-

The agency has relaxed some reporting requirements and joined other regulators in encouraging banks to help borrowers, but pressure is building on the bureau to do more to aid consumers suffering financial hardship.

March 30 -

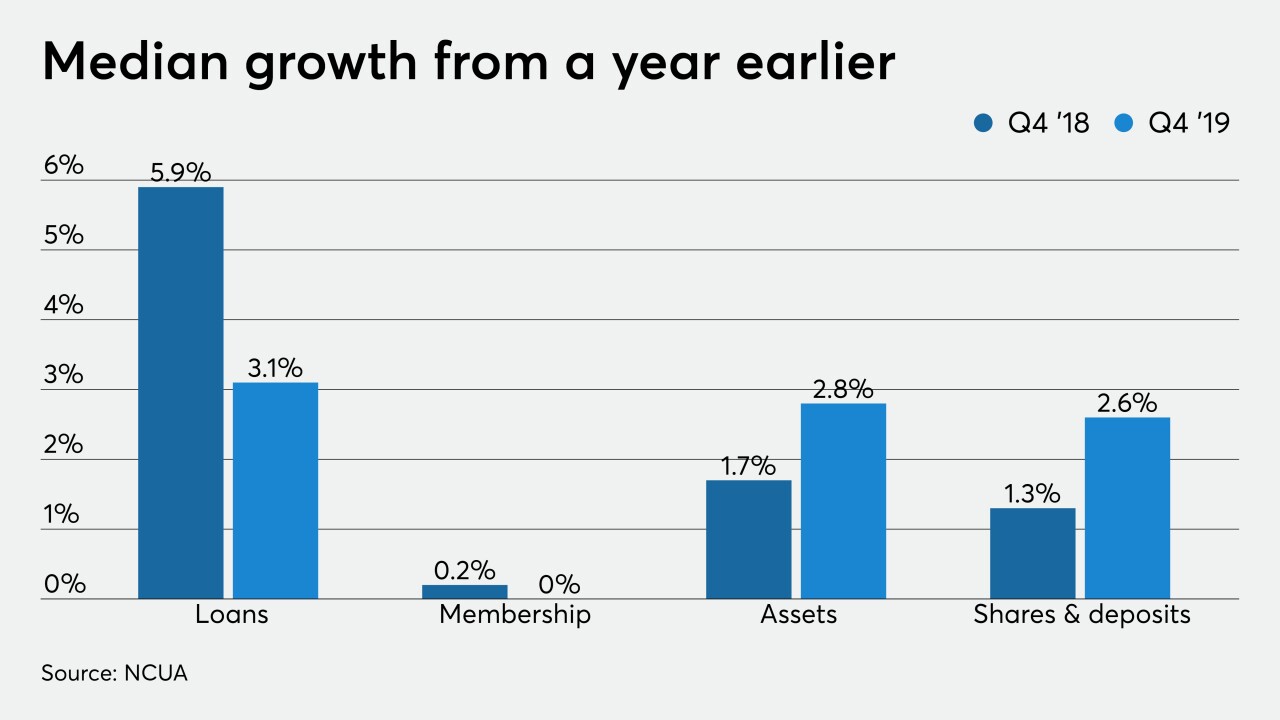

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

Banks may be protected from a direct hit, but they have invested in vehicles that include such loans, potentially exposing them to defaults.

March 11 -

The expansion comes after a year in which net income at the Nashville-based credit union dropped by more than half amid a rise in delinquencies and charge offs.

January 31 -

Big picture the industry is doing well, but at the median, lending and membership are flagging even as deposits and assets rise.

December 18 -

Delinquencies also remained at "historical low levels" through Sept. 30, according to the state's financial regulator.

November 19 -

The nation's largest private student lender plans to curtail its use of forbearance, a move that could well save some borrowers money but could also result in more defaults.

October 27 -

At the median, credit unions saw growth slacken in several key areas during the year ending at June 30.

September 12 -

Institutions in the Badger State reported that lending was up by almost 6% and delinquencies remained at historic lows.

August 28 -

The most recent Credit Union Trends Report from CUNA Mutual Group is “indicative that both the credit cycle and the U.S. business cycle are moving into their last stage before the next economic slowdown,” according to one economist.

