-

The company revised its results to a net loss of $700,000 after deciding to record a $16 million loan-loss provision for the commercial loan.

February 24 -

Intuit’s reportedly nearing a $7 billion deal to acquire Credit Karma, giving it an offering that could empower fintechs to more closely encroach on bank territory.

February 24 -

Ally Financial's recently announced $2.65 billion cash-and-stock deal for CardWorks, which offers unsecured credit cards among other products, places a high price tag on a traditionally risky product.

February 21 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

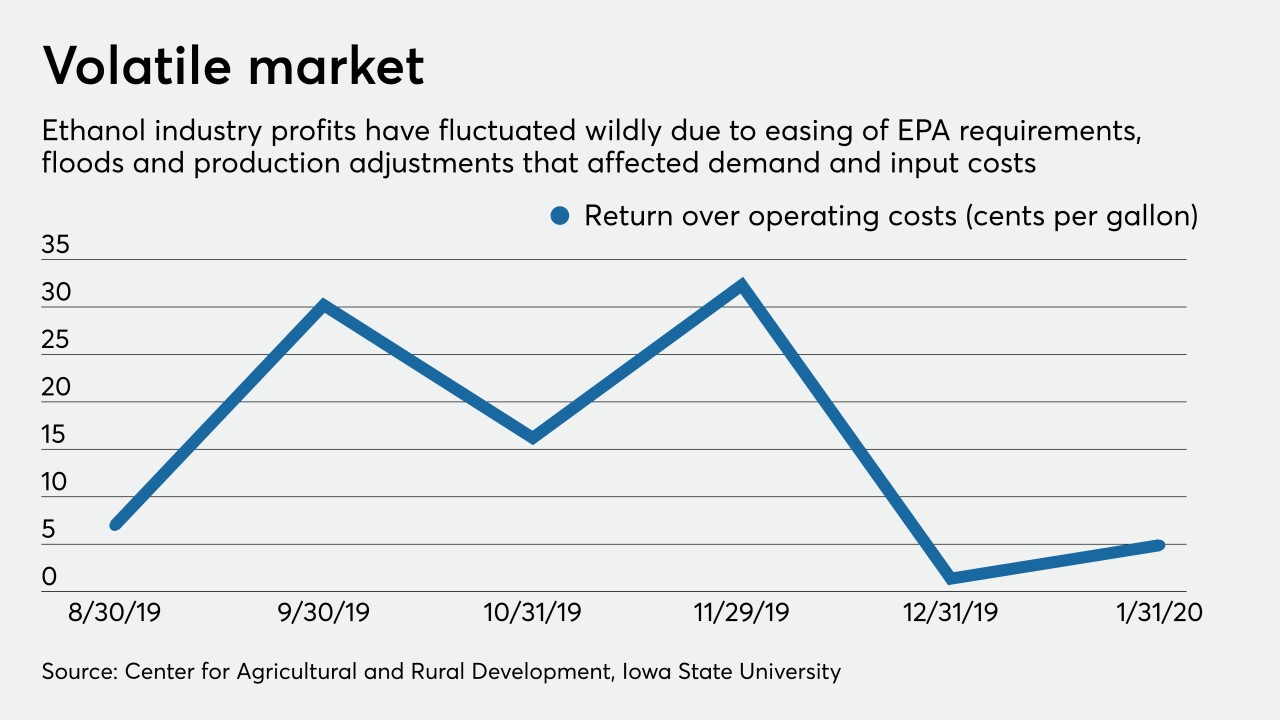

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

The fintech, which translates foreign credit reports to help immigrants get loans, says it has raised millions from venture capital firms and celebrities like Alex Rodriguez and U2's The Edge because its product addresses important economic and social needs.

February 12 -

Point of sale credit is a popular option, and Visa has followed its investment in Klarna by financially backing ChargeAfter.

February 12 -

Kaustav Das was part of Kabbage’s effort to transform small-business lending by using new data analytics, and the CEO of Petal wants him to help it do the same in consumer credit cards.

February 4 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

Nonbanks hold a disproportionate percentage of the worst-rated loans, but banks hold a majority of the market, and risk management safeguards are largely untested, according to an interagency report on shared national credit.

January 31