-

An “emergency merger” with troubled Progressive Credit Union gives PenFed – already the nation’s third-largest credit union – the ability to welcome any potential member nationwide.

January 4 -

Recent data from NCUA showed a lot of positives for the industry, but it also revealed some potentially worrisome trends.

December 18 -

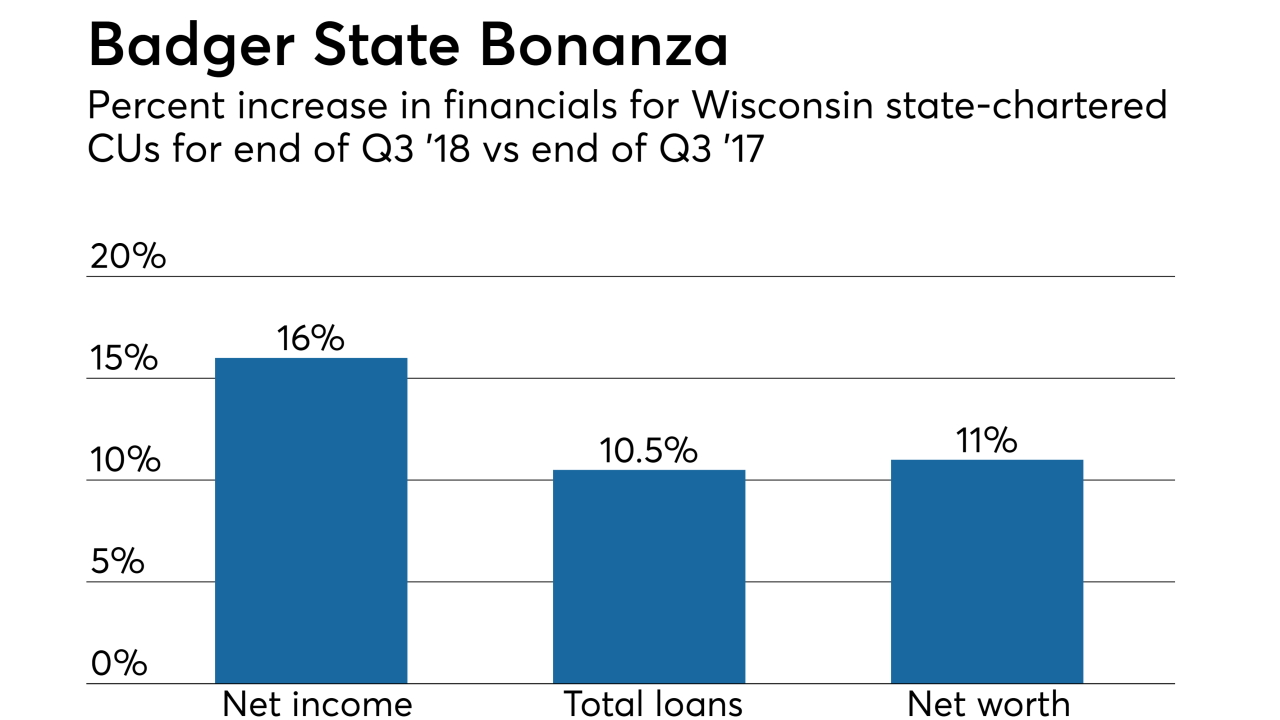

The state's Q3 numbers show a continuation of positive trends for Wisconsin's state-chartered credit unions.

November 9 -

The regulator's latest Quarterly Map Review shows credit unions' good run continuing, but some states remain stuck in a rut.

October 11 -

Rising wages and savings rates resulted in a decline in past-due payments in the second quarter, the American Bankers Association said in its quarterly report on delinquency trends in consumer lending.

October 4 -

Delinquencies have held steady for a year, and observers are optimistic about upcoming third-quarter data. But the long-term question is whether solid underwriting can overcome higher vehicle prices and consumer debt burdens.

September 7 -

Aggregate data from analytic and predictive modeling is helping State Employees' Credit Union improve delinquencies and other areas.

July 23 -

An index that tracks late payments on consumer loans inched closer to historic norms, according to data from the American Bankers Association.

July 10 -

Terms on car loans continue to lengthen in an attempt to keep monthly payments manageable for consumers, but one expert warns that at some point they're going to impact affordability.

June 4 -

Dark clouds may not yet be on the horizon, but industry executives are sending the message to investors that they know a turn in the credit cycle is coming, and they are planning accordingly.

May 31