-

A Brooklyn startup predicts a mix of blockchain and AI can give retailers a referral and conversion model like Amazon and eBay, but the merchants will have to cede some data control.

May 16 -

At a fintech event hosted by the FDIC, the agency’s chief and the head of the OCC offered their views on a wide range of matters.

April 24 -

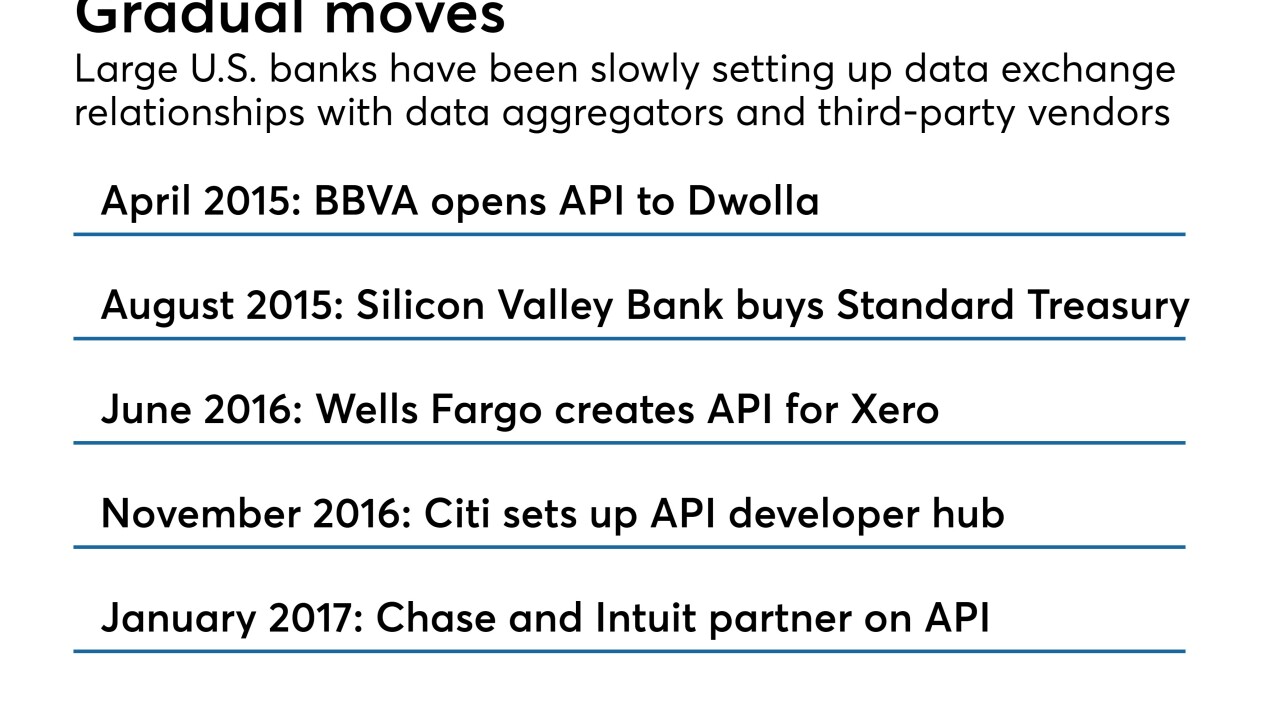

Long-simmering tensions between the financial industry and Silicon Valley startups are erupting behind-the-scenes into a battle over the reams of valuable data held inside Americans' bank accounts.

March 26 -

California and others have passed consumer privacy laws, and lawmakers in Congress are beginning to address the issue. Here's an overview of the players and the proposals.

