-

The decision to rewrite the regulation came two days after a hearing in which New York bankers unleashed a litany of complaints about the regulation to Empire State lawmakers.

December 22 -

Had Wells Fargo simply complied with regulatory guidelines on multifactor authentication across all channels, there would have been substantially less fraud.

December 22 Open Identity Exchange

Open Identity Exchange -

Munich-based digital bank technology provider

Fidor andToken Inc. have signed a memorandum of understanding to develop services enabling banks to control the way they share data with third parties.December 21 -

Scandal, business models gone awry, missing money and executive shake-ups — 2016 had it all. Here are the financial services executives or groups of them who took the heat and will be looking for better times in 2017.

December 21 -

With identity management now established as a distinct industry, it needs an organization to nurture its practitioners like those that exist for the privacy and security sectors.

December 21 Kantara Initiative

Kantara Initiative -

The scourge of account takeover isn't lost on Citizens Union Bank, which is involving its business customers — or rather, their biometric traits — in improving the security of their accounts.

December 21 -

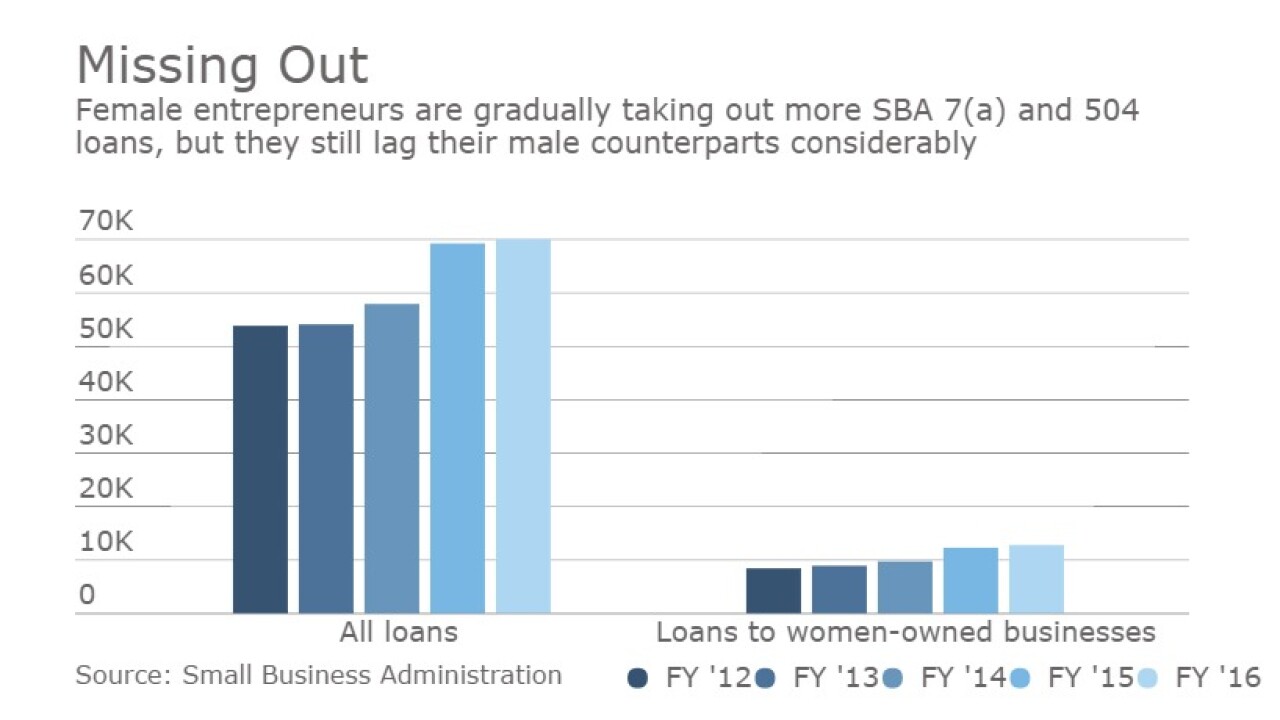

Female entrepreneurs who apply for loans online and are evaluated by an automated system get a bigger share of online credits than they do traditional in-person bank loans. It could be a sign that automated credit decisions are fairer.

December 20 -

Tim Pawlenty, the head of the Financial Services Roundtable and former Minneosta governor, sent a letter Monday to President-elect Donald Trump requesting that he take steps to harmonize government cybersecurity requirements.

December 20 -

As long as there has been mobile commerce, there have been calls for different stakeholders to share competitive turf in the name of universal acceptance.

December 20 -

Tim Pawlenty, the head of the Financial Services Roundtable and former Minneosta governor, sent a letter Monday to President-elect Donald Trump requesting that he take steps to harmonize government cybersecurity requirements.

December 19 -

The appeal of information pathways such as the internet were seen as possibly bringing about a "comeback" for artificial intelligence in financial services in the 1990s.

December 19

-

As retailers, banks and technology companies continue to suffer data breaches, issuers and merchants need to take extra care when selecting payment vendors.

December 19 Forte Payment Systems

Forte Payment Systems -

Facing security challenges at its member banks and competition from other tech providers, the Society for Worldwide Interbank Financial Telecommunication [Swift] plans to put its best foot forward in 2017.

December 19 -

Online shoppers can expect fraudsters to be at the height of their creativity during the 2016 holiday season.

December 16 -

By making tokenization available on each other's digital wallets, Visa and Mastercard are addressing the security concerns of merchants who are happy to accept both brands but nervous about how their wallets can be misused.

December 15 -

In response to a series of cyber bank thefts, Swift has developed new guidance. It's a necessary first step, though banks for now are still left to fend for themselves.

December 15 Trusona

Trusona -

Yahoo! Inc. disclosed a second major security breach that may have affected more than 1 billion users, another blow to the company's reputation as it nears the sale of its main web businesses to Verizon Communications Inc.

December 14 -

The tech firm behind USAA's digital assistant has introduced an authentication tool that identifies customers by the sound of their voice or by their facial features.

December 14 -

Russian authorities have handed over an American fugitive who the U.S. accuses of conspiring to organize the largest known cyber attack on Wall Street, according to people familiar with the matter, resolving months of negotiations at a moment of high tension over hacking between Moscow and Washington.

December 14 -

Banks should embrace artificial intelligence so that they can more easily navigate policy shifts that will affect their compliance resources and processes.

December 14 The Rudin Group

The Rudin Group