-

The core-banking provider Temenos, based in Geneva, was drawn to Kony's strong U.S. presence, its software for banks and a special app it owns.

August 30 -

The Memphis-based developer of core processing software is now majority owned by three credit unions.

July 12 -

Alexander Lopatine, who founded Nymbus and has joined Mbanq, says alternative providers are gaining the confidence of more banks. However, questions remain about their staying power in the fight with traditional vendors.

July 2 -

Jeremy Balkin, head of innovation at HSBC Bank USA, shares how the bank is investing in retail innovation, including a $350 million core system.

June 11 -

The London firm lags the three largest U.S. vendors but bets its new open banking platform can win it more business.

May 30 -

Give Lindsay Lawrence a big job to do and she just might find a way to make it even bigger.

May 1 -

Alternative providers like courting new banks. De novos like the modern features many alternative providers offer upfront.

April 18 -

The 2020 budget would add the Consumer Financial Protection Bureau and FSOC to congressional appropriations, charge lenders for FHA upgrades and require universities to have skin in the game on student loans.

March 11 -

The merged bank would set up an innovation and technology center in Charlotte as part of its bid to compete better against the largest institutions and fintech startups.

February 7 -

The core-banking vendor won the investment and ringing endorsements from the trade group and several banks because its open system and cloud delivery could eventually challenge entrenched tech players.

January 25 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The $126 million-asset credit union selected the new core platform in order to increase automation and cut down on "busy work" for employees.

December 27 -

The three institutions will use a platform from Fiserv to help improve efficiency.

December 20 -

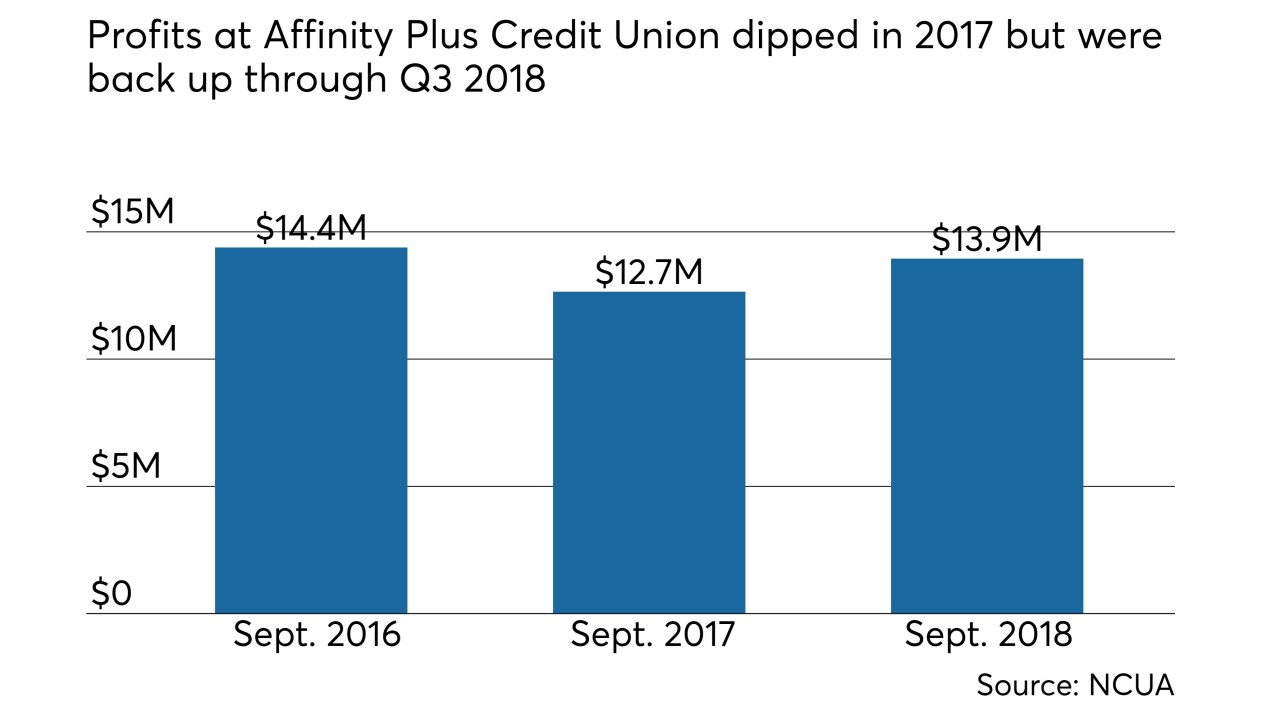

Along with a core conversion, the Twin Cities-area credit union deployed new loan origination systems and online and mobile banking platforms.

