-

As connected devices expand in use and add payment capabilities, retailers and technology companies will need to move fast to stay safe and ahead of the curve.

March 23 Intel

Intel -

A lot of time can pass between a breach and when a company discovers the incident, creating an opportunity to damage payment systems.

March 15 Imperva

Imperva -

Firms including Betterment, Coinbase and TransferWise have told customers that despite a bug affecting the content delivery network Cloudflare, their data is safe.

February 27 -

Hotels and other hospitality businesses need to adopt new security technology methods such as biometrics to stay ahead of the crooks.

February 13 HYPR Corp.

HYPR Corp. -

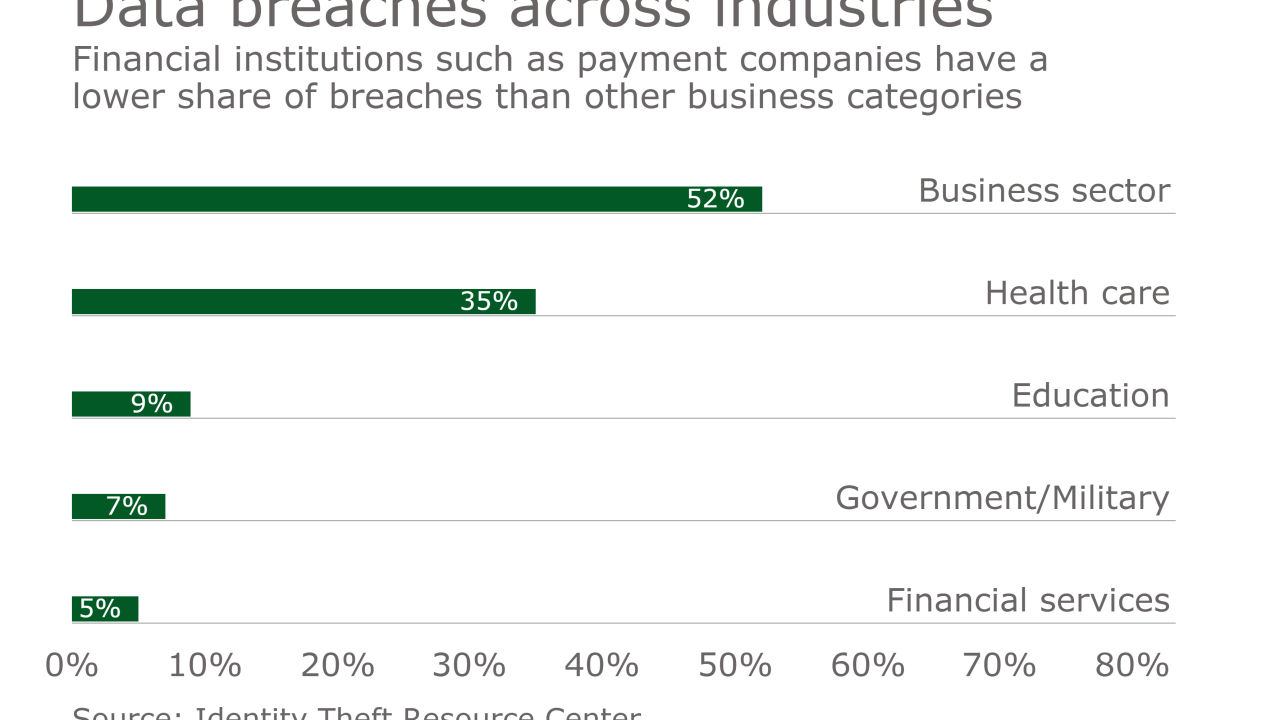

Data breaches at financial institutions dropped by 26% in 2016, but breaches as a whole were up significantly.

February 2 -

The breaches at large retailers and other companies are continuing, making it time to fully embrace a new authentication method.

January 25 HYPR Corp.

HYPR Corp. -

Payment companies and other financial institutions were victimized less than health care, educational institutions and government agencies.

January 20 -

Artificial intelligence is moving from science fiction to practical reality fast, and it's in banks' best interest to gear up now for the changes ahead. Here are some strategies to consider.

January 8 -

For years, there's been a lot of talk about personal information as an unalloyed asset. But by now it should be clear that the more information a company has about its customers, the bigger a target it is for hackers.

January 5 -

The time banks have to investigate red-flagged credit payments has shrunk from several days to a few hours and fraudsters have already taken notice.

December 29 -

Data breaches have been proliferating over the past couple of years, but there's new technology out of the 'bot' and analytics worlds that can help.

December 29 Imperva

Imperva -

A 2010 cyberattack targeting the Federal Deposit Insurance Corp. believed to have originated in China is reportedly the subject of an FBI investigation.

December 23 -

As retailers, banks and technology companies continue to suffer data breaches, issuers and merchants need to take extra care when selecting payment vendors.

December 19 Forte Payment Systems

Forte Payment Systems -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8 -

Banks tend to respond to ATM and payment breach risks after an incident. They need to get more proactive.

December 1 CAST

CAST -

Financial industry groups have rolled out a plan for keeping bank customers' data safe if a mega-disaster, like a massive attack or a natural disaster, strikes.

November 29 -

Behavioral biometrics has already stopped several million dollars worth of online banking fraud at National Westminster Bank in London.

November 17 -

Any company that uses point of sale systems or technology is at risk.

November 11 CoSoSys

CoSoSys -

The president-elect's policies on taxes, offshoring, surveillance and other issues will affect bank technology officers and their vendors in a variety of ways. The positives may slightly outweigh the negatives.

November 10