-

Once a hotbed of activity, the region has reported the fewest bank mergers since the financial crisis.

July 30 -

On Mar. 31, 2018. Dollars in thousands.

July 30 -

Wells Fargo is considering a sale of commercial real estate broker Eastdil Secured, according to a person briefed on the matter.

July 26 -

Repayments on acquired residential mortgage loans were the main reason, but other bottom-line boosters more than made up for that, the Buffalo, N.Y., bank said in reporting second-quarter results.

July 18 -

One firm's inability to access bank data shows how fragile fintechs can be; payments processor Square quietly withdraws bank application; turnover of chief risk officers is on the rise; and more from this week's most-read stories.

July 6 -

Banks could shed as much as 20 million square feet of office space over the next five years as they shift many functions to high-tech operations centers in markets with cheaper rents.

July 6 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

As President Trump signed the regulatory relief bill into law on Thursday, most of the attention was on a provision to help regional banks with more than $50 billion of assets. But a majority of the new law is aimed at helping institutions below $10 billion. Here's how.

May 24 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

As part of a larger regulatory relief effort, regulators have raised the dollar-amount threshold for commercial real estate transactions that require a formal appraisal.

April 2 -

SunTrust's new IT chief preaches collaboration; will CRE securitizations return to haunt?; Amazon here, there and everywhere; and more.

March 23 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

On Sep. 30, 2017. Dollars in thousands.

February 5 -

The Office of the Comptroller of the Currency’s semiannual report on industry risk said tougher competition between banks, leading to looser underwriting, could arise from the economic expansion.

January 18 -

The Arkansas company has spent two years trying to reassure nervous investors and analysts that it can rapidly book real estate loans using conservative practices.

January 18 -

Consumers’ desire to shop online is creating huge demand for distribution centers and forcing property owners to think creatively about redeveloping vacant retail space. Meanwhile, hundreds of billions of dollars will be spent rebuilding areas hard hit by hurricanes and wildfires.

December 27 -

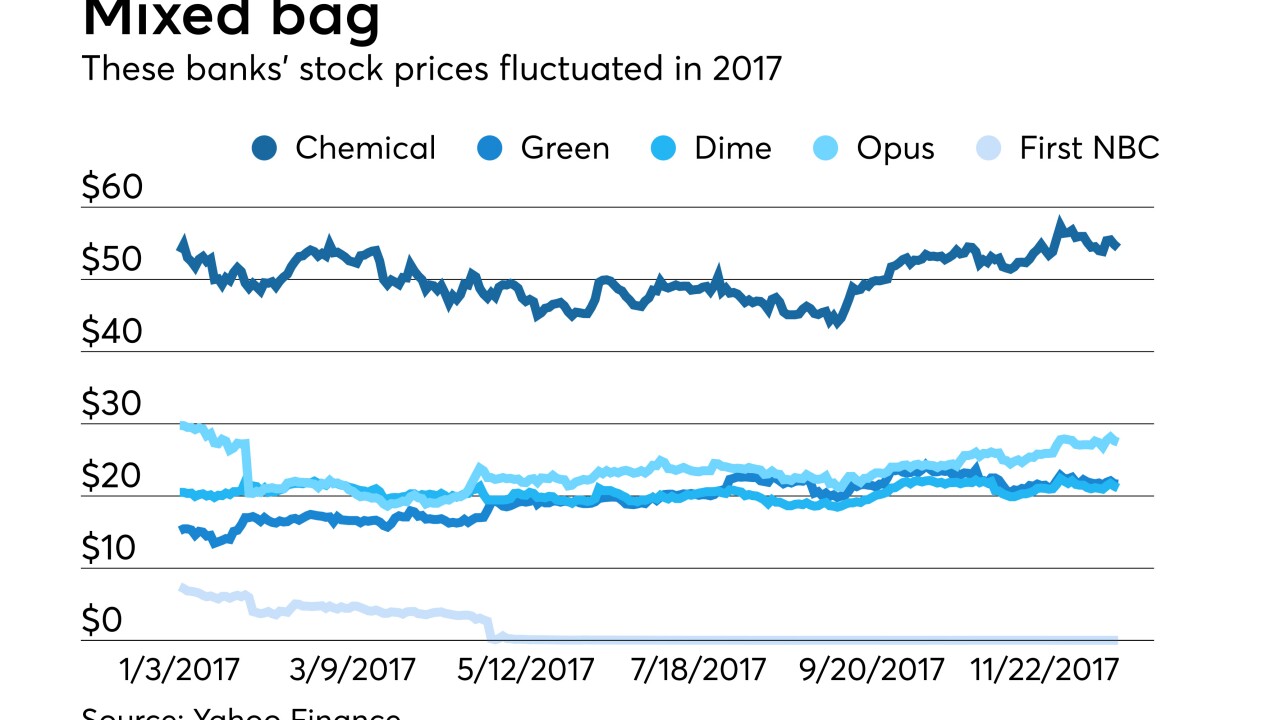

We never promised the news would be good for all these community bankers, and it wasn’t. One couldn’t stop a failure, and another quit soon after an acquisition. The rest have their banks at different points on the comeback trail.

December 22 -

The $280 million securitization is also expected to boost capital levels and lower Dime's loan-to-deposit ratio.

December 19 -

A bill that would ease Basel III capital requirements on commercial real estate loans could level the playing field between depository and nonbank lenders and spur more construction lending if it passes in the Senate.

November 10 -

On Jun. 30, 2017. Dollars in thousands.

October 23