-

Chemical is paying roughly $3.6 billion for the $23.5 billion-asset TCF. The combined company will be based in Detroit, Chemical's hometown, and operate under the TCF brand.

January 28 -

Among the things we've learned this earnings season: C&I is back, fee income is flat, and leveraged lending is beginning to "rear its ugly head."

January 27 -

A man entered a SunTrust branch in Sebring, Fla., and shot and killed five women, four of whom were bank employees; 24 million mortgage documents exposed in data security lapse; the battle for deposits is like "a steel-cage" match; and more from this week's most-read stories.

January 25 -

The low-cost deposits it gained in its purchase of 52 Wells Fargo branches, combined with higher interest rates, lifted Flagstar's net interest margin.

January 22 -

Loan demand is finally picking up after several lackluster quarters. Banks' big challenge is finding cheap deposits to fund all those new loans.

January 18 -

The New York company added eight new client teams in 2018 and established a new division that caters to private equity firms on both coasts.

January 17 -

The nation’s fifth-largest bank now has the financial flexibility to consolidate more branches in existing markets and open new, smaller ones in cities where it has no retail presence, CEO Andy Cecere said.

January 16 -

Bank of America CEO Brian Moynihan and his fellow executives said they see nothing to suggest a slowdown is imminent. Their outlook was far more upbeat than that of JPMorgan chief Jamie Dimon.

January 16 -

The San Francisco company's quarterly earnings also reflected higher wealth management revenue.

January 15 -

Robotic process automation is said to have a high return on investment, but adopting it on a large scale has proven challenging, especially at community banks.

January 11 -

As government employees carry on without pay, Cabrillo Credit Union and others must balance liquidity concerns with staying out of a political fight.

January 11 -

Deposit premiums for bank mergers, which topped 10% in 2018 for the first time in years, are expected to keep rising as competition for cheap funding intensifies.

January 9 -

The bank will pay over $15 million in restitution and fines to settle claims that it neglected stop-payment requests and reopened deposit accounts without customers' consent.

January 3 -

New CEO John Turner hasn't fully laid out his vision for the future, but it clearly will involve hiring specialized lenders, balancing labor-saving AI with old-fashioned relationship building, and more streamlining.

January 2 -

As 2018 draws to a close, here's one more look at some of the year's most interesting stories and a glance at what 2019 may have in store for credit unions.

December 31 -

Legislators' attempts to reopen the government could hamper credit union advocacy priorities as the new Congress convenes.

December 31 -

On Sep. 30, 2018. Dollars in thousands.

December 24 -

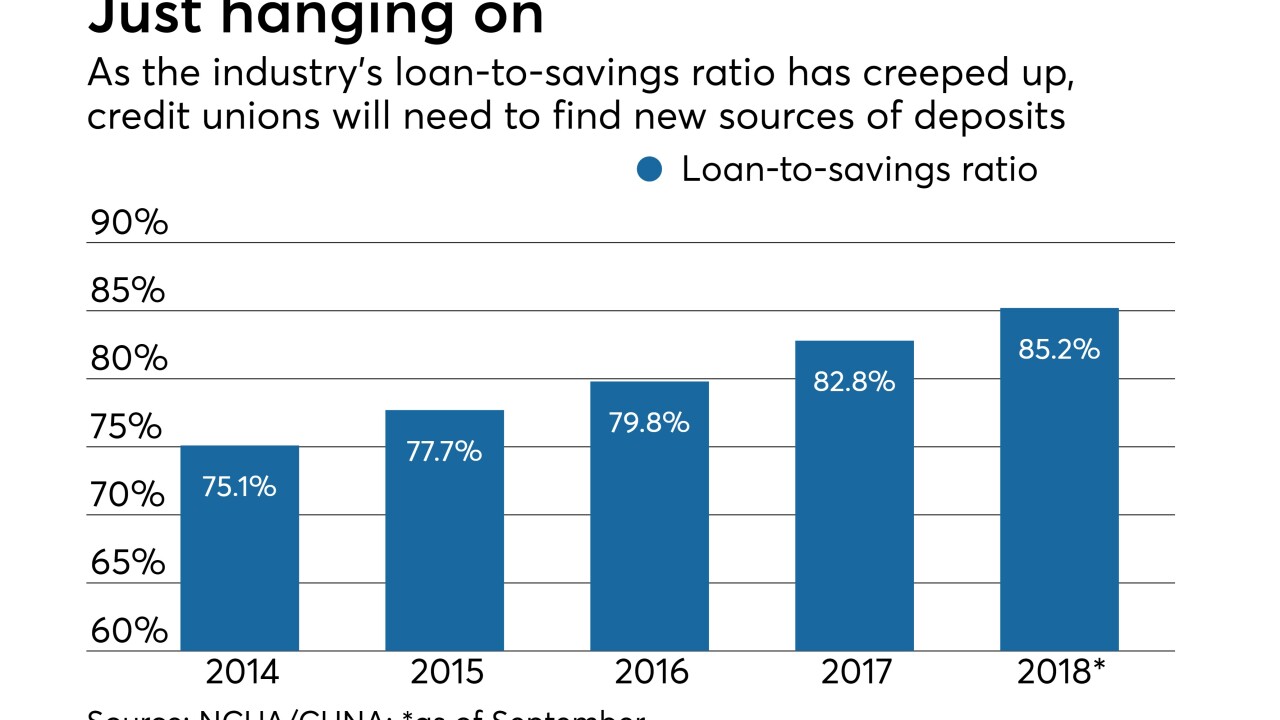

Amid rising rates and a surge in lending, credit unions will need to find additional sources of deposits to fund growth.

December 21 -

The agency’s rate cap for banks that are less than well capitalized contains several flaws and poses problems for community banks.

December 19 Independent Community Bankers of America

Independent Community Bankers of America -

Branch acquisitions, once a popular way to scale up in new markets, have started to go by the wayside in the digital age.

December 16