-

Some corporations are willing to oblige, turning instead to new, pricier term loans or revolving credit lines rather than tapping existing ones, industry officials say.

March 30 -

Commercial real estate is facing another crisis as companies shift to work-from-home policies. Banks and regulators should brace themselves.

March 30 Community Bank Consulting Services

Community Bank Consulting Services -

The pandemic has the industry rethinking its hiring practices, such as how to onboard employees while limiting in-person interactions, and deciding which roles need to be filled immediately.

March 30 -

Card fraud risks — already soaring prior to the coronavirus outbreak — are changing rapidly as the pandemic deepens, forcing issuers and merchants to rethink protective measures.

March 30 -

Address verification, geolocation and 3-D secure can all play a role, according to Chargebacks 911 and Global Risk Technologies' Monica Eaton-Cardone.

March 30 Chargebacks911

Chargebacks911 -

Homeowners reeling from coronavirus-induced economic shock are already enduring extremely long wait times while trying to get relief. Legislation passed last week could worsen the logjams.

March 29 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

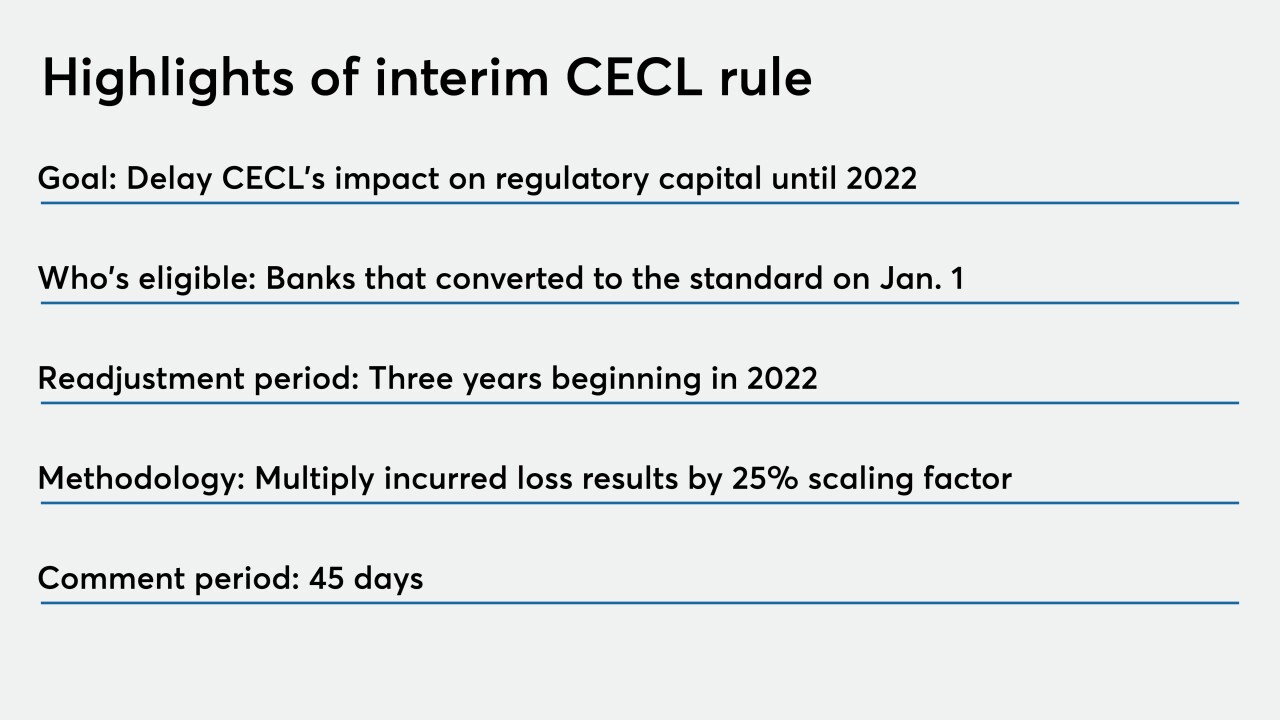

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

March 27 -

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

March 27 -

Many argue the economic turmoil from the pandemic makes the Comprehensive Capital Analysis and Review irrelevant this year, while others say testing banks’ capital strength is crucial now more than ever.

March 27 -

In contrast, grocery stores and pharmacies saw a jump in spending during the coronavrius outbreak, according to credit union member data examined by the CUSO.

March 27 -

The $2 trillion stimulus package, which the House passed earlier in the day, aims to expand Federal Reserve liquidity resources and provide financial institutions with some regulatory relief.

March 27 -

CEO Brian Moynihan also said in an interview that the bank is helping clients affected by the coronavirus pandemic through increased commercial lending to companies and expanded forbearance for Main Street customers.

March 27 -

The coronavirus pandemic has forced foreign exchange money agent Travelex to close all of its U.K. offices for the next eight weeks.

March 27 -

The U.S. government will shortly funnel trillions of dollars into the economy to soften the coronavirus’ impact on a variety of industries and small businesses. Payment companies that are also lenders will soon find out if it’s enough to save the market.

March 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

March 27 -

Online lenders can help the agency distribute loans faster as it gets set to deploy emergency funding to small businesses.

March 27 Kabbage Inc.

Kabbage Inc. -

Thousands of bankers are set for a reprieve as Citigroup, Wells Fargo and Morgan Stanley joined European lenders in pledging to preserve jobs amid the widespread impact of the coronavirus.

March 27 -

Credit unions serving university communities got an early taste of life during the pandemic when classes moved online and campuses cleared out.

March 27 -

Transit systems are suffering a dramatic loss in ridership, and must find a way to welcome back riders after the coronavirus pandemic ends, since many commuters will have canceled their monthly passes.

March 27