December 18 -

The Minnesota-based institution expects to $10,000 per month by switching its core systems.

December 17 -

The Ponca City-based institution becomes the first credit union in Oklahoma to join CU*Answers.

December 13 -

His knack for public policy, dedication to technological improvements once considered the province of big banks, and willingness to tear up a business model that he and his father built make him our top Best in Banking honoree.

November 25 -

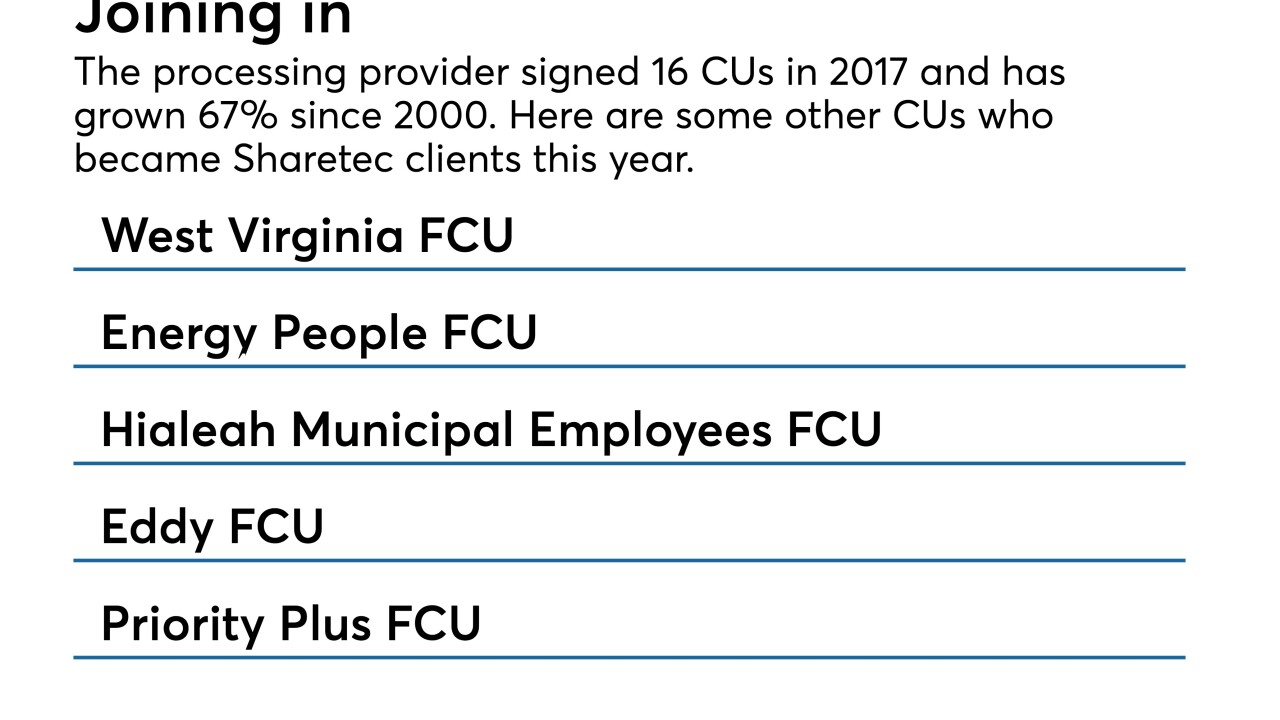

The Memphis-based CUSO, known for its NewSolutions system, signed six credit unions, all with assets under $140 million.

November 13 -

The credit union hsa been a Sharetec client for five years but was stuck in a contract that left it unable to convert until now.

November 7