-

First-quarter income for credit unions chartered in the Badger State increased by about 6% from the same period one year earlier.

June 12 -

Industry figures have begun to speak out in support of demonstrations in the wake of the deaths of George Floyd and other African Americans, and new data is expected to show how the coronavirus impacted balance sheets.

June 8 -

The SBA issues guidance on Paycheck Protection Program loan forgiveness; after staffing up for PPP, Bank of America may need to delay investments to meet cost targets; American Express has leaned hard on cloud tech to help employees work at home during the pandemic.

May 29 -

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

May 26 -

The FHFA says the two government-sponsored enterprises need at least $240 billion of capital before they can go private; Transunion says more than 3% of consumer loans it tracks are in financial hardship.

May 21 -

The Baltimore-area credit union crossed the latest threshold despite a dip in net income during the first quarter as many organizations struggle with the coronavirus fallout.

May 19 -

Just over 40% of respondents with private student loans said they had worked with their lenders to come up with a plan for reduced payments.

April 28 -

More details have emerged about the damage the coronavirus pandemic is inflicting on the hospitality industry. One servicer alone has received 2,000 workout requests in the past month.

April 24 -

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

April 1 -

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

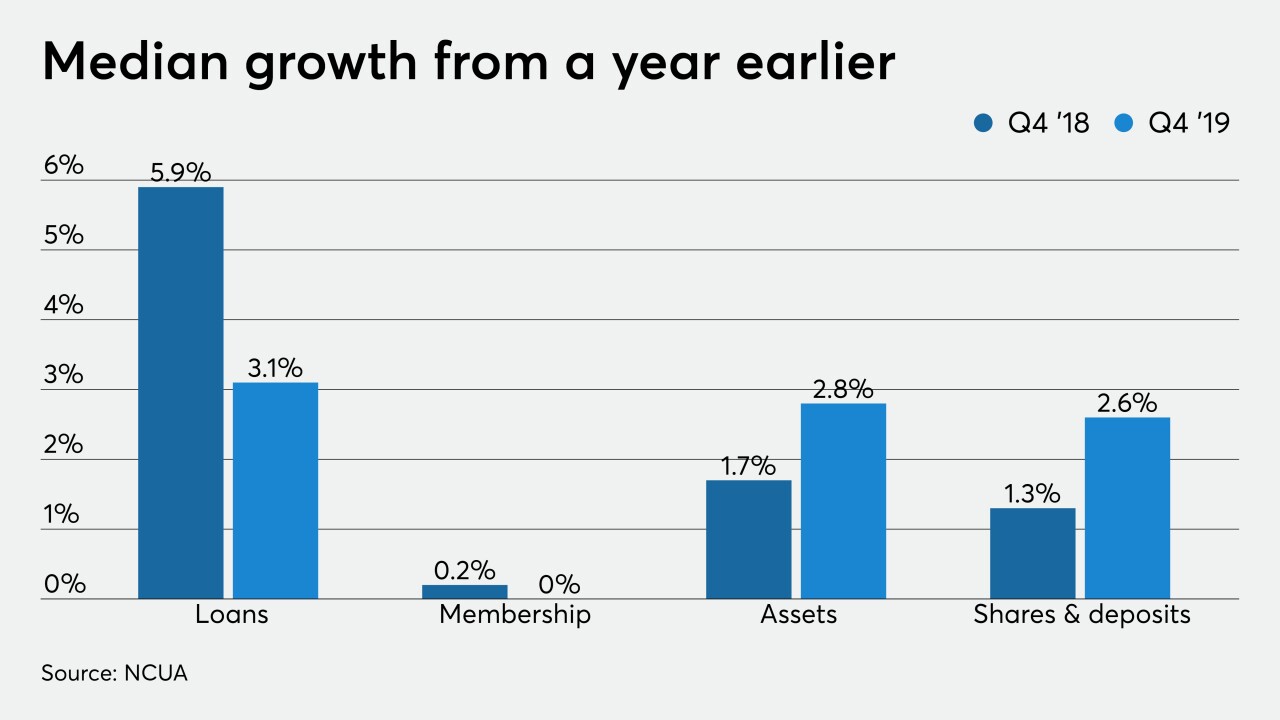

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The expansion comes after a year in which net income at the Nashville-based credit union dropped by more than half amid a rise in delinquencies and charge offs.

January 31 -

Big picture the industry is doing well, but at the median, lending and membership are flagging even as deposits and assets rise.

December 18 -

Delinquencies also remained at "historical low levels" through Sept. 30, according to the state's financial regulator.

November 19 -

The nation's largest private student lender plans to curtail its use of forbearance, a move that could well save some borrowers money but could also result in more defaults.

October 27 -

At the median, credit unions saw growth slacken in several key areas during the year ending at June 30.

September 12 -

Institutions in the Badger State reported that lending was up by almost 6% and delinquencies remained at historic lows.

August 28