-

Hint: For their e-commerce clients, it's all about faster payments.

September 10 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5 -

Don Cardinal of FDX and Olivier Helleboid of Intuit explain the FDX and OFX standards, how they're turning them into one standard and what that standard will be able to do for banks.

July 30 -

OFX is used by 7,000 banks while FDX is used by 2 million consumers. The two standards are converging.

July 26 -

Policymakers should consider how new data computing can help ensure equal lending, not hinder it.

July 23 Kabbage Inc.

Kabbage Inc. -

The former head of the Small Business Administration and current Harvard professor says data sharing can be transformational for banks.

July 23 -

The investment firm is launching a company called Akoya that it says will help ease the technical aspects of data sharing, as well as disputes and liability issues, for banks, fintechs and data aggregators.

June 11 -

The data aggregator plans to help U.S. fintechs expand into the U.K. and vice versa.

May 29 -

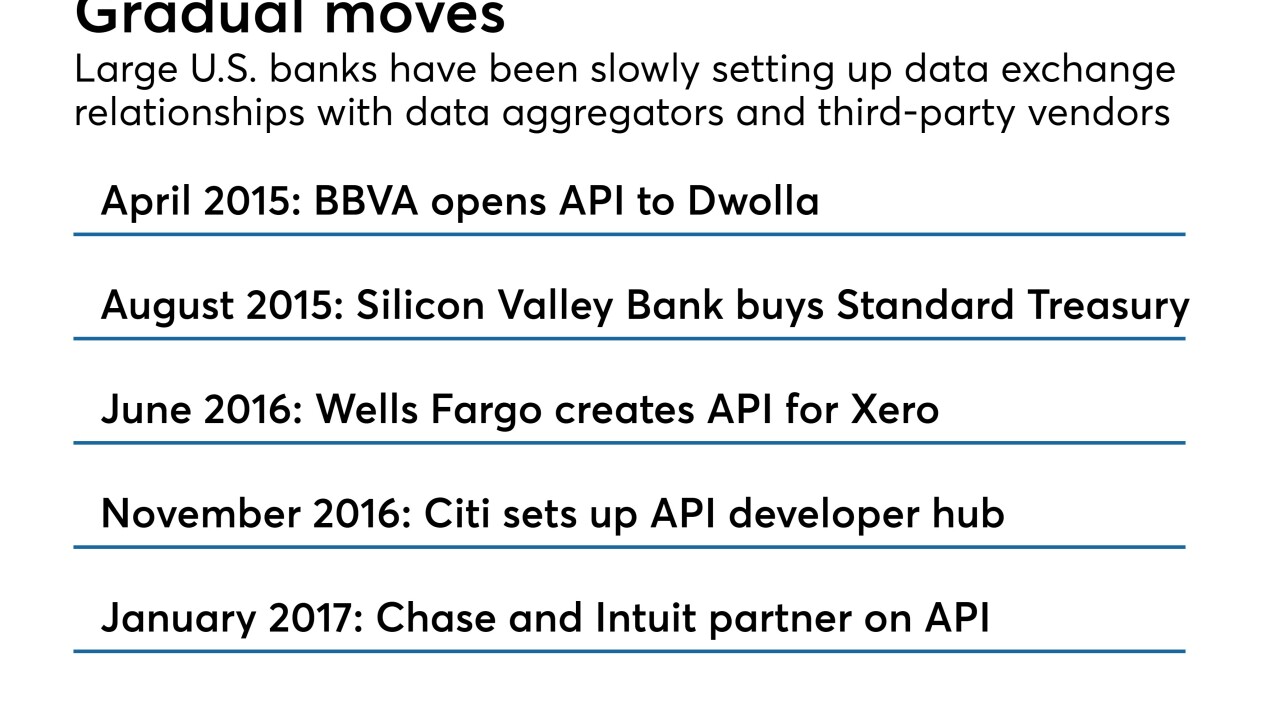

In the past few years, APIs have become a surprisingly hot topic, considered by many as a golden key to open banking and innovation.

May 26 - Software development

The company offers an operating system for financial applications akin to Apple's iOS, and more than 1,000 applications run on it.

May 16 -

A Brooklyn startup predicts a mix of blockchain and AI can give retailers a referral and conversion model like Amazon and eBay, but the merchants will have to cede some data control.

May 16 -

At a fintech event hosted by the FDIC, the agency’s chief and the head of the OCC offered their views on a wide range of matters.

April 24 -

Long-simmering tensions between the financial industry and Silicon Valley startups are erupting behind-the-scenes into a battle over the reams of valuable data held inside Americans' bank accounts.

March 26 -

California and others have passed consumer privacy laws, and lawmakers in Congress are beginning to address the issue. Here's an overview of the players and the proposals.

March 3 -

The all-in-one card market has been a dead end for many years, with products like Coin, Swyp, Stratos and Plastc doomed to be mere footnotes in the history of fintech. Curve is determined to avoid the same fate, and it says PSD2 is its ticket to success.

February 21 -

Through a partnership with Adyen, Dutch airline KLM is one of the first large merchants to adopt an online payments approach that bypasses payment cards, powered by PSD2's open banking framework.

February 20 -

Steve Boms, executive director of the Financial Data and Technology Association, says open banking standards are needed for U.S. banks and fintechs to follow.

February 5 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28