-

This is the seventh consecutive year that the Kansas City area institution has returned at least $5 million to its members.

January 16 -

The South Carolina institution has returned more than $31 million to members over the last 22 years.

January 14 -

President Trump has threatened that the closure may go on for a prolonged period. This could lead to higher loan delinquencies at credit unions that serve federal workers.

January 10 -

The Jackson, Mich.-based institution also made its largest donation ever to a program to help students pay for college.

January 7 -

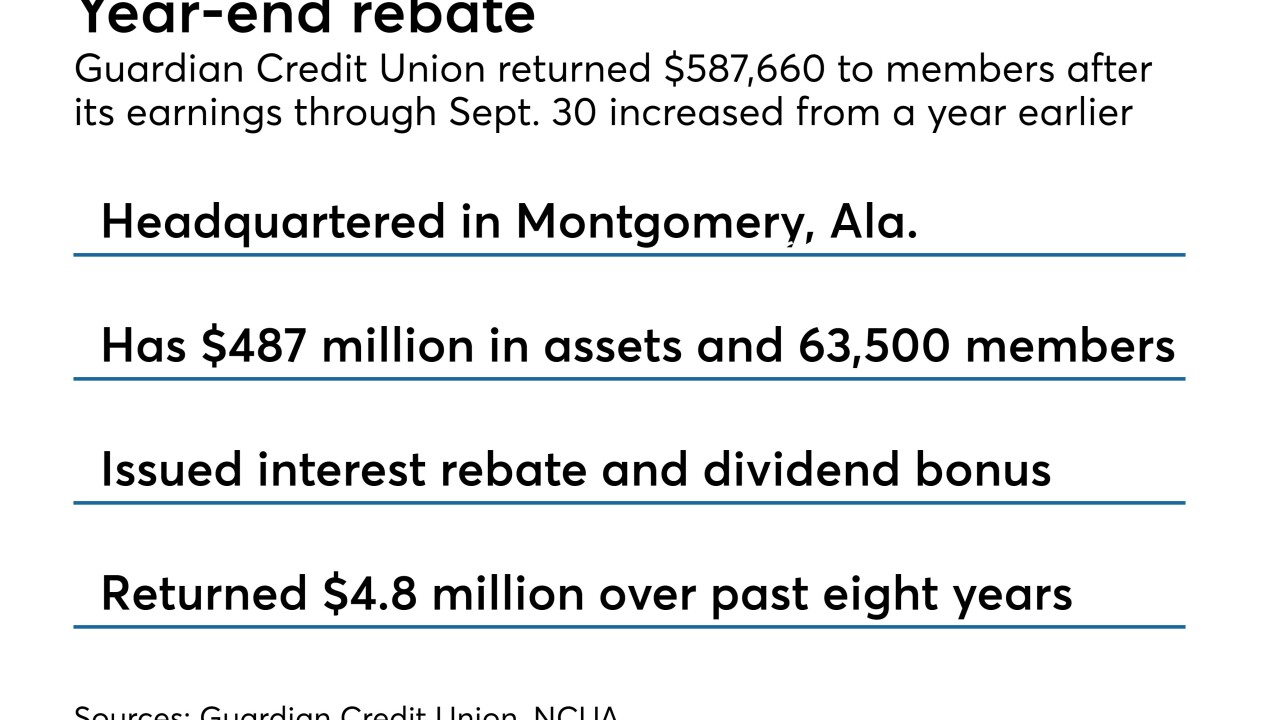

The Montgomery, Ala.-based institution has paid out more than $4.8 million to members over the last eight years.

January 4 -

Pennsylvania State Employees Credit Union returned $22 million to its members.

January 3 -

One bank is tracking the habits of its 4.4 million customers, giving them discounts on services if they visit the gym or get a flu shot. Other companies may soon follow suit.

January 1 -

Entering 2019, lenders must think carefully about how they expand their auto loan portfolio. Failure to do so could result in bad loans and bad reviews online.

December 26 EFG Companies

EFG Companies -

Customizing the customer experience will help credit unions keep up with evolving trends in service.

December 5 NewGround

NewGround -

The new promotion illustrates how banks are going beyond traditional advertising as they try to find something that customers will share on their own.

November 20 -

The bank has long collected data about digital interactions. Now it’s adding tech to gain knowledge from phone call to better understand each customer.

October 3 -

Financial firms must follow customers from mobile devices to desktop and back without missing a beat.

