-

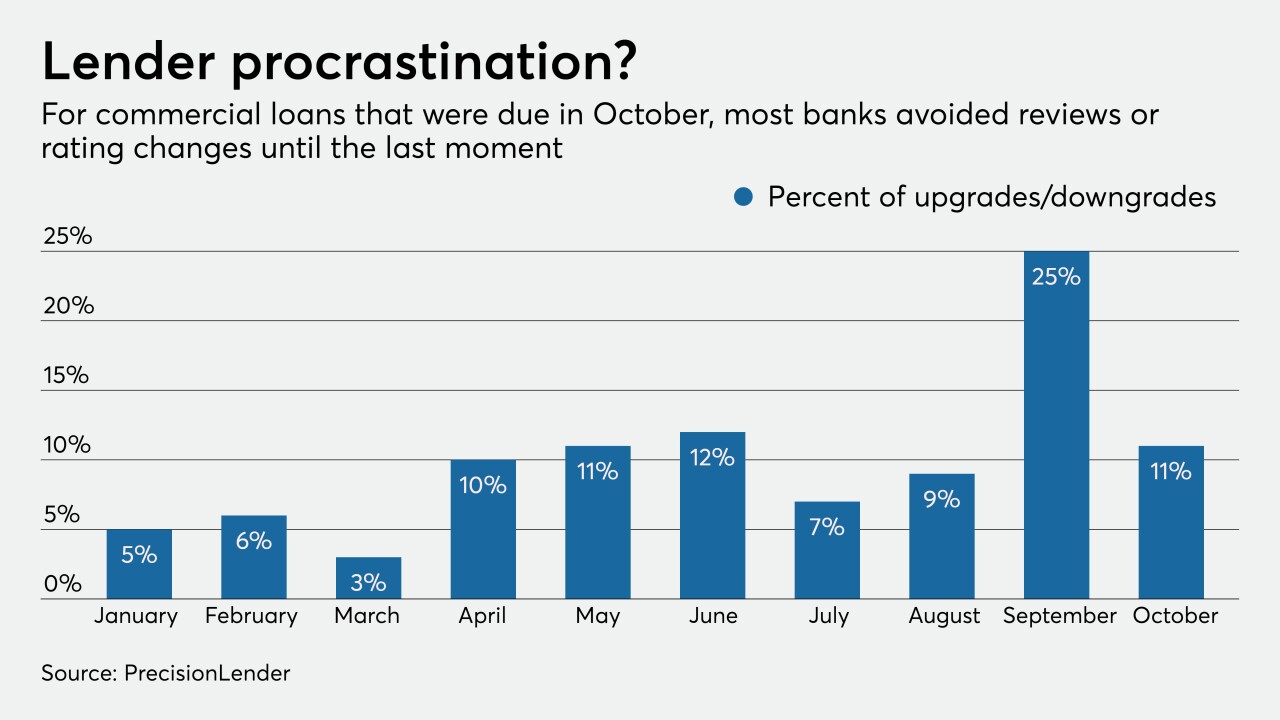

Some lenders are poring over commercial portfolios more frequently than normal — perhaps as often as once a month — to uncover problems hidden by payment deferrals and government stimulus before it's too late.

December 8 -

Once vaccines are widely available, some Americans may revert to old habits of paying cash and swiping cards, but many will stick to digital and mobile payment methods, says Paysend's Matt Montes.

December 8Paysend -

It includes simpler Paycheck Protection Program forgiveness and a consistent approach from federal regulators to reforming the Community Reinvestment Act, says Bank of America's Christine Channels, who chairs the Consumer Bankers Association's board.

December 7 -

U.S. consumer borrowing rose in October by less than forecast, reflecting a decline in credit card balances as the pandemic continued to limit some purchases.

