-

Deciding how far to go to protect customers is a complex issue, but one that the industry should address soon as phishing attacks continue to mount.

November 20 Liberty Bank

Liberty Bank -

Look who's co-chairing the notoriously male-dominated World Economic Forum. A female automotive enthusiast eloquently calls out an industry where bias is ingrained in the everyday language, and women in prison cook up a better future. Plus, State Street, Goldman Sachs and Bank of Montreal.

November 16

-

Consumers are increasingly concerned about payment card fraud, but it remains to be seen how much work they’re willing to do to protect themselves when they’re not directly liable for monetary losses from stolen cards.

November 16 -

The advent of blockchain technology may prove to be disruptive to traditional credit reporting agencies by decentralizing data aggregation and allowing consumers to take ownership of their data through a personalized wallet they could share with prospective lenders, writes Alexander Koles, CEO, founder and managing director of Evolve Capital Partners.

November 16 Evolve Capital Partners

Evolve Capital Partners -

As consumers’ personal information is compromised almost daily, hackers are increasingly targeting banks.

November 14 -

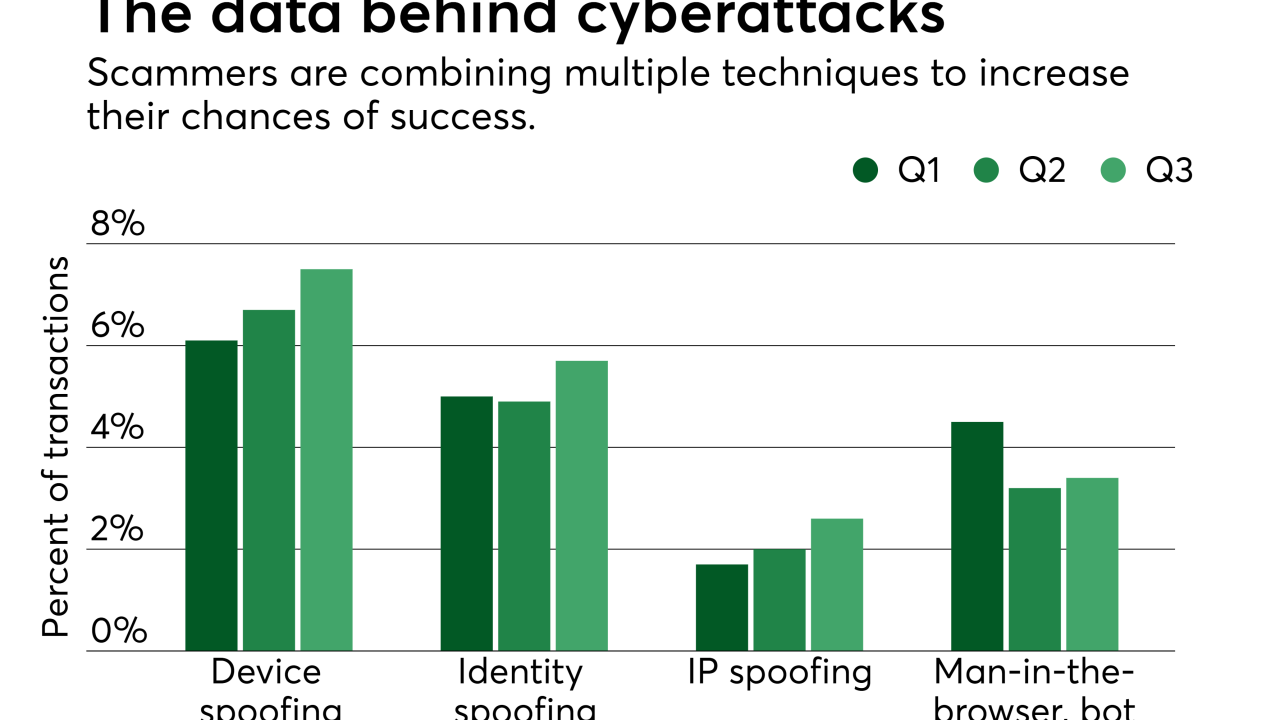

There is a visible shift in attack patterns immediately following a breach, from initial attacks focusing on high-value loan applications at online lenders to low-value identity testing on charities and social media sites to determine if a stolen credential will work.

November 14 -

PayPal has suspended the operations of TIO Networks, a bill-payment company it purchased earlier this year, following the discovery of security vulnerabilities that require investigation.

November 13 -

When a coder locked $150 million of digital currency stored in Parity digital wallets last week, many bankers probably saw it as another reason to ignore cryptocurrencies. Instead they should recognize the business opportunity (key custody) that the incident presents.

