-

The nation's largest private student lender plans to curtail its use of forbearance, a move that could well save some borrowers money but could also result in more defaults.

October 27 -

Why the Toronto bank is focusing on digital features; complaints about credit monitoring plans flood CFPB; the strategies midsize banks are relying on to stimulate growth; and more from this week’s most-read stories.

October 25 -

Newcomers to the U.S. tend to have a hard time getting credit cards because they lack credit history here. Amex has deployed technology from a fintech, Nova Credit, that could change this.

October 25 -

The credit card issuer, which recorded an 11% decline in net income last quarter, took one-time charges in connection with a U.K. sales scandal, the start of a new partnership with Walmart and a recent data breach.

October 25 -

Readers react to Regions Financial's plan to replace its core deposit system, a House bill meant to curb jobs moved overseas, a resurgence of consumer complaints against the credit bureaus and more.

October 24 -

The online lender posted a profit for the sixth consecutive quarter, as higher margins helped offset a decline in loan originations.

October 24 -

Executives say they are passing on more loans as bank and nonbank competitors cut rates and forgo traditional safeguards.

October 23 -

It has already been modifying more problem loans and investing in efforts to recover charged-off loans, and now the credit card lender is ready to tighten underwriting in case the economy weakens.

October 23 -

The company says the upgrade will support future digital investments. It also said Tuesday that third-quarter profits climbed 8% but reported a sharp increase in criticized business loans.

October 22 -

Regulators have long warned the credit bureaus about deceptive marketing that causes consumers to sign up unwittingly for paid monitoring services. But the practice has persisted, according to complaint data.

October 20 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

Its quarterly results show lower rates and emerging credit risks can be overcome. Whether most banks have all the same levers to pull is another matter.

October 15 -

Slowdowns in new factory orders and production, largely tied to the trade war with China, could translate to more defaults among industrial clients.

October 15 -

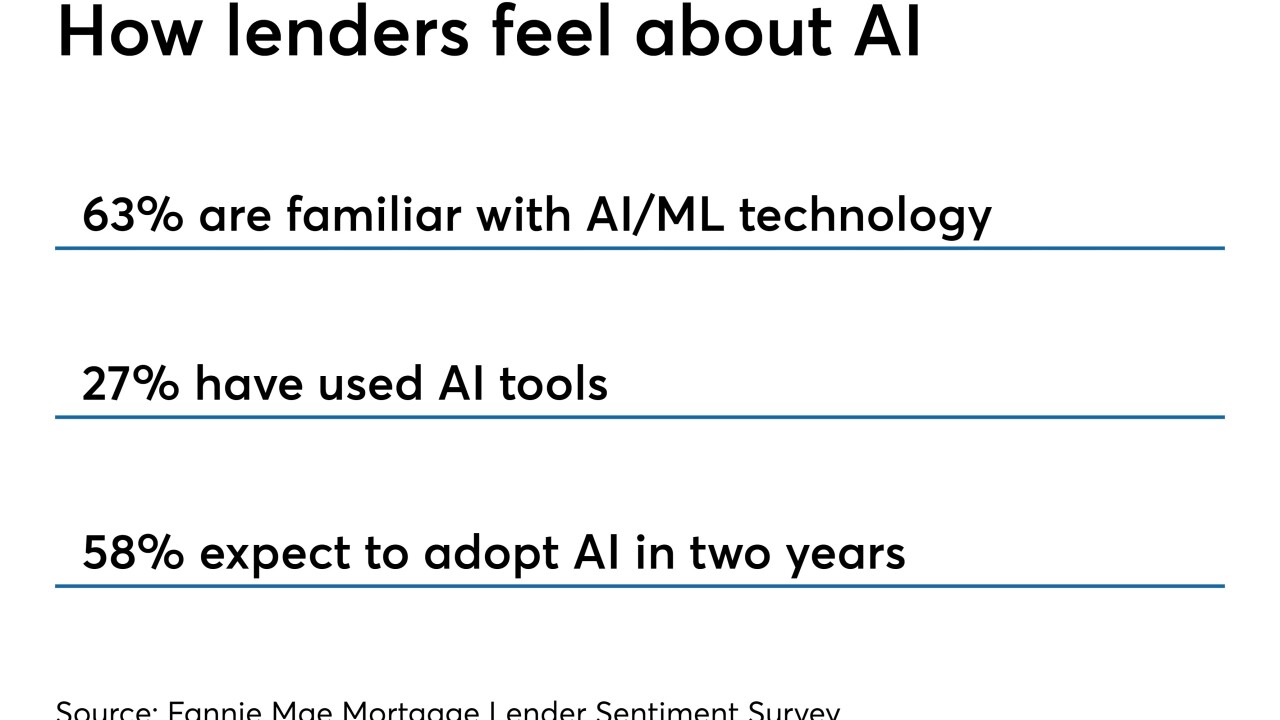

Freddie Mac's test of artificial intelligence to make lending decisions could be a significant turning point in broadening the use of the technology.

October 2 -

Bankers are expected to field numerous questions on third-quarter earnings calls about the threat of shrinking loan yields, stubbornly high deposit prices and what they're going to do about them.

September 30 -

Caught in the middle of a credit-subsidy debate, the program would have shut down on Tuesday without congressional action.

September 27 -

The Dallas company inherited the loan relationship from a bank it bought in 2017.

September 24 -

The Boston company said the loan participation went into default due to potentially fraudulent activity.

September 23 -

Boosted by companies like Klarna, Affirm and Splitit, payment installment plans have become a popular alternative to credit card debt for consumers — and business transactions are the next target.

September 23 -

The House Financial Services Committee passed a bill that would exclude adverse credit information for consumers impacted by a government shutdown.

September 20