December 7 -

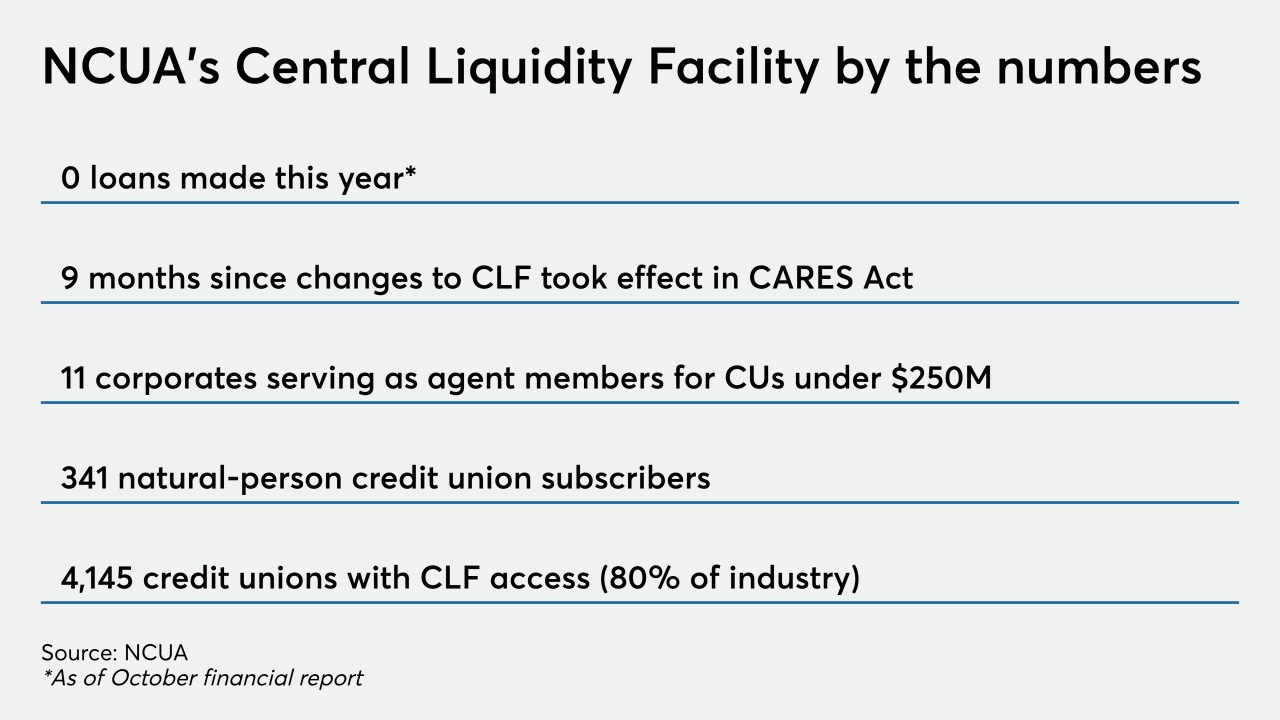

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Citigroup’s Michael Corbat said he’s worried about potential long-term negative effects after many of his employees spent the vast majority of 2020 working from home.

December 4 -

Webster Bank and Customers Bank are among the lenders that have turned to alternative data sources and automated loan reviews to assess business customers' ability to weather the coronavirus pandemic.

December 3 -

Following their disagreement about emergency funds mandated by the last big relief package, the Treasury secretary and Fed chief urged House lawmakers to pass another stimulus bill by the end of the year.

December 2 -

Visa Inc. said growth in spending on its cards in the U.S. slowed last month as coronavirus cases surged across the country.

December 2 -

People with scores below 500 are often in communities that suffer the most from economic hardship and violence. Banks and regulators can do more to qualify them for financing, ultimately creating healthier local economies.

December 2 Operation HOPE Inc.

Operation HOPE Inc. -

First Horizon, TCF and Webster are among the banks eyeing efficiency initiatives that could include more branch closings, layoffs and reduction of office space. Expect others to follow suit as low rates and tepid loan demand tied to the pandemic pressure revenue.

December 1 -

Tuesday's hearing on the CARES Act was dominated by bickering over Treasury's decision to shut down the Fed's emergency lending facilities, drowning out pleas from some lawmakers for more aid.

December 1 -

With COVID-19 cases soaring, a growing number of banks, including JPMorgan Chase, U.S. Bancorp and Capital One, have pushed back target dates for bringing employees back to offices. Some are even allowing them to work from home indefinitely.

December 1 -

The latest bipartisan plan to accelerate the economic recovery would appropriate roughly $300 billion for the Paycheck Protection Program, but the legislative package still faces long odds in the divided Congress.

December 1 -

With the globe pivoting to e-commerce during the ongoing coronavirus pandemic, an array of new opportunities have arisen for fraudsters, and merchants have found themselves being increasingly hit by different forms of chargeback fraud.

December 1 -

Lenders are worried that the Small Business Administration could use borrower responses to deny forgiveness for many Paycheck Protection Program loans that exceed $2 million.

November 30 -

The incoming administration chose a battle-tested policymaker who can draw on her nearly two decades at the Fed to help rebuild an economy still struggling from the coronavirus pandemic.

November 30 -

The central bank will prolong the life of the Commercial Paper Funding Facility and three other programs while returning congressionally approved funds for five separate facilities that will shut down Dec. 31.

November 30 -

Some workers have thrived while working remotely, but others miss the social interaction of an office, and the recent surge in coronavirus diagnoses means employers will be facing these challenges well into next year.

November 30 -

As the pandemic continues to expose vulnerabilities, executives need to alter and reshape their risk management strategies with purchase to pay in mind for future success, says Proactis' Jan van der Pouw.

November 30 Proactis

Proactis