March 3 -

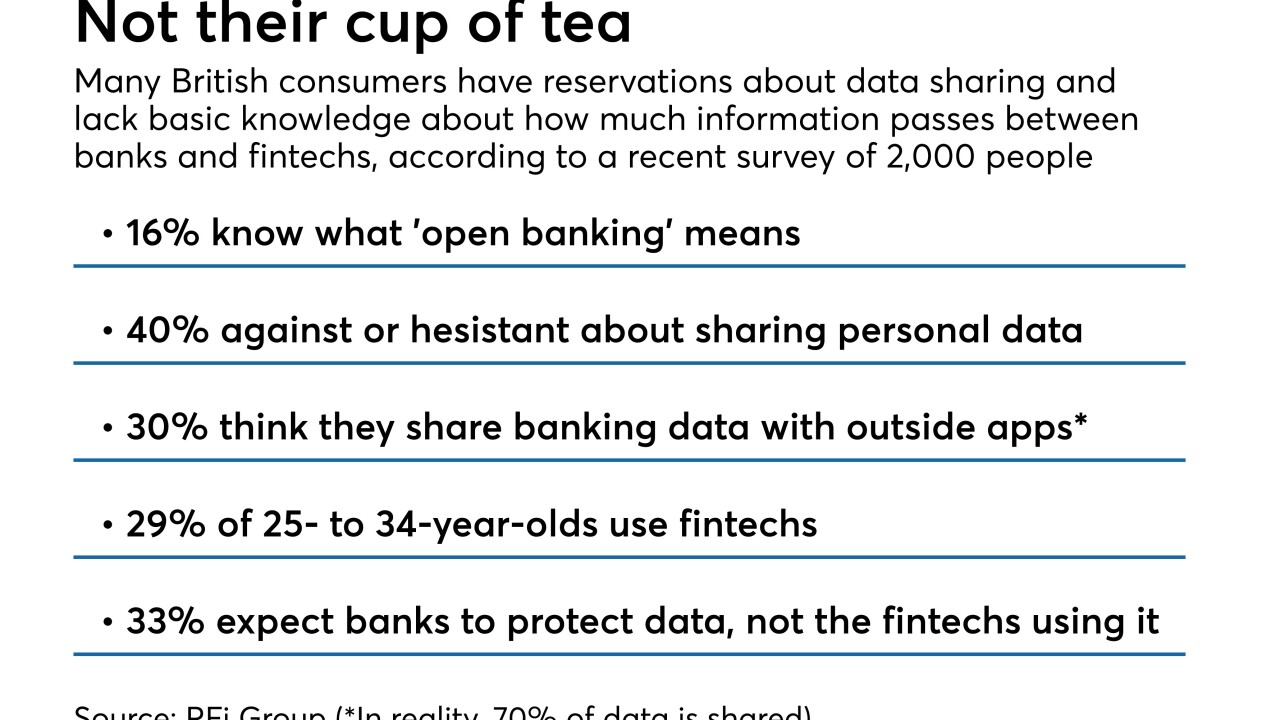

The all-in-one card market has been a dead end for many years, with products like Coin, Swyp, Stratos and Plastc doomed to be mere footnotes in the history of fintech. Curve is determined to avoid the same fate, and it says PSD2 is its ticket to success.

February 21 -

Through a partnership with Adyen, Dutch airline KLM is one of the first large merchants to adopt an online payments approach that bypasses payment cards, powered by PSD2's open banking framework.

February 20 -

Steve Boms, executive director of the Financial Data and Technology Association, says open banking standards are needed for U.S. banks and fintechs to follow.

February 5 -

Several fintechs are testing apps that let customers gain more say over how third parties use their data — and hope to one day be able to give them the power to revoke access to it entirely.

January 1 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

Both sides acknowledge where expectations haven't been met, and are feeling the same market pressures to adapt faster.