October 1 -

Forrester principal analyst Alyson Clarke explains why the two nonbanks fared well in a recent survey of 110,000 Americans.

July 26 -

First it was coffee and car service, and now it could be cashier’s checks and debit cards. Matt Krogstad left his bank job to build tech that lets bank customers order products at the press of a button and pick them up at a branch or get delivery.

January 10 -

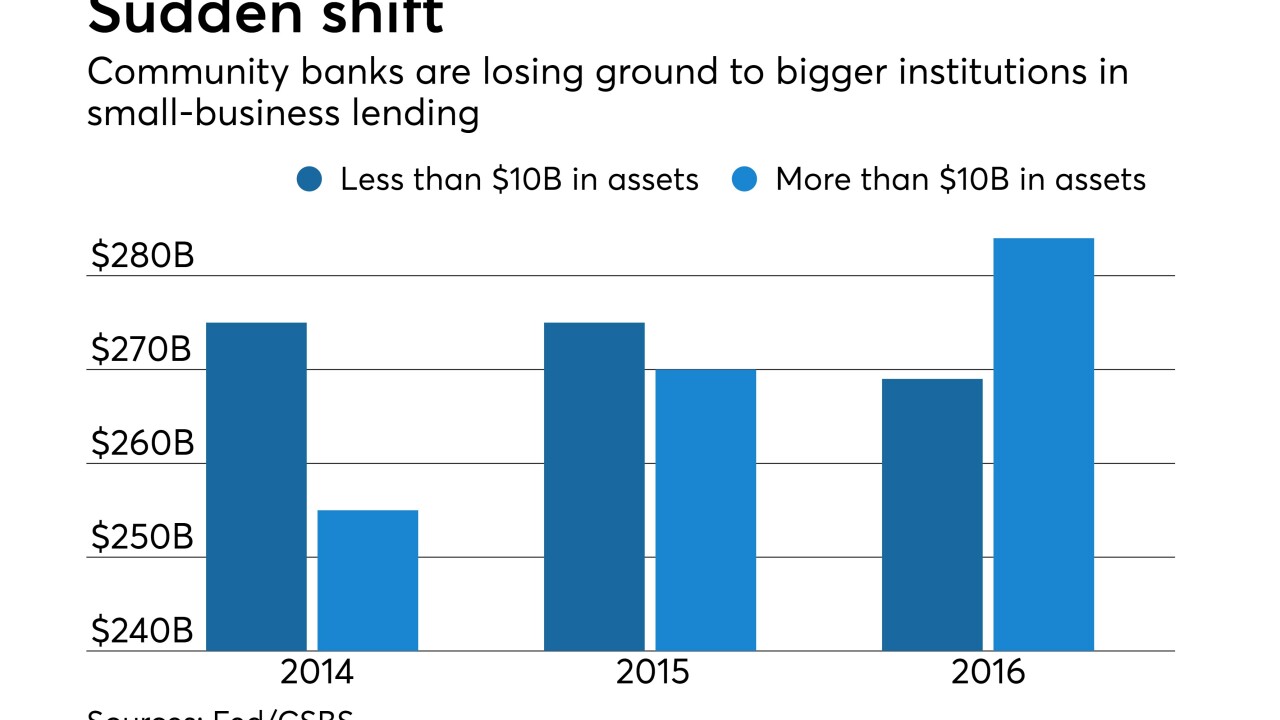

Bigger rivals are making inroads into small banks' bread-and-butter business line, yet the leaders of three community banks say they just need to keep doing what they do best — personal service — but work harder at it and incorporate new technology.

December 6 -

After two century-old community institutions merged in 2010, they never suspected it would take seven years before their operating systems got along.

December 6 -

A lot of lenders say they're dedicated to customer service, but here are six instances when Amarillo National Bank — whose CEO is one of our Banker of the Year award winners for 2017 — went above and beyond the normal call of duty.

November 30 -

The regional bank’s first-year CEO is doing some expected things, like offering more products through digital channels, and making a few surprising moves, like inviting all credit card customers to switch to lower-rate loans.

November 8 -

The Midwest bank said that digital usage rose 400% after a makeover of online and mobile banking platforms that was meant to make them more customer-friendly and more competitive.

October 23 -

Banks such as Citigroup, Regions and TD have decided they need to offer mobile customers truly customized experiences. They are experimenting with different ways of doing so that come across as helpful without being intrusive.

October 12