-

The Mississippi company said it has recorded most of the expected charge-offs tied to the last severe decline in oil prices.

July 18 -

Declines in corporate banking and energy loans were part of the reason loan growth was light, but the Dallas bank reported strong earnings thanks heavily to fatter margins.

July 17 -

Good times end eventually. And it is inevitable that some new approach to banking will cause financial institutions to fall flat in a downturn.

July 11American Banker Magazine -

Provident Financial said it increased its allowance against a commercial loan after discovering that the borrower overstated the value of its collateral.

July 6 -

Virginia National will set aside up to $950,000 to cover losses after ReliaMax, a firm that issues surety bonds for student loans, was placed into liquidation.

July 5 -

The advisory vote came two weeks after Preferred Bank in Los Angeles disclosed a major loan default.

June 5 -

There are so many reasons — the credit cycle, the plight of small banks or competition from Amazon and foreign banks — that the head of JPMorgan could live to regret that statement.

June 1

-

Dark clouds may not yet be on the horizon, but industry executives are sending the message to investors that they know a turn in the credit cycle is coming, and they are planning accordingly.

May 31 -

Fulton Financial, Univest Corp. of Pennsylvania and Franklin Financial Services disclosed a total of $75 million in exposure to the commercial relationship.

May 31 -

Amid their recent policy victories and record earnings, big banks have also been forced to grapple with the possibility that commercial lending — the lifeblood for large regionals — may never fully come back.

May 31

-

A chunk of alternative loan customers are perfectly creditworthy, a report from the credit bureau shows.

May 24 -

The company has also hit its goal of having half of total loans tied to customers around Atlanta.

May 21 -

The post-recession boom in auto loans and credit cards for borrowers with marred credit histories has been winding down in recent months.

May 17 -

Preferred Bank's experience with an apartment developer is a reminder of how important strict underwriting terms will be as loan demand increases, rates rise and lenders try to outdo each other.

May 4 -

Costs rose at the global bank, profit in North America fell 16% and questions are mounting for new CEO John Flint ahead of the release of his strategic plan.

May 4 -

Porter Bancorp in Kentucky spent years tackling credit and capital issues. As Limestone Bank, it will finally get back on offense.

April 27 -

CIT took a $22 million hit on a business loan, and overall loan growth was tepid.

April 24 -

The Utah company reduced the size of its loan-loss allowance, citing improvement in its energy book at minimal losses from Hurricane Harvey.

April 23 -

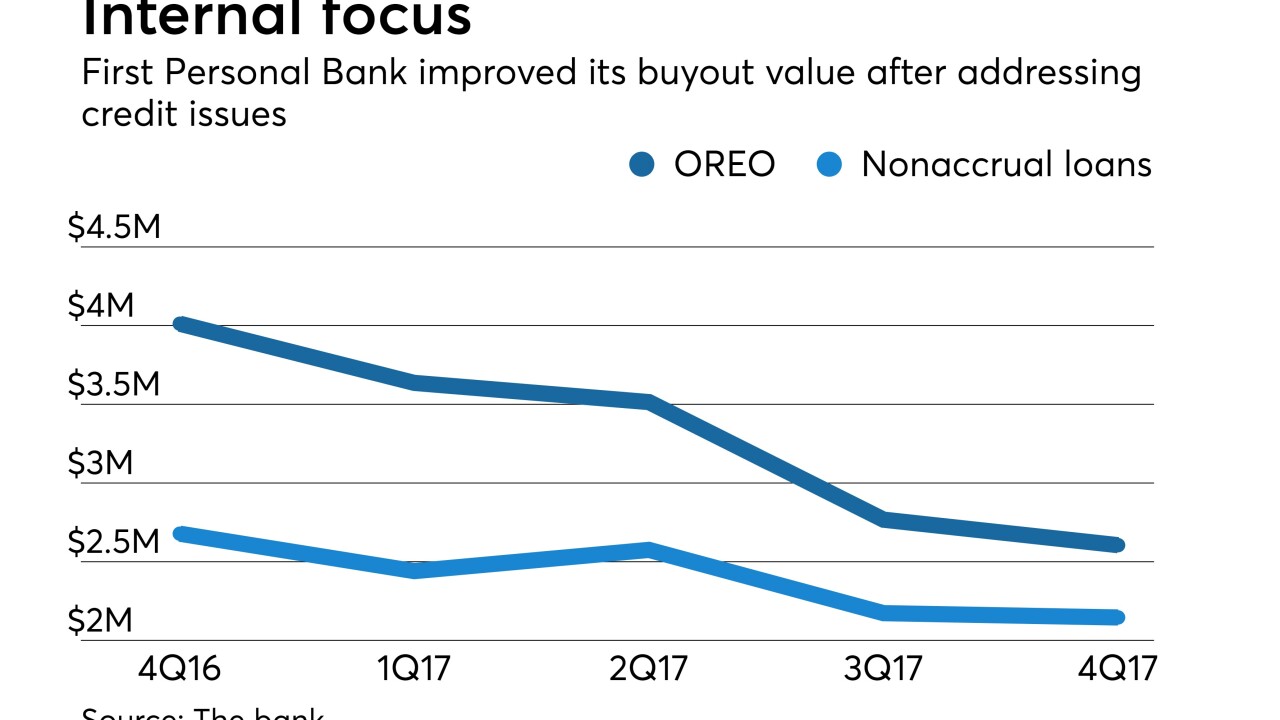

First Personal Bank in Illinois tried — and failed — to sell itself three times. The bank finally found an eager buyer after tackling several lingering problems.

April 20 -

The Los Angeles bank also benefited from a reduced reliance on costlier certificates of deposit.

April 17