-

The company's latest report predicted there could be sustained economic pressures well into next year tied to rising coronavirus cases.

November 20 -

Technology imperatives, weak loan demand and the need for increased efficiency could put pressure on dozens of regional banks to join forces with rivals.

November 17 -

The forthcoming measure could override staff opinions that helped certain deposit-gathering companies partner with banks.

November 13 -

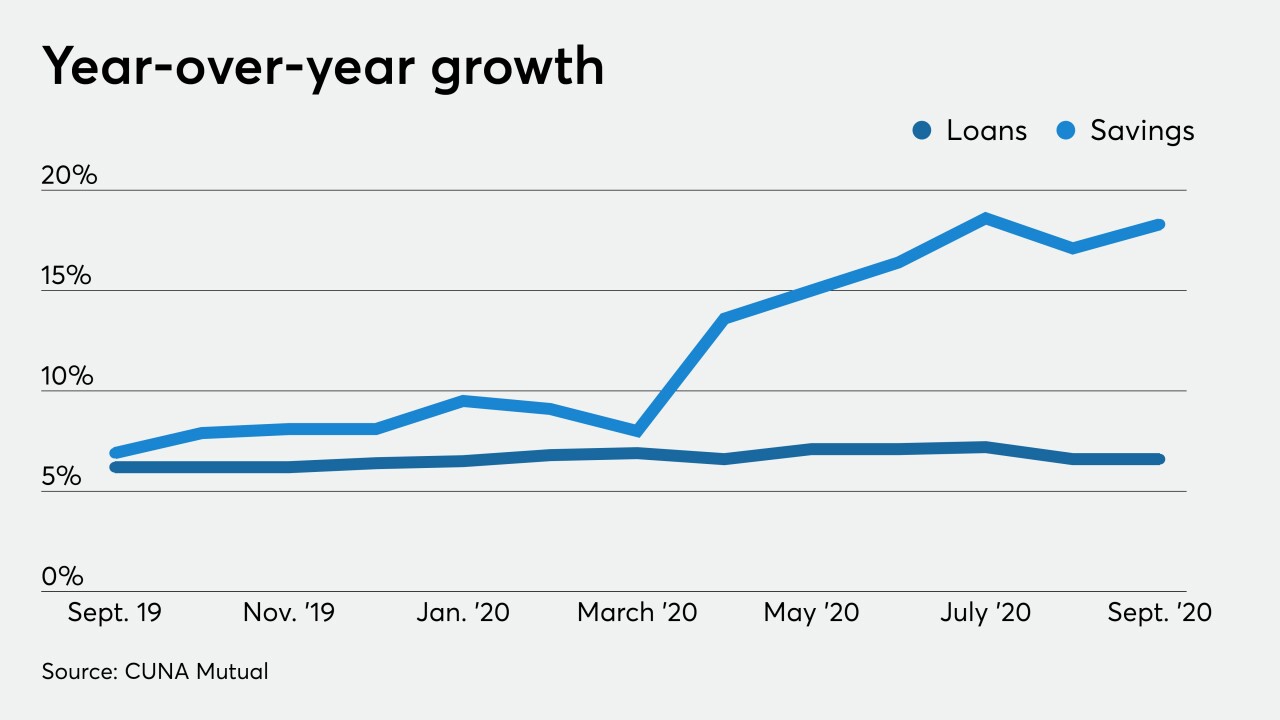

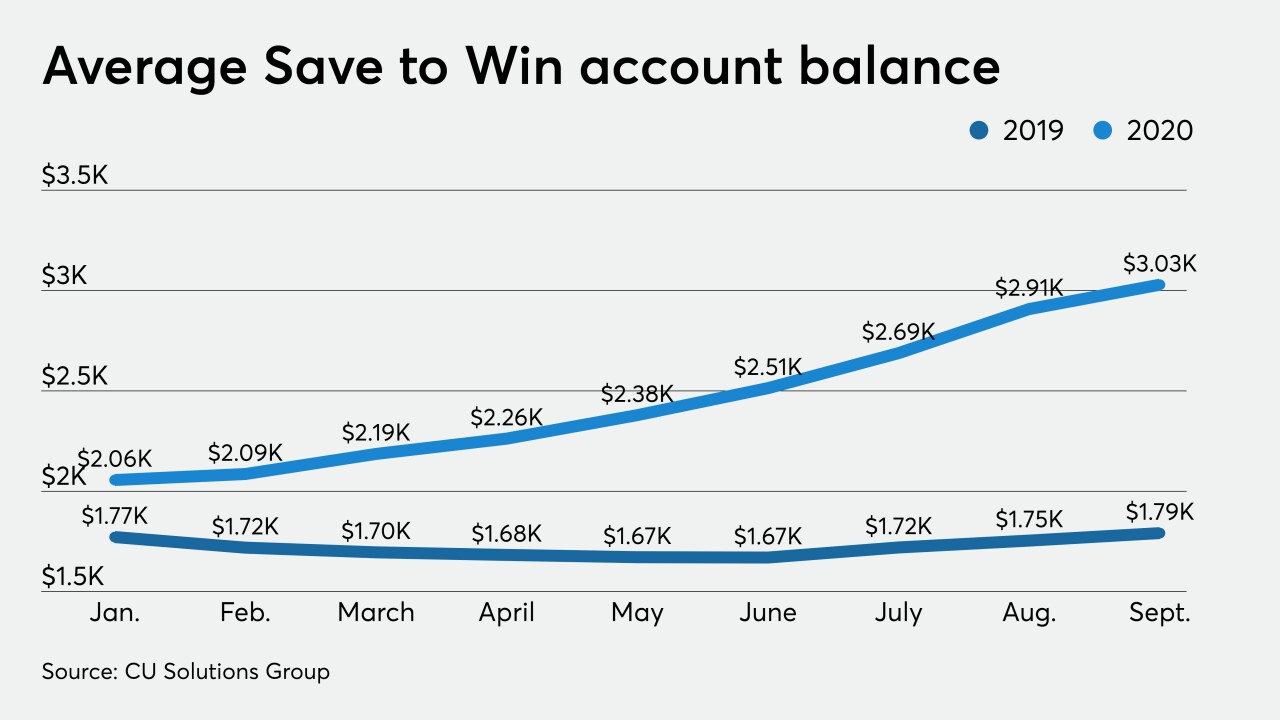

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

On Jun. 30, 2020. Dollars in thousands.

November 2 -

The company is best known for its reciprocal deposit program, but it’s finding new ways to serve banks without competing for their customers.

October 29 -

First City Bank of Florida had suffered “longstanding capital and asset quality issues” that were unrelated to the pandemic, the FDIC said.

October 16 -

The family-owned bank from the South and the New York commercial lender each would fill a clear need for the other. First Citizens would gain business lending expertise and an online deposit-gathering platform, and CIT would get the cheap deposits it coveted.

October 16 -

Cash, Treasurys and other securities effectively guaranteed by the federal government now make up more than 35% of the combined balance sheets of the 25 biggest U.S. banks, according to data compiled by the Fed. That’s the biggest share in records dating to 1985.

October 9 -

USAA sues PNC over mobile check deposit technology; flood of liquidity that accompanied the pandemic recession unlikely to subside anytime soon; 'enigmatic' CFPB chief could drop more surprises in a second Trump term; and more from this week's most-read stories.

October 9 -

SaveBetter.com from Deposit Solutions lets consumers shop for different savings products through one portal and provides national exposure for participating banks, which include Ponce Bank in New York and Central Bank of Kansas City.