August 20 -

Credit unions reported gains in a number of key areas but member business lending and new auto loans took a hit as overall growth continued to slow.

July 18 -

William Mellin will serve as a lending institution representative on the task force, which will evaluate the evolution of the taxi medallion industry.

July 12 -

Citi’s chief lending officer to take over HSBC’s U.S. business; Pittsburgh banks brace for incursion of industry heavyweights; borrowing by nonbank leveraged lenders is growing (maybe too much); and more from this week’s most-read stories.

July 12 -

A recent investigation found that institutions taken over by the National Credit Union Administration “are often the least willing to work with borrowers struggling to afford their loans.”

July 10 -

CUs in the Keystone State saw loan balances rise by 8.5%, while membership rose more than 3.3% to top 4.2 million.

July 10 -

Membership continues to rise across the Wolverine State, though at a slower pace, but lending overall is on the decline.

July 1 -

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

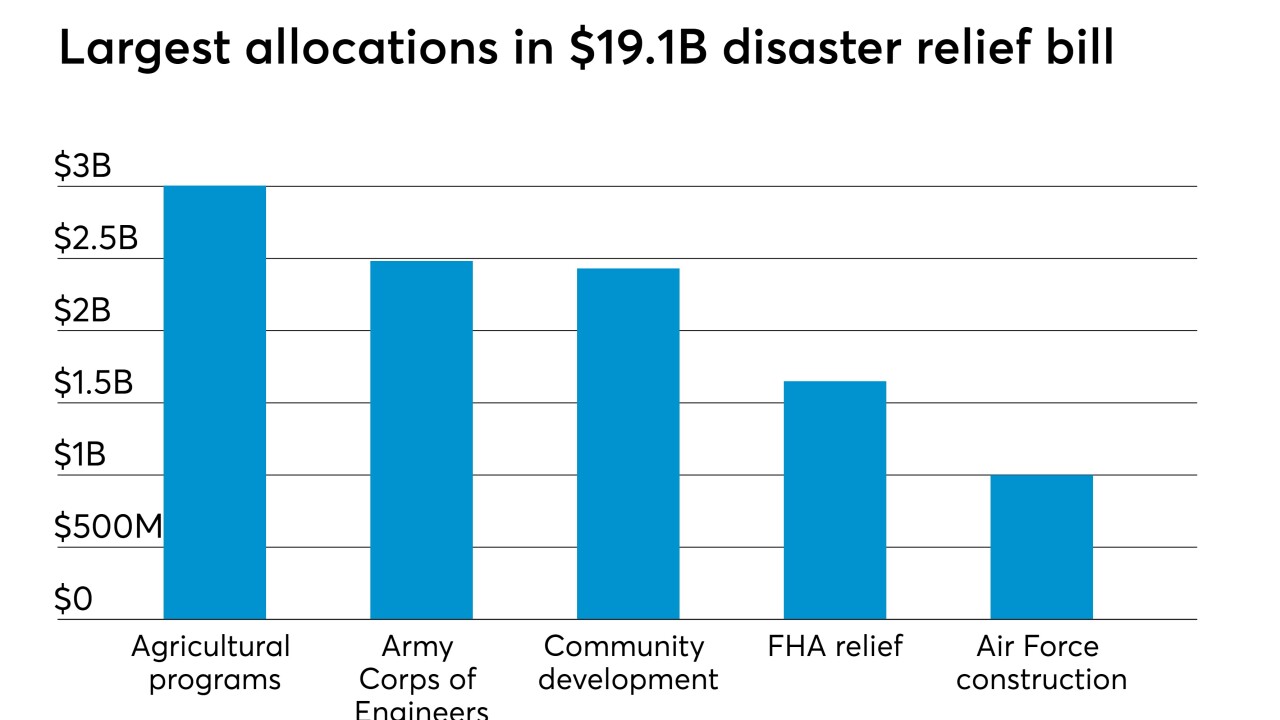

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

Median annual membership growth stood at just 2% at the end of the first quarter, though delinquencies dropped and ROA got a boost.

June 14