-

In addition to Apple and Google delivering smartphone apps that would alert users that they are near a person infected by the virus, various other government agencies and businesses are developing that type of technology to address the pandemic's spread.

June 2 -

The rescue bill enabled banks to protect loans in forbearance from an immediate hit to a borrower’s credit report, but experts say affected consumers may have trouble getting loans after the pandemic ends.

June 1 -

Acting Comptroller of the Currency Brian Brooks took the extraordinary step of wading into the debate over when it was appropriate to reopen businesses.

June 1 -

With the pandemic putting Plexiglas in short supply, Joe McDonald called up a local source: a former classmate.

June 1 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

In the U.K., many policy researchers predict that the economic fallout of the pandemic in the U.S. could change attitudes toward the idea of basic income on both sides of the Atlantic.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

It took a global pandemic to get many baby boomers to bank online. Lenders have taken notice.

June 1 -

The coronavirus pandemic was an unexpected catalyst for contactless cards, and another no-contact payment method is poised for growth as well: voice payments.

June 1 -

Since March, issuers have tightened their criteria for opening new accounts and closed millions of existing ones in hopes of avoiding waves of defaults.

May 29 -

Chairman Jerome Powell said the Federal Reserve's actions during the coronavirus outbreak have been aimed squarely at helping U.S. workers, not Wall Street or wealthier Americans. He also said Friday that a new lending program geared toward middle-market firms is "days away" from getting up and running.

May 29 -

The Independent Community Bankers of America has asked NCUA's inspector general to review the agency's decision to change how low-income credit unions receive that designation.

May 29 -

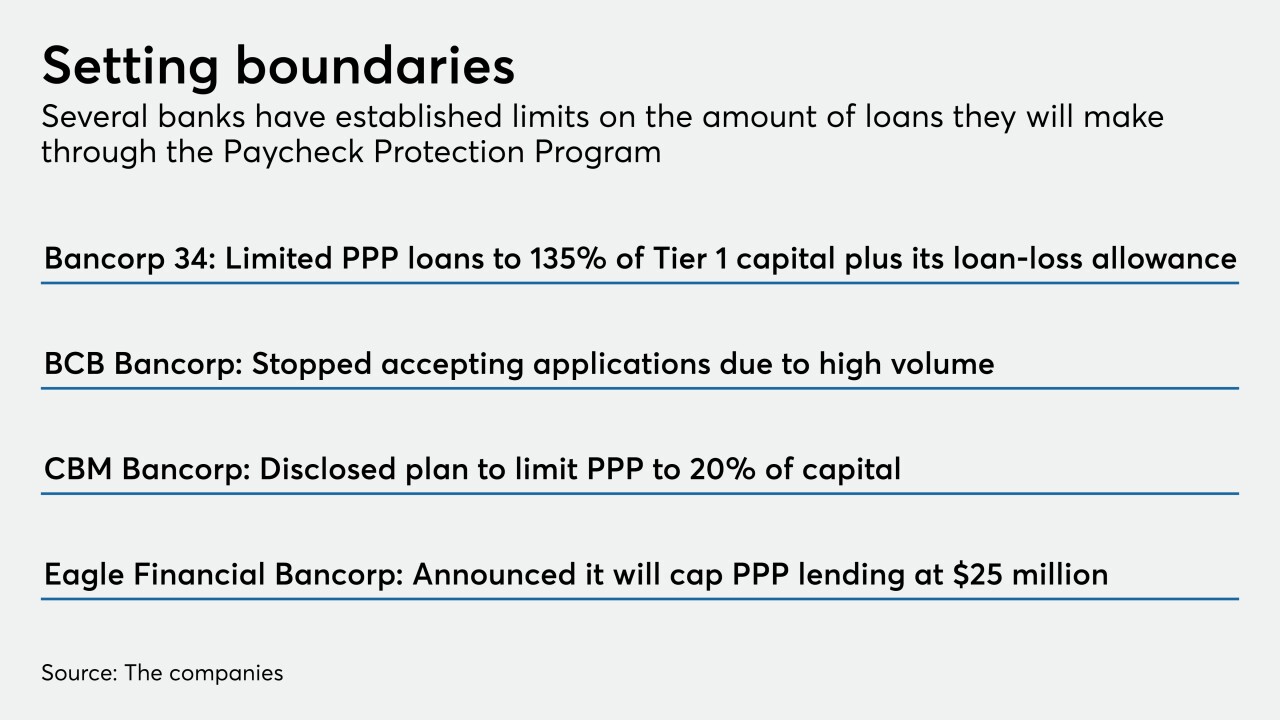

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29 -

U.K. fintechs are using their technology to assist British businesses and consumers during the coronavirus pandemic by helping banks disburse emergency business loans, enabling e-commerce merchants to offer installment payments to consumers, and giving employees access to salary advances.

May 29 -

Though he acknowledged working remotely has definite advantages, CEO Michael Corbat says “our goal is to get our employees back."

May 29 -

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29 -

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

May 29 -

The bill, which now goes to the Senate, would give small businesses greater flexibility in how they use the funds; not everyone's on board with Otting's signature achievement.

May 29 -

The congressional showdown over the pace of rulemaking during the pandemic is a hardening of older positions on banking policy ahead of the 2020 elections, observers said.

May 29 -

As Erez Ben-Kiki and his wife tried to move her yoga business online — conducting classes via Zoom — they discovered that the process of monetizing such classes was surprisingly awkward. Ben-Kiki, CEO and co-founder of 2Key Network, spotted a gap in the market.

May 29