -

Democratic leaders in Congress want to extend the interest rate limit applying to service members to all consumers. Republicans and industry representatives warn such a broad restriction will hamper lenders' ability to price risk.

July 29 -

The goal is to add customers and prop up borrowing until business travel rebounds and consumers burn through their excess cash, CEO Roger Hochschild says.

July 22 -

Tanya Sanders, who joined the company in 2019, takes the reins as the division's loan growth is on an upswing. She will succeed Laura Schupbach, who is retiring after 26 years at Wells.

July 21 -

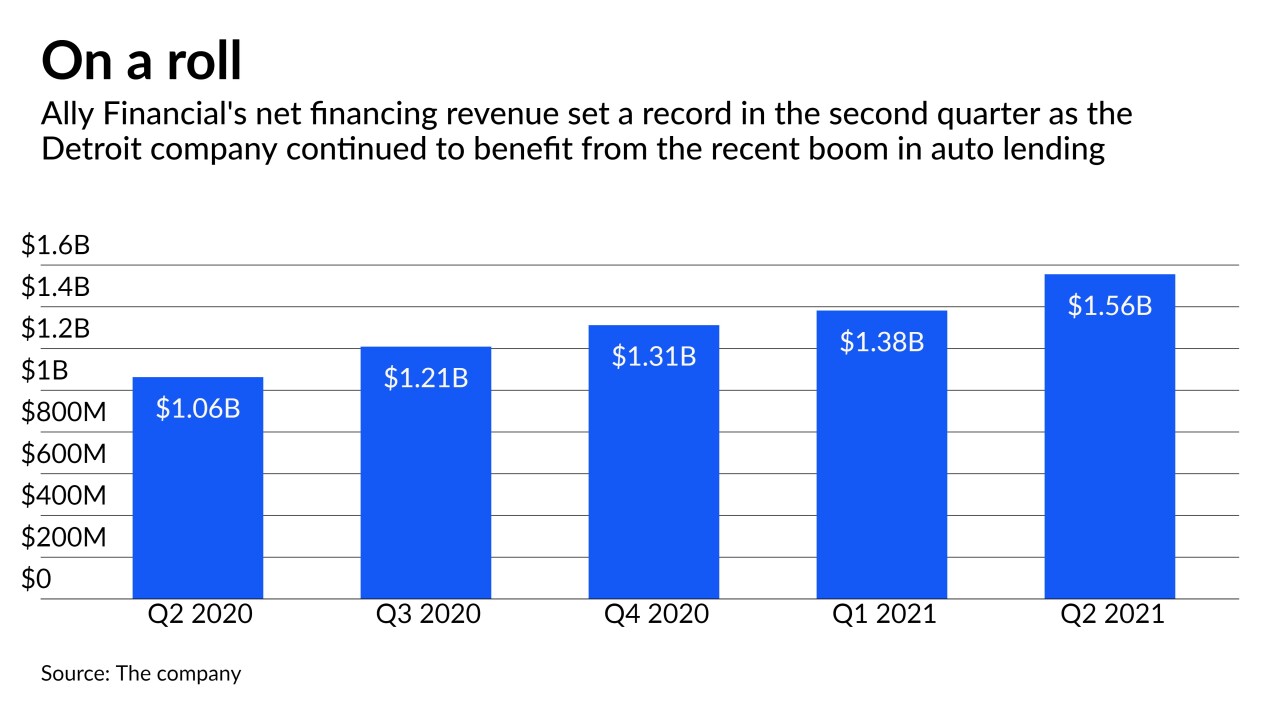

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

July 19 -

Bank of America expects interest income to rise as stronger borrowing outweighs the impact of low rates. The upbeat forecast is in contrast with remarks from JPMorgan Chase executives.

July 14 -

The company fell short of net interest income projections as loans and leases in the consumer banking unit dropped 12% from a year earlier. However, loan balances grew from the first quarter — the first sequential increase in a year.

July 14 -

While customers of the nation’s largest bank are spending more, an unusually small percentage of their purchases are becoming debt. Executives warn that the bank’s predicament could persist for the rest of the year.

July 13 -

Bankers insist borrowing will pick up on the back of a post-pandemic economic recovery. But so far there are few signs of a rebound, and analysts are skeptical one is imminent.

July 12 -

The fintech, which arranges point-of-sale loans in partnership with merchants, was fined $2.5 million by the Consumer Financial Protection Bureau and ordered to refund up to $9 million to consumers who received loans they never applied for.

July 12