December 28 -

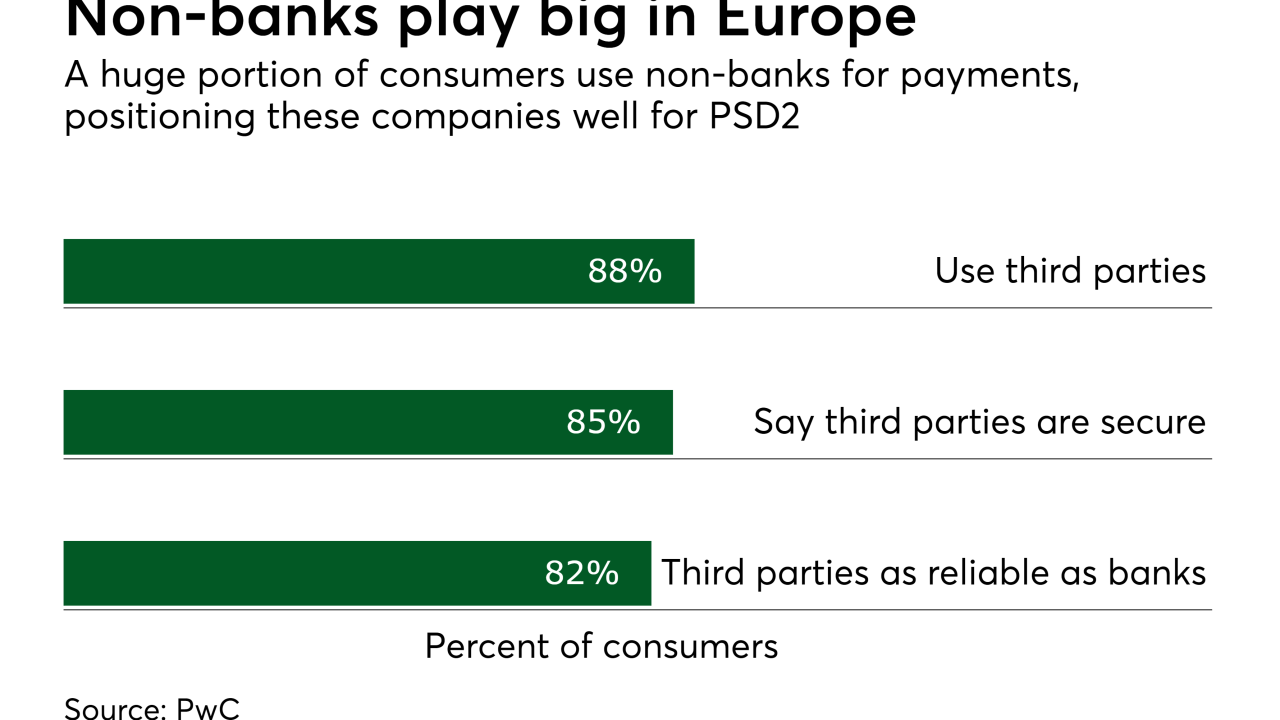

Though it became official in January in the U.K., most people there don't know what it is, according to a new survey that offers many insights for U.S. banks.

December 19 -

Data regulations pressure small banks and credit unions, which could benefit from a pro-innovation regulatory environment, according to Stephen Menon, vice president of product at Finn AI.

December 10 Finn AI

Finn AI -

Schwark Satyavolu, original co-founder of Yodlee and current venture capitalist at Trinity Ventures, shares his opinion on how consumer data sharing is evolving.

December 4 -

Policymakers have called for streamlined disclosures for customers granting third parties access to their financial account data. They don’t have to look far for a potential solution.

November 2 Quovo

Quovo -

Policymakers have called for streamlined disclosures for customers granting third parties access to their financial account data. They don’t have to look far for a potential solution.

October 25 Quovo

Quovo -

Netspend customers kept from accessing paychecks; Sen. Elizabeth Warren rebukes Comerica over fraud in benefits program; FDIC poised to revamp deposit rules (about time, say banks); and more from this week's most-read stories.

October 19 -

A recent study concluded there are first-mover benefits for banks that embrace open banking. But many executives see its risks instead.

October 19 -

Wells Fargo, Bank of America, Citigroup and other banks have joined forces with fintechs and data aggregators to create the Financial Data Exchange, which aims to resolve the fight over sharing customer information.

October 18 -

Trellance has acquired IronSafe, which provides data analytics to more than 2,300 credit unions.

October 2 -

Two of the credit union movement's biggest names are teaming up to help CUs better tackle big data.

September 13