November 13 -

It is important to have the right layers of security in place, ideally those that evaluate passive and behavioral biometrics, as they are proving to be the most reliable, writes Robert Capps, authentication strategist and vice president of NuData Security.

November 13 NuData Security

NuData Security -

Because wearable payments technology is still considered experimental, it is important to address security before the market for such products gets much bigger.

November 13 -

In mid-2015, several thousand banks registered for dot-bank domains. More than two years later, only a few hundred have converted.

November 10 -

Outsiders gained access to customer information at Southern National Bancorp of Virginia using a malicious email. Other financial institutions, meanwhile, are implementing policies in hopes of avoiding the same fate.

November 10 -

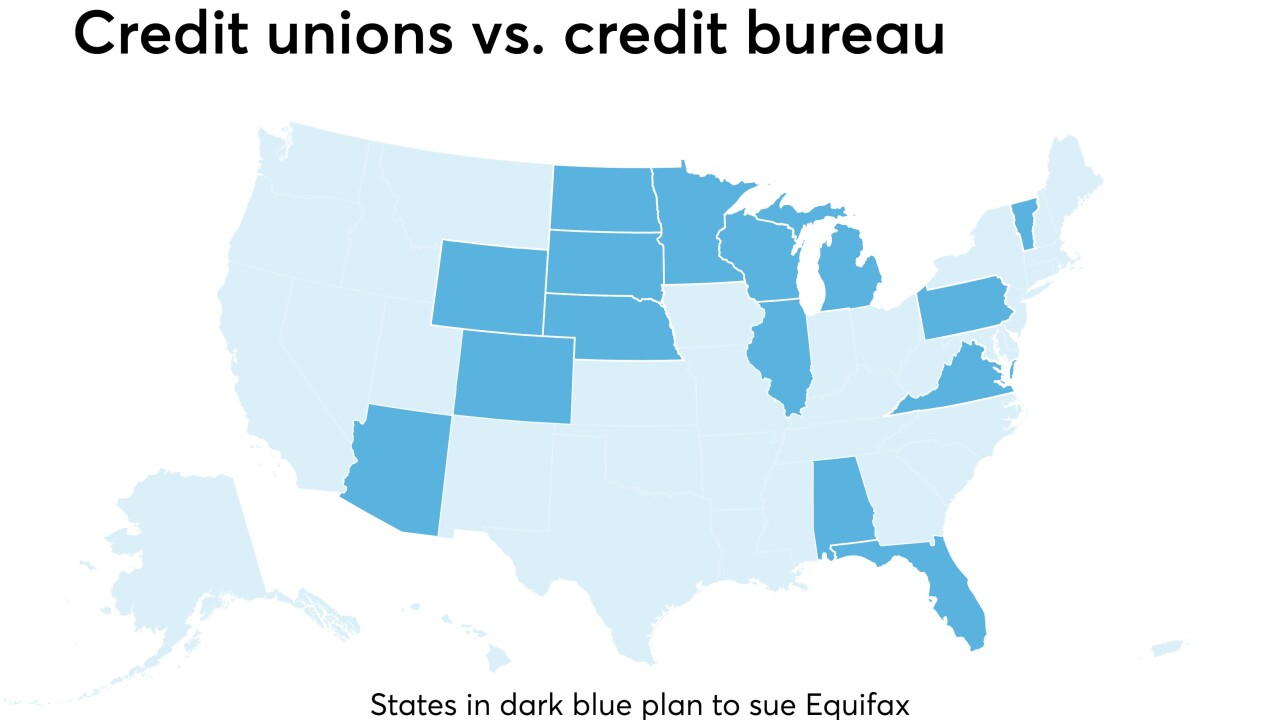

Equifax Inc.’s massive data breach is proving costly.

November 10 -

Company’s first earnings report since the data breach also discloses lots of suits and investigations; Senate bill also calls for one-year delay in corporate tax rate cut to 20%.

November 10 -

Readers chime in on the idea of a state-backed bank to serve the cannabis industry, data-sharing between banks and fintechs, whether community banks can just focus on tech laggards, and more.

November 9 -

Barros has no answer for Senate committee on encryption; a bitcoin network split won’t happen … for now.

November 9 -

More than a dozen state leagues and credit unions have signaled their intent to sue Equifax, but to what end?

November 8 -

As blockchain becomes increasingly popular, heightened levels of data protection and customer awareness of its use become a reality, writes Abhishek Pitti, CEO of Nucleus Vision.

November 8 Nucleus Vision

Nucleus Vision -

The heads of some of the largest U.S. banks are calling for a new security-focused mindset among executives, better forms of ID and collective action in the aftermath of the Equifax breach.

November 7 -

The new vice chairman of supervision at the Fed said the agency will seek comment on its rules for stress tests, capital and other areas, as well as look at how fintech has impacted the industry.

November 7