-

Investors are flocking to point of sale credit firms, which have emerged as a popular option during a time of economic stress. And market dynamics suggest more upside even as traditional payment competitors enter the fray.

December 2 -

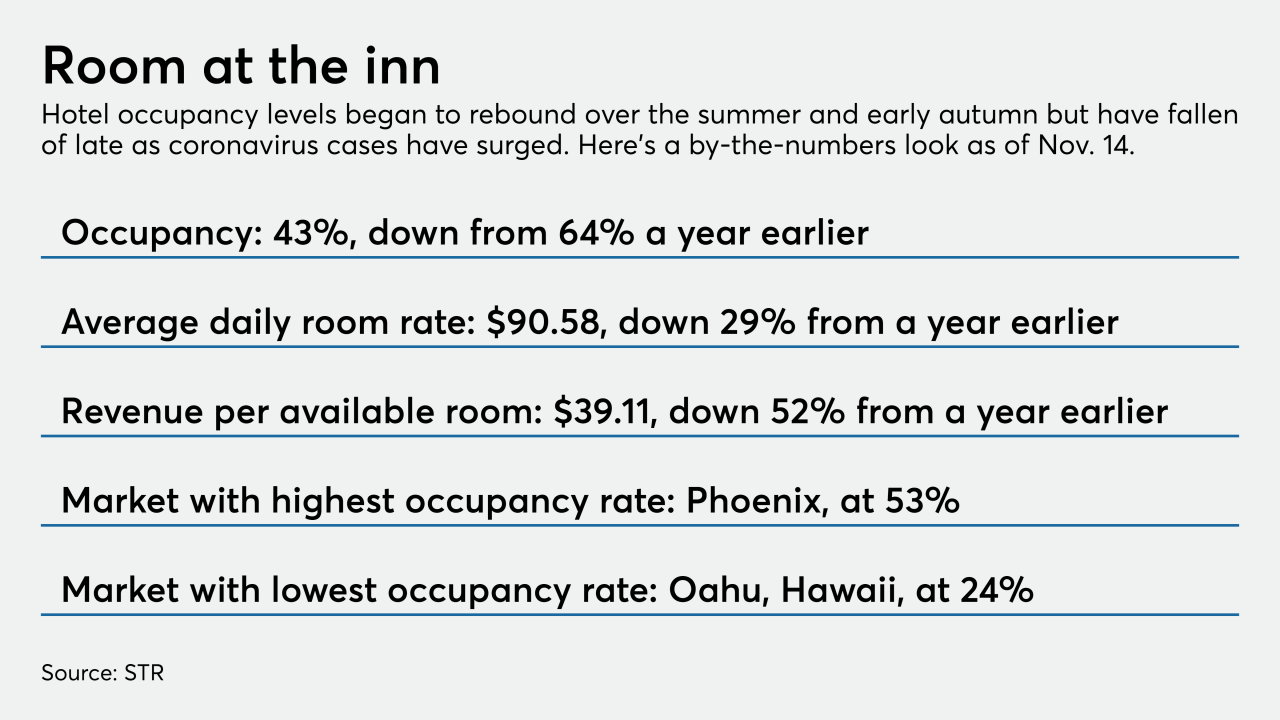

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

Companies like Affirm and Klarna have been a beacon for investors, leading to at least one multibillion-dollar planned IPO in support of a point-of-purchase lending model that could set the stage for use cases well beyond credit.

November 19 -

The Ohio company will benefit after settling unpaid judgments tied to nonperforming loans at a bank it bought before the last financial crisis.

November 19 -

The Federal Housing Administration said in its annual actuarial report that the capital reserve ratio on its mutual mortgage insurance fund increased to 6.10% in fiscal year 2020, up from 4.84% a year earlier.

November 13 -

Lending opportunities have become scarce, especially with commercial borrowers, and banks are resisting the temptation to relax standards to boost volume.

November 12 -

The cross-border e-commerce market is set to pass the $1 trillion mark in 2020, providing a huge addressable market for Afterpay's buy now, pay later expansion.

November 12 -

In a bid to fuel online sales, Barclaycard is partnering with Amazon in Germany to offer installment lending to overcome the country’s low credit card ownership rates.

November 11 -

While national banks have remained strong during the pandemic, they are still navigating risks from a murky credit environment and other potential warnings signs, according to a report by the Office of the Comptroller of the Currency.

November 9 -

The region now leads the nation in virus cases, and with winter lurking the fear is that the outbreak will only get worse.

November 5