October 7 -

Many community banks need brokered deposits to help fund loans, so policymakers must strike the right balance between promoting liquidity and guarding against reckless lending.

October 7 Peoples Bank

Peoples Bank -

The industry is warning regulators putting the finishing touches on the Net Stable Funding Ratio that the measure could exacerbate volatile market events like the spring selloff of Treasury securities.

October 5 -

The flood of liquidity that accompanied the pandemic recession isn’t likely to subside anytime soon. Banks will have to employ a mix of securities buying, hedging and other balance-sheet-management tricks to prop up margins longer than initially imagined.

October 5 -

Credit union groups continue to make ad buys for industry-supported candidates in advance of Nov. 3, but recent positive economic news could be short-lived.

October 5 -

To shore up the share insurance fund, the National Credit Union Administration would be wise to give the industry additional temporary investment options.

September 29 Mission Federal Credit Union

Mission Federal Credit Union -

Waiting for the SBA to sign off on PPP loan forgiveness; banks criticized for requiring balloon payments on loans in forbearance; how backlash over Scharf remarks affects Wells Fargo’s diversity push; and more from this week’s most-read stories.

September 25 -

Partnering with the account-opening software firm Mantl, the New Jersey bank created a CD campaign that helped fund its Paycheck Protection Program lending.

September 22 -

On Jun. 30, 2020. Dollars in thousands.

September 21 -

A historic influx of deposits has brought the National Credit Union Share Insurance Fund’s equity ratio close to the point where premiums would be required, but the regulator’s plan is intended to boost it.

September 17