-

The Dunedin, Fla.-based institution reported an 18.8% surge in assets last year, along with substantial growth in commercial lending, thanks in part to the Paycheck Protection Program.

March 25 -

The Arlington-based institution made gains across several metrics in 2020, including loan growth of 22%, driven in part by the mortgage refi boom.

March 24 -

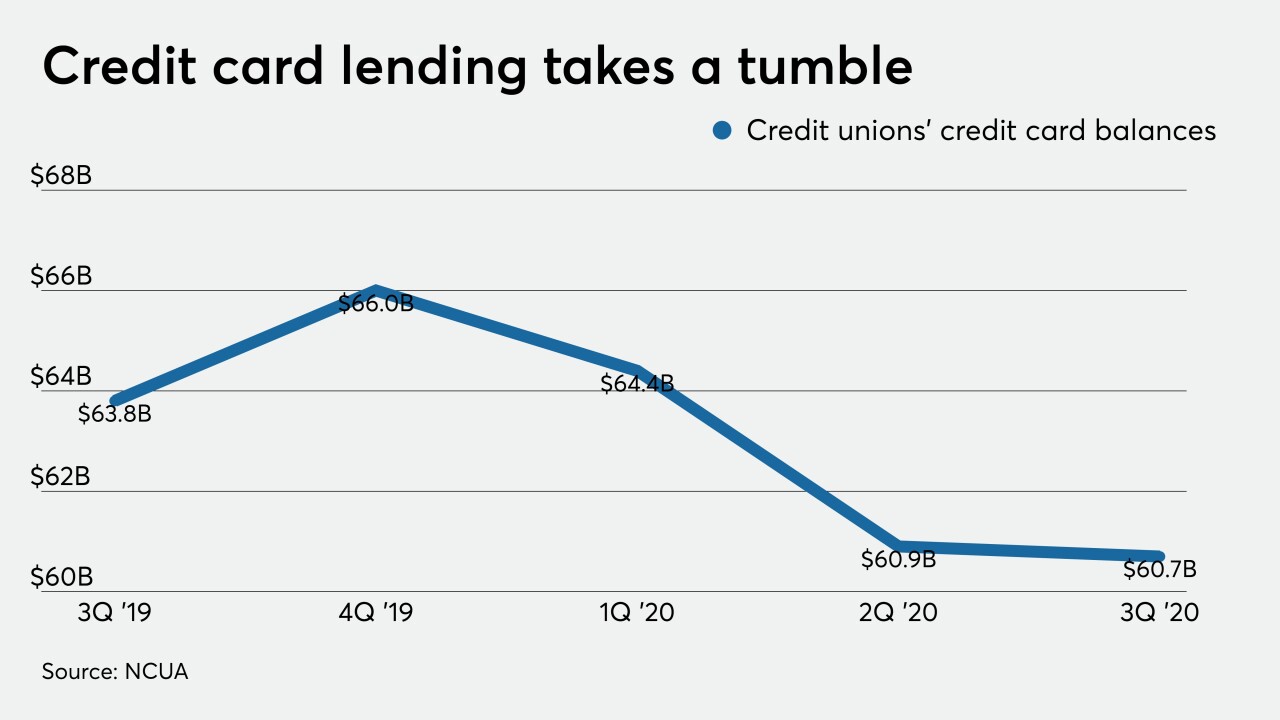

A new report from the regulator shows slower growth in membership and lending, as well as a decline in the number of credit unions reporting profits.

March 18 -

After digging deep into member data, Randolph-Brooks FCU in Texas developed a marketing campaign aimed at persuading JPMorgan Chase clients to switch to the credit union's own card. It's an effort its peers could imitate.

March 15 -

Home loans accounted for the bulk of the industry’s lending gains in 2020, but inventory shortages in some markets and an uneven economic recovery may dim prospects this year.

February 9 -

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

Any business loan growth the industry sees this year will be closely tied to mass vaccination efforts and a broader economic recovery, meaning it may take until at least the third quarter for pent-up demand to translate into new opportunities.

February 3 -

With one study showing consumers racking up additional credit card debt this season, some members may be eager to consolidate their balances in the year ahead.

December 23 LendEDU

LendEDU -

Demand for home purchases and car loans would need to increase substantially to make up for what's expected to be a sharp drop in refinancing revenue.

December 22 -

A new report from the National Credit Union Administration showed institutions in many states are struggling with a deluge of deposits while their lending opportunities are drying up.

December 20 -

Credit quality has remained strong at credit unions, but there are hints that some of them — especially the smallest ones — could report lackluster earnings well into next year, according to the National Credit Union Administration's latest intel on industrywide finances.

December 8 -

Institutions that cling to outdated lending tools run the risk of being left behind by commercial clients who are barraged with opportunities to borrow faster and more conveniently.

October 22 LendingFront

LendingFront -

Credit union groups continue to make ad buys for industry-supported candidates in advance of Nov. 3, but recent positive economic news could be short-lived.

October 5 -

The pandemic and economic downturn upended most institutions' advertising plans for the year, and many credit unions have had to adjust not only their messaging but also the loan products they are promoting.

September 10 -

A new report from the National Credit Union Administration shows how hard the industry was hit during the second quarter as businesses closed and consumer spending dropped.

September 8 -

New analysis from S&P found that only two of the of the top 20 credit unions that participated in the Paycheck Protection Program loans had assets of less than $1 billion.

August 27 -

New data from the state regulator showed that assets at credit unions in the Badger State grew by 28% during the first half of this year, versus growth of 14% in the first six months of 2019.

August 26